S&P 500, Nasdaq 100 and Dow Jones Index Price Forecast:

- S&P 500 price attempts to reverse four-day decline as prices edge above 50-day MA (moving average)

- Nasdaq 100 leads gains after Nvidia and Palo Alto earnings lift the tech index

- Dow Jones Index (DJI) futures hold onto modest gains, rising toward 33,200.

Futures Shake Off Hawkish Fed Minutes & Focus on Upbeat Earnings

US stock futures are experiencing modest gains as market participants digest the Fed minutes and upbeat earnings.

With the SPX and Dow Jones futures attempting to rebound, the release of positive earnings has allowed the US tech heavy Nasdaq 100 to lead the rebound in major US stock indices. After Nvidia and the cybersecurity provider Palo Alto beat earning estimates, the two companies have assisted in driving NDX back to the 12,200 mark.

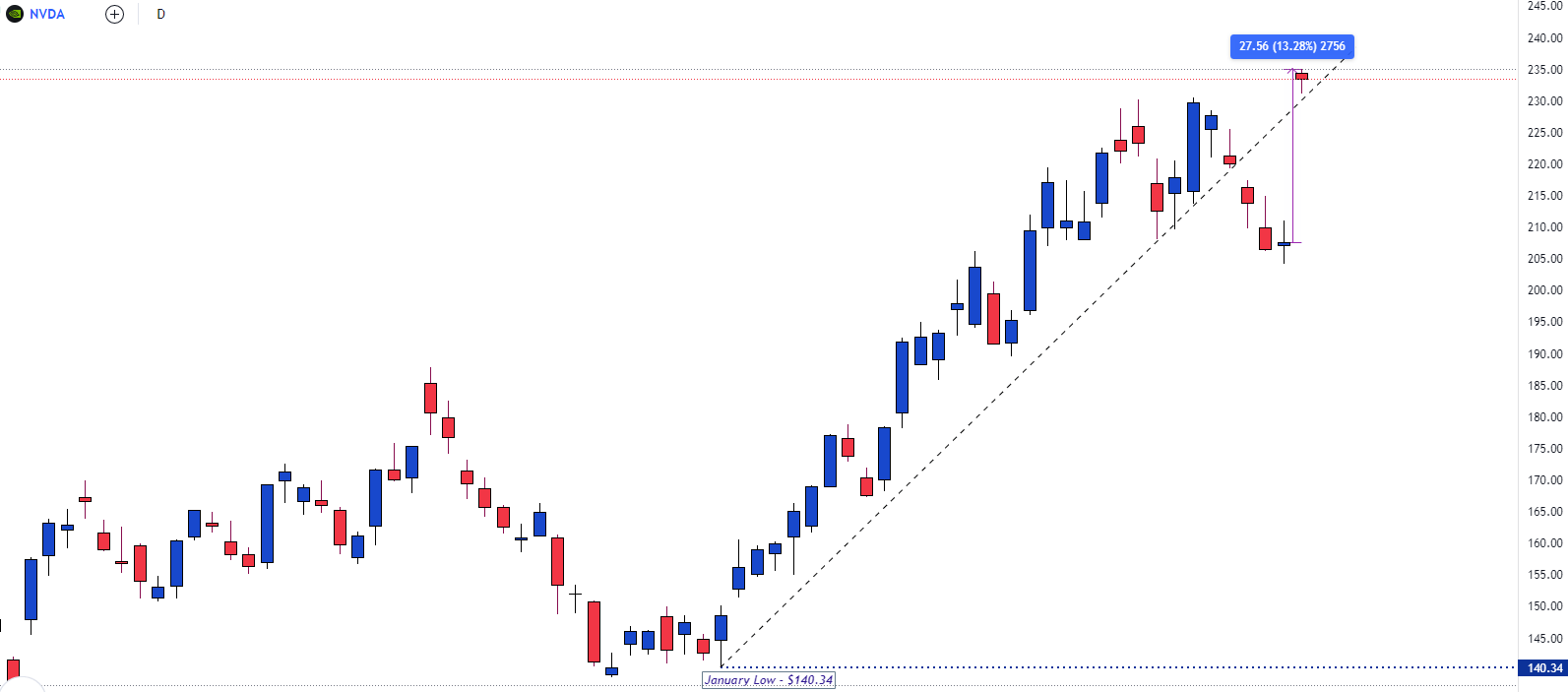

For Nvidia, the upside surprise in Q4 2022 earnings and an increase in the revenue outlook from AI (artificial intelligence) technology has seen the stock rose approximately 13% until reaching a high of $235. As NVDA pulls back to the mid-February high around $230.00, a rebound in gaming has provided an additional boost for profits.

Nvidia Daily Chart

Source: TradingView

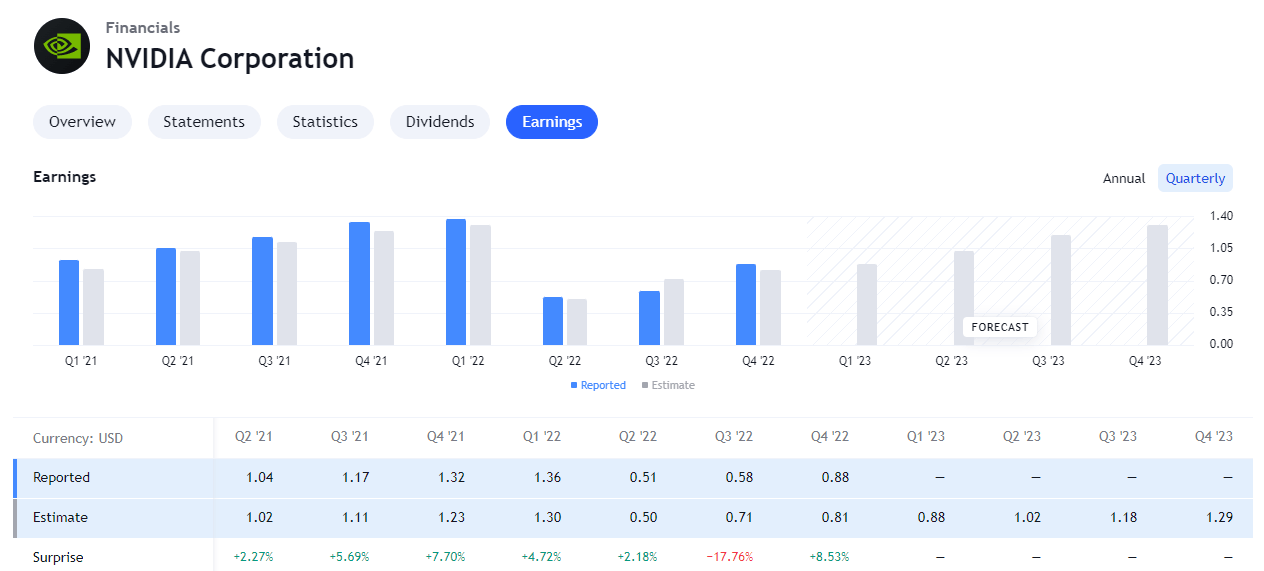

NVIDIA Q4 Earnings: TradingView

Meanwhile, with Palo Alto Networks looking to hold onto yesterday’s 12.5% gains, revised price targets from a number of banks and analysts has helped lift the Nasdaq.

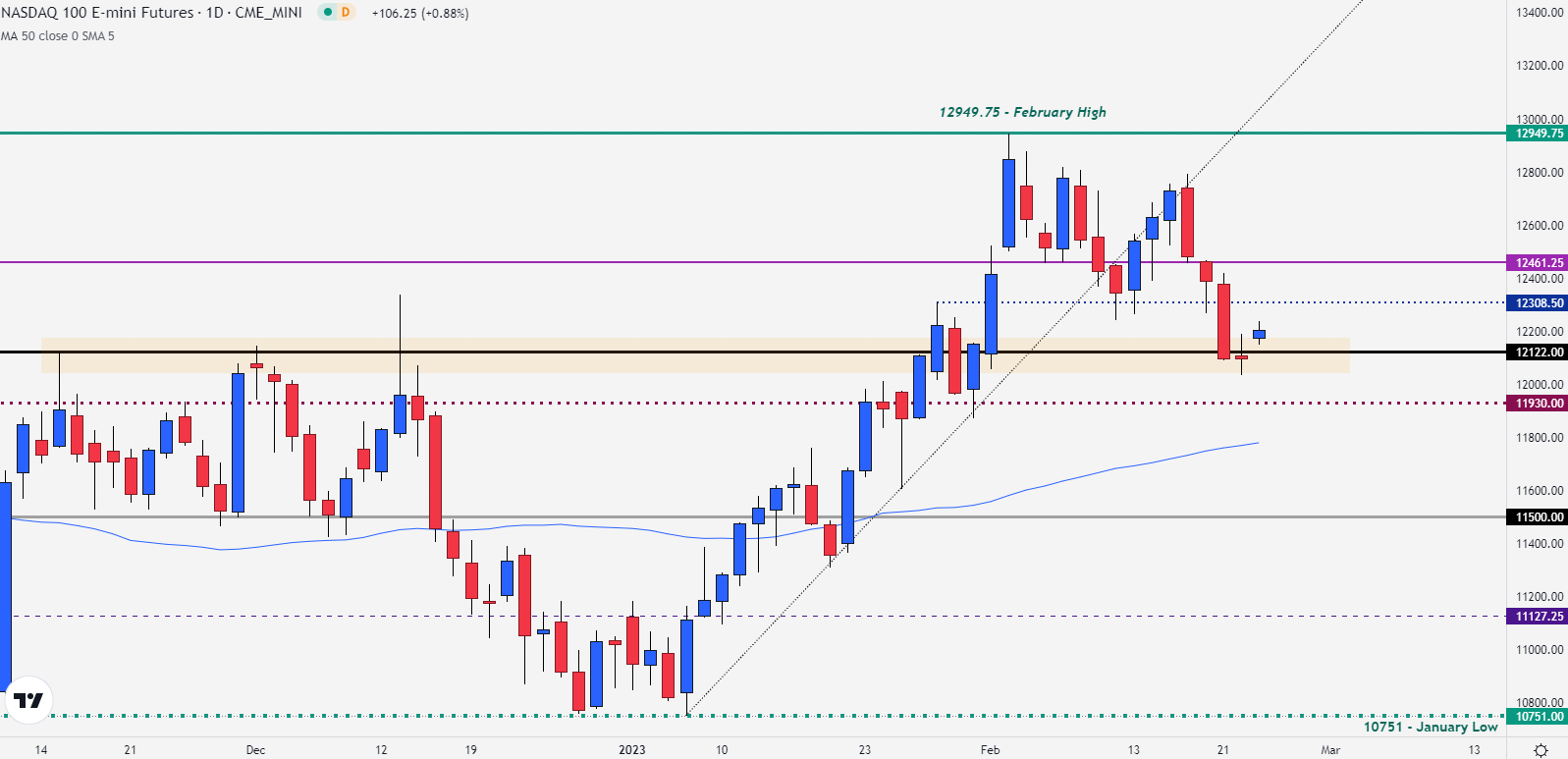

From a technical standpoint, the daily chart highlights how a rebound off the weekly low at 12,034 has enabled a move back to psychological resistance at 12,200. With the doji candle appearing at the Wednesday close, an additional zone of support has formed around $12,122 while the January high comes in as resistance at 12,308.

Nasdaq 100 (NDX) Daily Chart

Chart prepared by Tammy Da Costa using TradingView

S&P 500 Technical Analysis

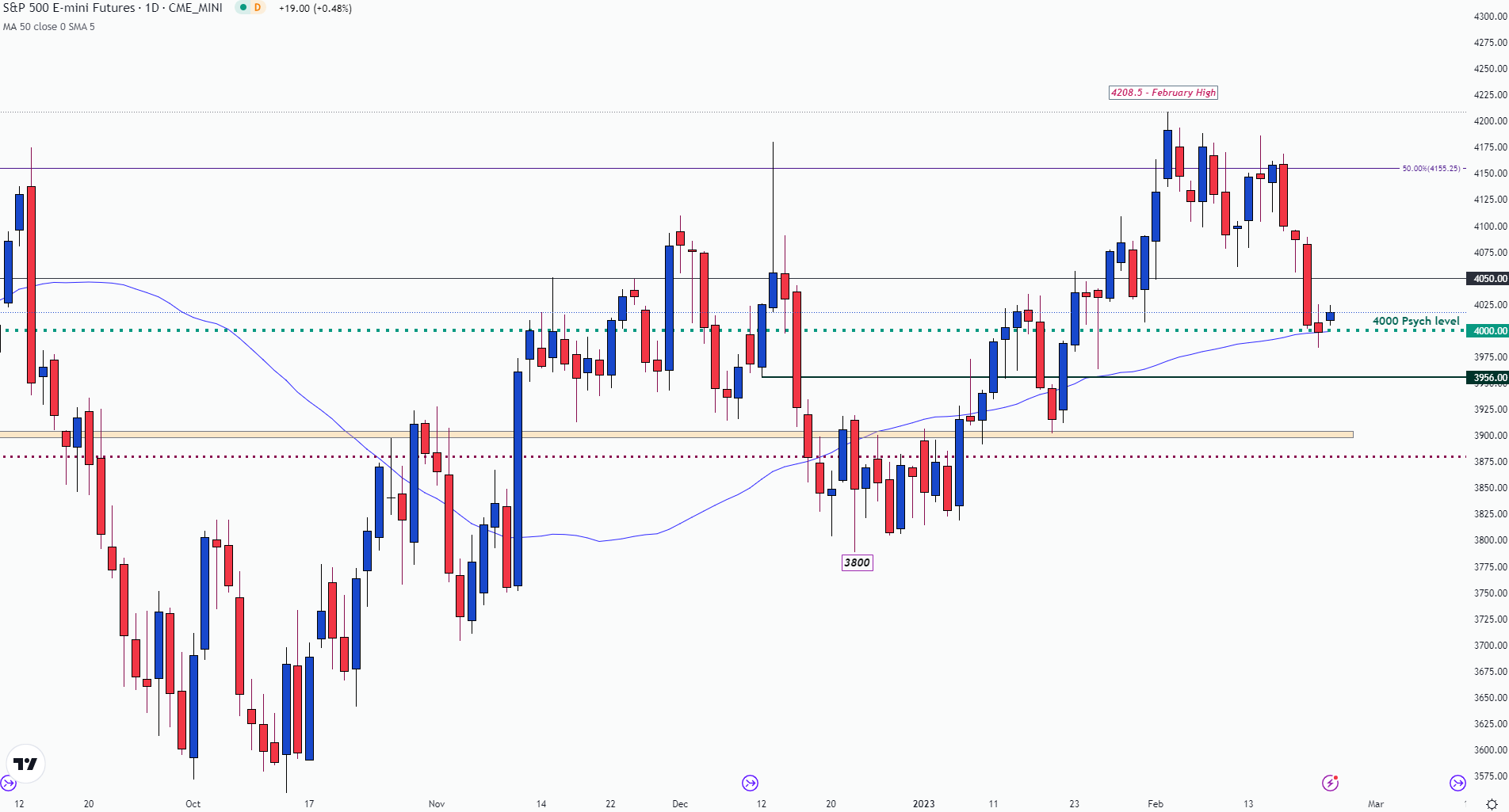

After falling to the 4,000-psych level, S&P 500 futures has tried to reverse the downtrend that has persisted since the start of the week. At the time of writing, prices are trading 0.50% higher, pushing the SPX index to 4,025. From the daily chart, the 50-day MA (moving average) has stepped in as support just below 4,000 which could provide more of a challenge for bears in the short-term.

S&P 500 (SPX) Daily Chart

Chart prepared by Tammy Da Costa using TradingView

Dow 30 Index Price Action

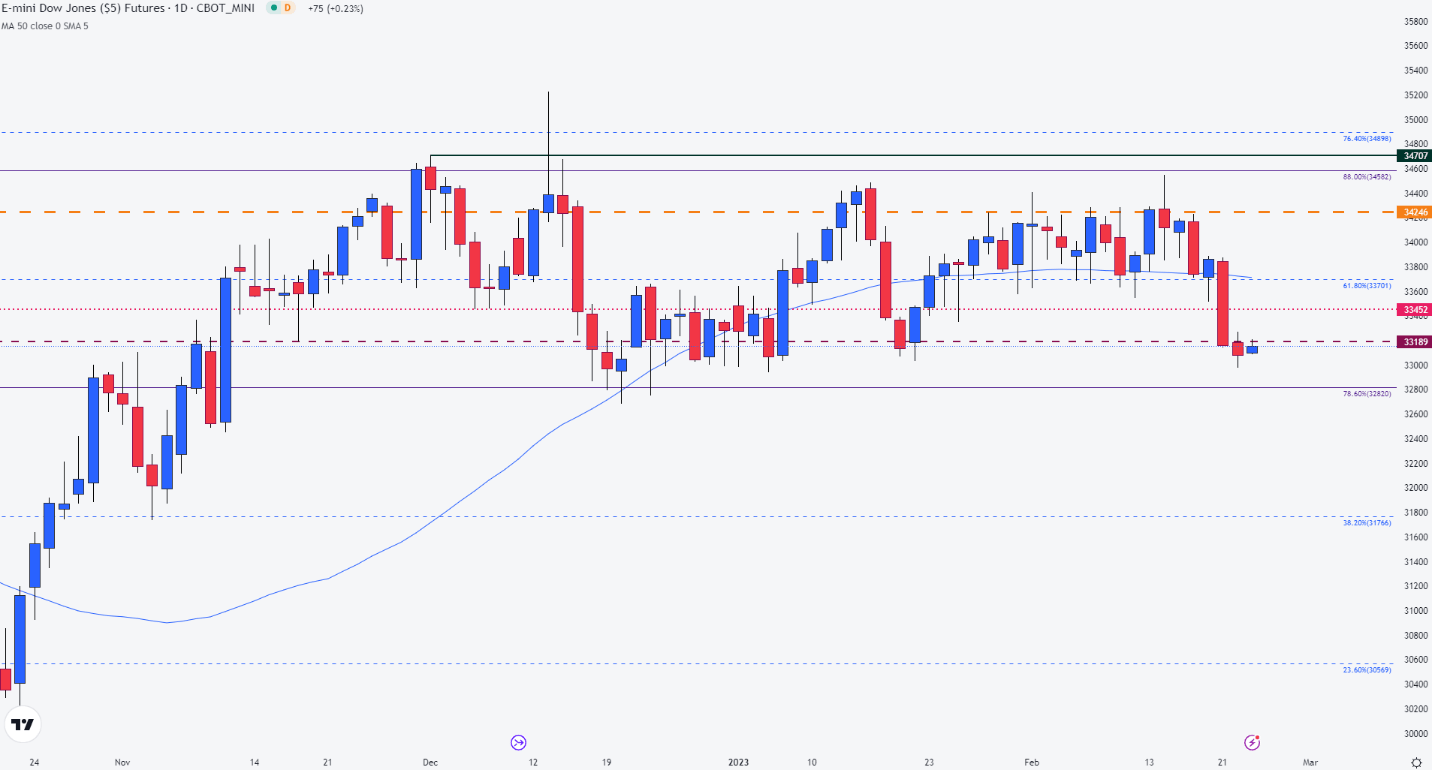

However, the Dow Jones has lagged behind its major counterparts, rising modestly by 0.20% (at the time of writing). While the current daily candle lingers in a narrow range, the 33,200 level has come back into play as resistance with the next barrier forming at 33,452 (prior support in December). Above that, is the 61.8% Fibonacci retracement of the 2022 move at 33,701 which coincides with the 50-day MA (moving average).

Dow Jones Index (DJI) Daily Chart

Chart prepared by Tammy Da Costa using TradingView

In terms of support, a retest of 33,000 could fuel bearish momentum, driving prices back toward the 78.6% retracement of the 2020 – 2022 move at 32,820.

--- Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707