EUR/USD Price, Chart, and Analysis

Most Read: Euro Week Ahead Forecast: EUR/USD Looking to Build a New Base

The latest German ZEW economic sentiment report shows optimism fading in April. The economic sentiment indicator fell to 4.1, missing expectations of 15.3 and last month’s reading of 13. According to ZEW President Professor Achim Wambach,

‘Economic expectations are negatively affected by several factors. Experts expect banks to be more cautious in granting loans. The still high inflation rates and the internationally restrictive monetary policy are also weighing on the economy. On the positive side, the danger of an acute international financial market crisis seems to have been averted: Earnings expectations for banks and insurance companies have improved compared to the previous month and are once again clearly in positive territory,”

Euro Area sentiment fell to 6.4 compared to 10 in the previous month.

For all market-moving events and economic data releases, see the real-time DailyFX Calendar

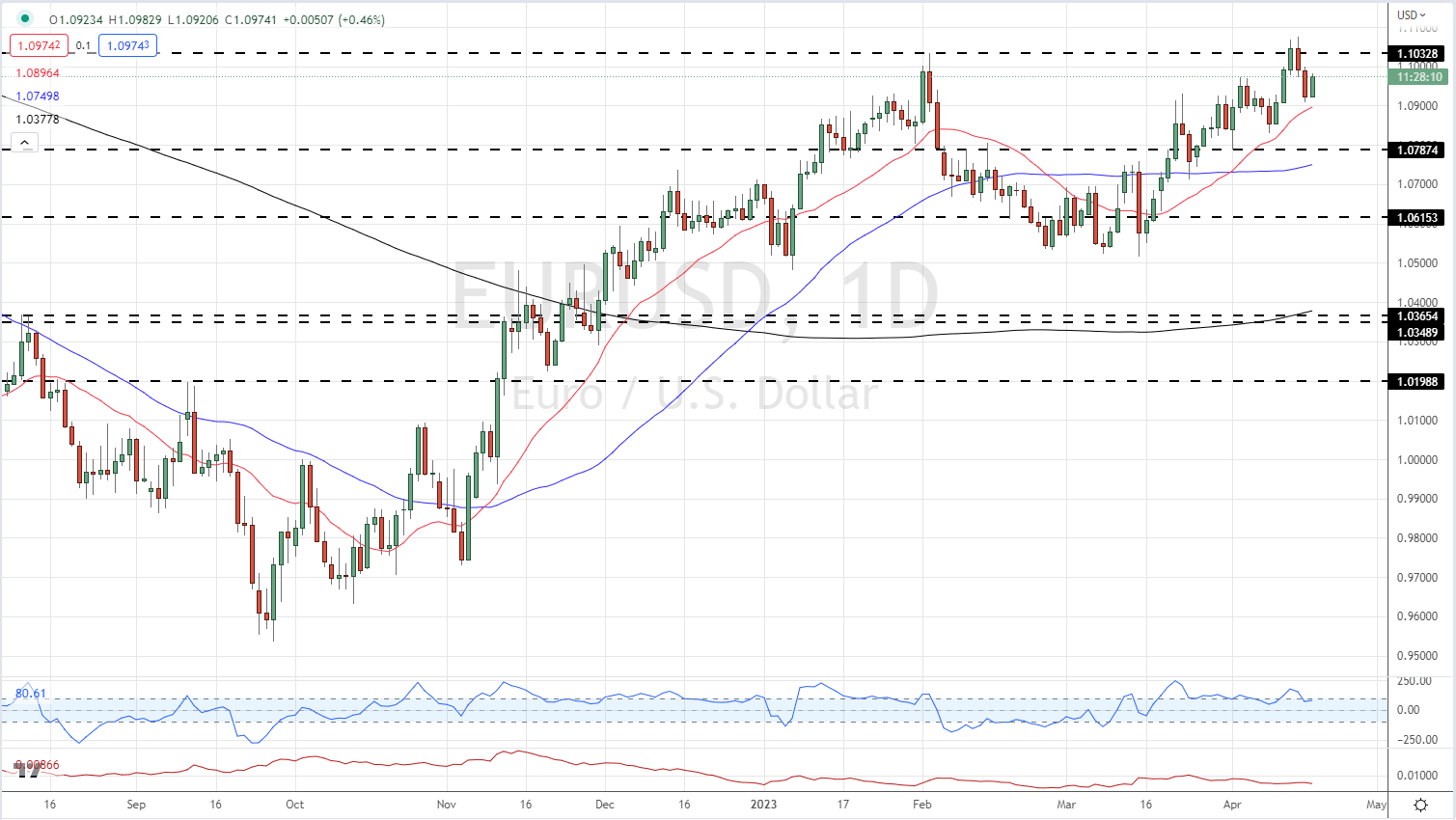

After falling by around 170 pips (high-to-low) over the last two days, EUR/USD is now pushing higher and eyeing a re-test of the 1.1000 level. The US dollar is slipping lower today after rallying Monday on higher US Treasury yields. The EUR/USD technical set up remains positive with the 20-day simple moving average (red line on chart) providing short-term support, while the recent series of higher highs and higher lows remains for now. A multi-week cup and handle pattern is also continuing to play out. A confirmed break of 1.1000 will bring last Friday’s multi-month high at 1.1076 back into focus. Support is seen in the 1.0900 to 1.0910 area.

EUR/USD Daily Price Chart – April 18, 2023

Chart via TradingView

| Change in | Longs | Shorts | OI |

| Daily | 2% | -12% | -3% |

| Weekly | -2% | 11% | 2% |

Retail Traders Boost Net-Longs

Retail trader data show 49.02% of traders are net-long with the ratio of traders short to long at 1.04 to 1.The number of traders net-long is 38.26% higher than yesterday and 13.09% higher from last week, while the number of traders net-short is 11.53% lower than yesterday and 0.45% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse lower despite the fact traders remain net-short.

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.