EUR/USD Price, Chart, and Analysis

- ECB are expected to commit to a series of interest rate hikes.

- The Euro may appreciate further, backed by higher rate expectations.

Most Read: EUR/GBP Latest – Is a Fresh Multi-Month High Brewing?

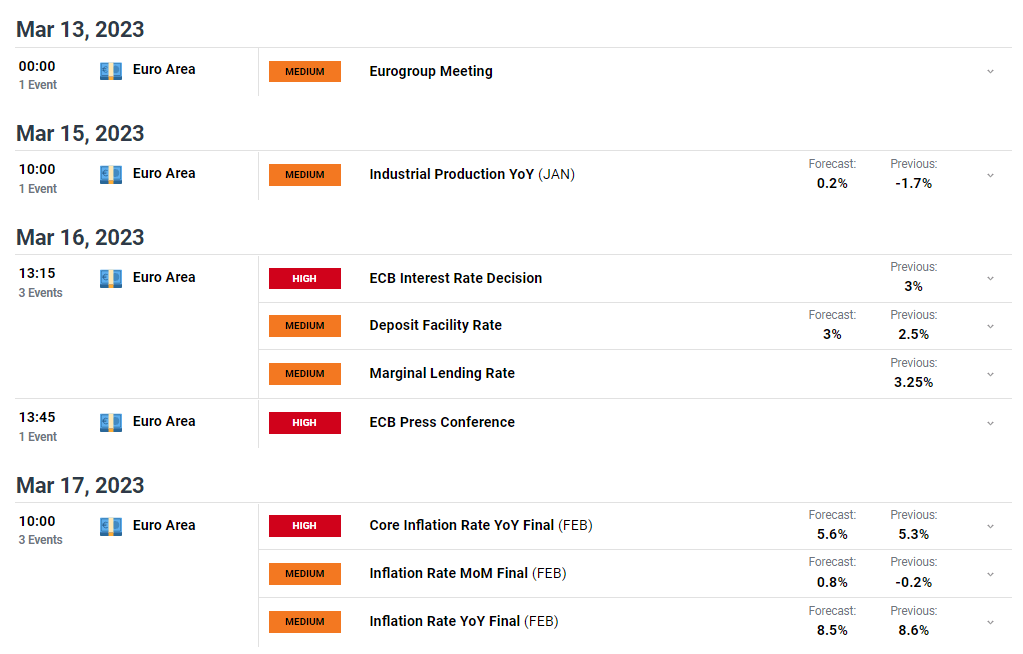

The European Central Bank is expected to raise interest rates by half a percent next week as part of its ongoing effort to stamp down on inflation in the single block. This hike has already been given the green light by President Lagarde at the last meeting, despite the central bank saying that they are not going to pre-commit and that they are data dependent. Next week’s hike will not be the last and it is the battle between various members of the ECB board that will be worth noting. One ECB board member has suggested a hawkish policy of four consecutive 50bp rate hikes, while other slightly dovish board members are revoicing calls for data-dependent moves. The ECB press conference, post-decision, will be the main event for the Euro next week.

For all market-moving events and economic data releases, see the real-time DailyFX Calendar

While the ECB meeting next Thursday is key for the Euro, the US inflation release on Tuesday will be another driver for EUR/USD. The latest US NFP release showed nonfarm hiring increasing by more than expected but also showed monthly wages dipping and the unemployment rate to 3.6% from the prior 3.4%. Fed chair Powell will have noted these moves, especially wages, and the unemployment rate, and if inflation continues to fall, then he may well go for a 25bp rate hike on March 22nd instead of the current thinking of 50bps.

US Economy Adds Strong 311k New Jobs, Wages Grow Less Than Expected

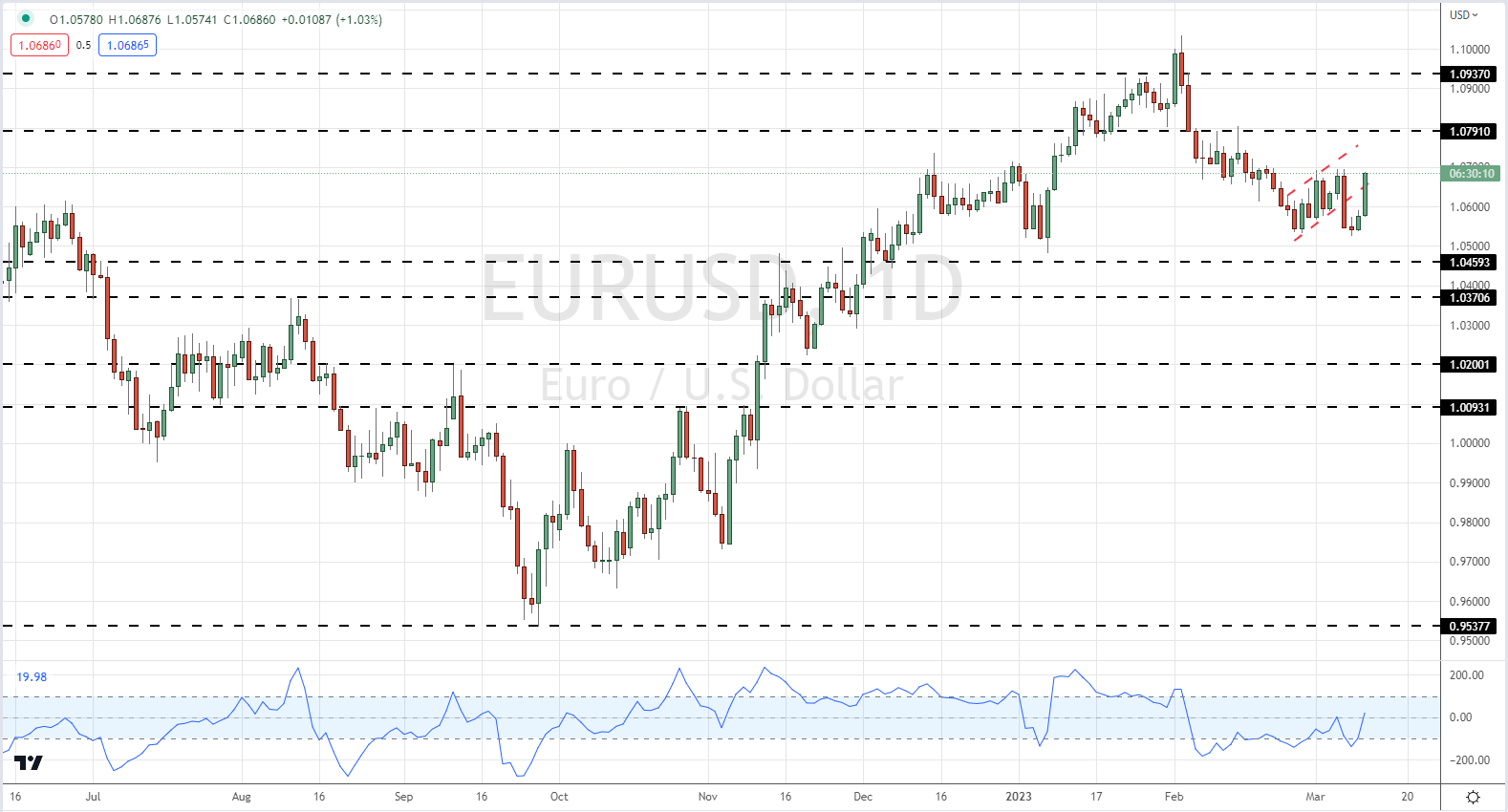

EUR/USD is pushing higher going into the weekend, buoying a weaker US dollar. US Treasury yields have fallen sharply over the last 24 hours, taking away one of the greenback’s props, as investors move into safe haven products after the Silicon Valley Bank sell-off on Thursday.

Dow Jones, S&P 500 Plunge as SVB Financial and Silvergate Bank Drive Financial Woes

EUR/USD has recovered all of Tuesday’s losses after chair Powell’s hawkish testimony to US lawmakers and is back in a short-term bearish flag formation that started in late February. The next level of resistance is on either side of 1.0700 before 1.0790/1.0800 come into play.

EUR/USD Daily Price Chart – March 10, 2023

Chart via TradingView

Retail Traders Pare Back Long Positions

Retail trader data show 53.95% of traders are net-long with the ratio of traders long to short at 1.17 to 1.The number of traders net-long is 19.20% lower than yesterday and 10.04% lower from last week, while the number of traders net-short is 10.44% higher than yesterday and 2.23% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse higher despite the fact traders remain net-long.

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.