AUDUSD PRICE, CHARTS AND ANALYSIS:

- Federal Reserve Policymakers Drown Out Hawkish RBA Governor Comments.

- AUDUSD Price Caught Between 50 and 200-Day MA.

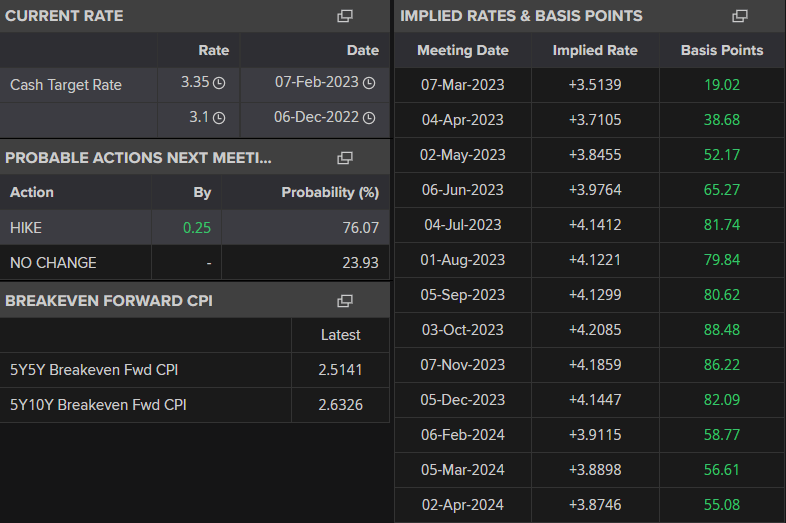

- 76% Probability of a 25bps Hike from the RBA in March.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Most Read: US Dollar Bumped Higher by Hawkish Fed and Blistering PPI. Higher USD?

AUDUSD FUNDAMENTAL BACKDROP

AUDUSD continued its move to the downside in the Asian session as the dollar index extended gains. Hawkish commentary from RBA Governor Lowe was seemingly drowned out by a host of similarly hawkish Federal Reserve policymakers.

Comments from Reserve Bank of Australia (RBA) Governor Lowe failed to arrest the slide in AUDUSD. Governor Lowe cautioned that the RBA are keeping an open mind, and their opinion is that further rate hikes are needed. Lowe also stated that interest rates are not on a predetermined path as it takes 18-24 months for rate hikes to be felt in the economy. The probability for a further 25bps hike at the RBA meeting on March 7 now rests at 76% (as shown below).

SOURCE: REFINITIV

Federal Reserve policymakers meanwhile continued their hawkish rhetoric yesterday which likely drowned out the comments from RBA Governor Lowe. Fed policymakers Loretta Mester and James Bullard both stated that they would not rule out a 50bps hike at the Fed’s March meeting. Bullard and Mester’s comments were in response to US PPI data which recorded its largest increase since June 2022. The recent moves in AUDUSD are largely attributable to the US dollar as we continue to see repricing of the Fed Funds Peak rate with this week’s upbeat economic data out of the US further strengthening the narrative.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

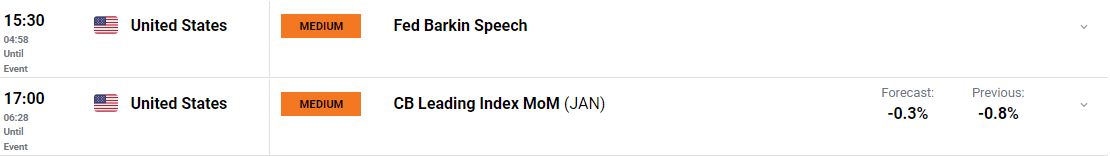

Looking ahead to the rest of the day we have a relatively quiet US economic calendar with Federal Reserve policymaker Thomas Barkin speaking and the CB Leading Index for January out of the US. Neither of which is expected to provide markets with any significant shocks ahead of the weekend.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK

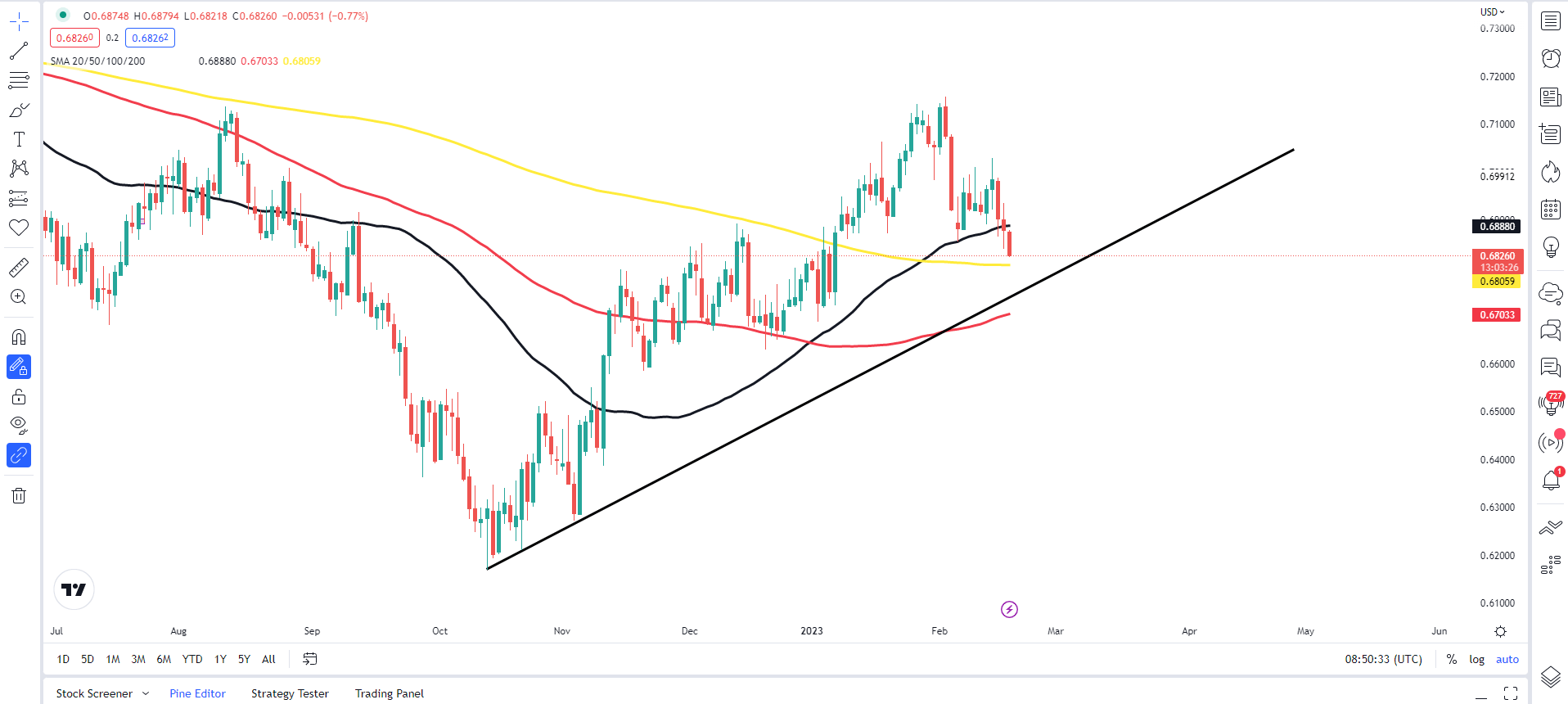

The continued selling pressure on AUDUSD could be linked to yesterday’s daily candle which closed below the 50-day MA. The pair has failed to find acceptance above the 0.7000 level despite briefly breaking above it on January 23. Further downside seems the path of least resistance at this stage, however the 200-day MA rests just below current price at 0.68090 and could provide temporary relief. A bounce of the 200-day MA could lead to a retest of the 50-day MA before the next leg to the downside and a third touch of the ascending trendline from October 2002 lows.

AUD/USD Daily Chart – February 17, 2023

Source: TradingView

KEY RESISTANCE LEVELS:

- 0.6880 (50-Day MA)

- 0.6950

KEY SUPPORT LEVELS:

- 0.6806

- 0.6750

- 0.6700 (100-Day MA)

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda