- EUR/USD Under Pressure Below 0.9850 Area.

- Continued Dollar Strength to Keep Gains Capped.

- ECBs Potential 75bp Hike May Not Be Enough to Prevent a New YTD Low.

EUR/USD Fundamental Backdrop

EUR/USD continued its indecisive nature this morning in a week that has seen the pair struggle for any clear direction. As bulls and bears continue their battle, the pair has remained relatively rangebound as a host of key data events lie ahead next week.

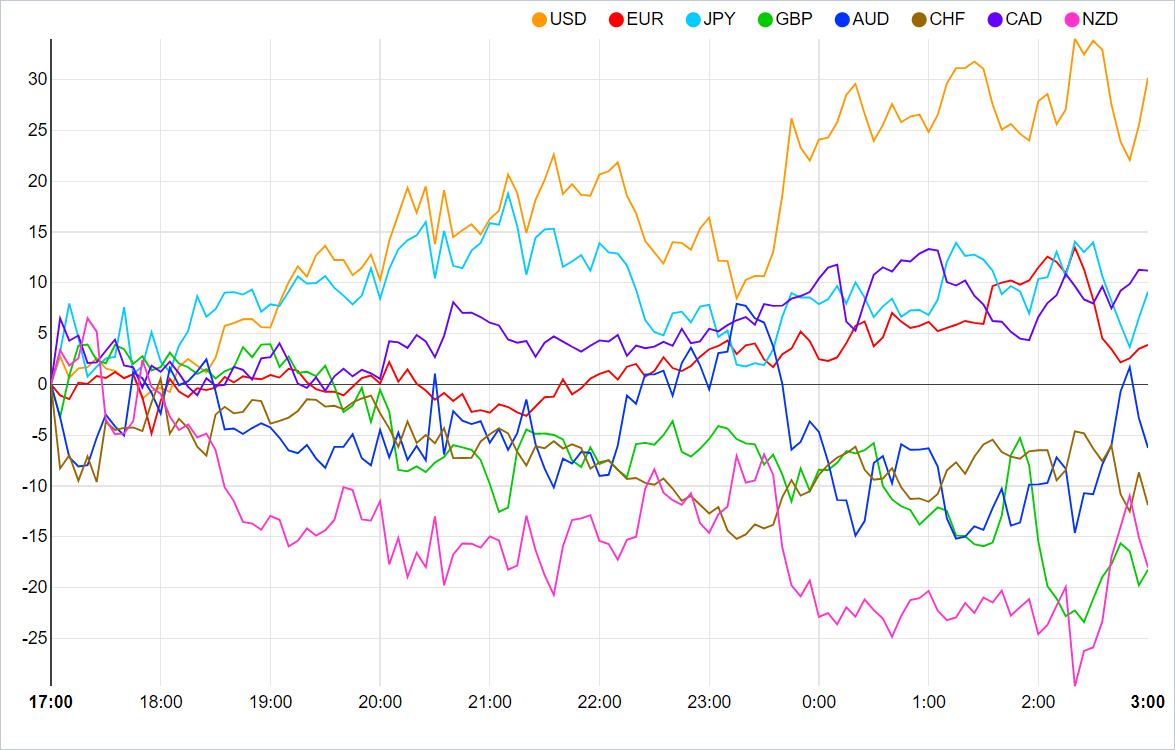

The pair had enjoyed a bounce since last week’s US CPI print, however the return of dollar bulls this week has seen any attempted upside move cut short. The dollar has benefitted from rising Fed funds rate expectations with markets now pricing in a peak rate of around 5%, up from 4.75% last week. This coupled with rising treasury yields has kept the dollar bid as investors still view the greenback as their preferred haven.

Currency Strength Meter

Source: FinancialJuice

The week ahead looks likely to bring a fresh bout of volatility to the market as we have a host of key data events. The European Central Bank (ECB) policy meeting is scheduled for 27 October, while no further ECB comments are expected as the central bank began its blackout period yesterday. Despite fears over a looming recession for the zone the recent inflation numbers coupled with comments from ECB policymaker Joachim Nagel, who stated inflation will likely ease gradually over the next 12 months, are not helping matters. Markets are still pricing in a 75bp hike at next week’s policy meeting which is unlikely to stop the pair from printing a new YTD low.

For all market-moving economic releases and events, see the DailyFX Calendar

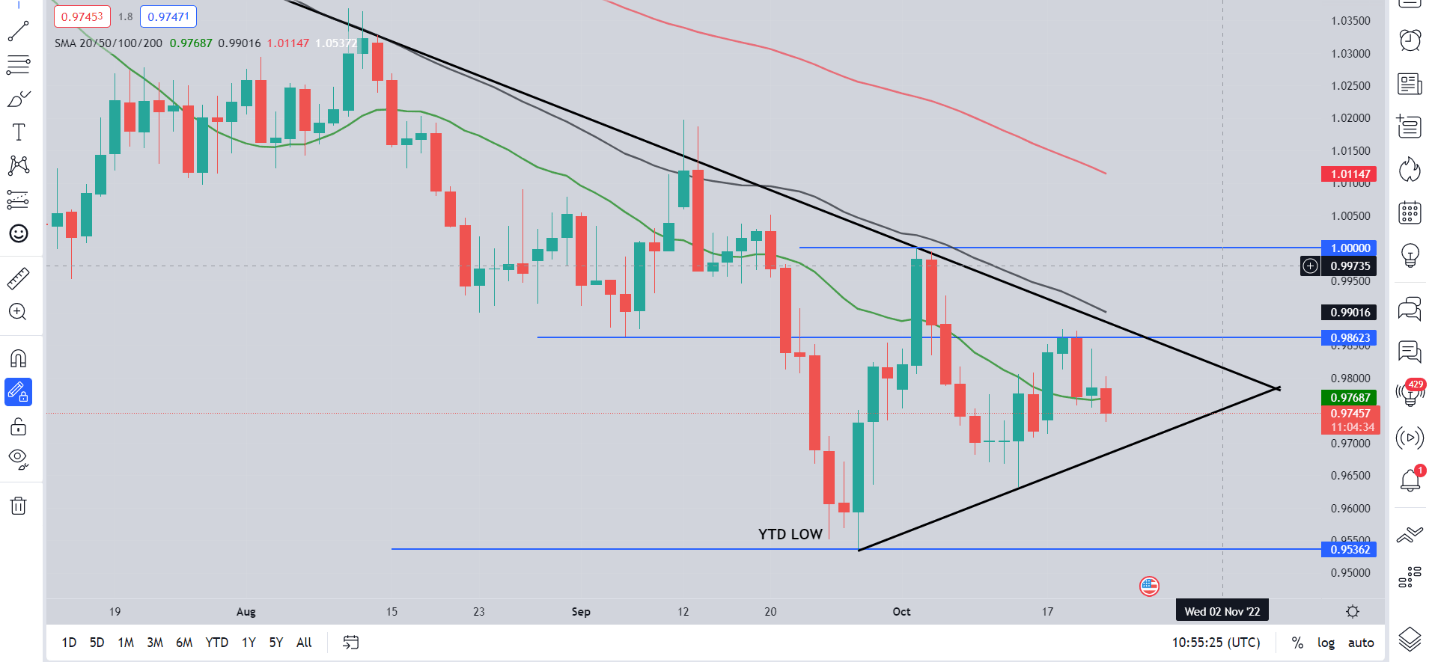

EURUSD Daily Chart – October 21, 2022

Source: TradingView

From a technical perspective, we can see the indecision reflected in price action as after creating a lower high on the back of US CPI, the pair failed to create a higher high, finding resistance around the 0.9850 area.

The long-term descending trendline remains in play as it lines up with the 50-SMA while the price is being squeezed by a symmetrical triangle pattern which is becoming more relevant as the price dips lower. Given the amount of data events next week which could provide the catalyst for a breakout, interest and volatility in the pair will no doubt increase.

A break to the downside could see a new YTD low printed as the month draws to a close. Alternatively, an upside break will need to clear the 0.9850 area as well as the descending trendline before parity comes back into play.

Trading Strategies and Risk Management

Price Action

Recommended by Zain Vawda

Key intraday levels that are worth watching:

Support Areas

•0.97000

•0.96320

•0.95360

Resistance Areas

•0.98500

•1.00000

Resources For Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicators for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda