DAX (Germany 40) Analysis

- ECB’s bank lending survey reveals signs of concern in the credit market

- DAX technical levels of interest – prices remain elevated but waning volatility and momentum hint at a propensity for sideways trading to come

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

ECB’s Bank Lending Survey Reveals Signs of Concern in the Credit Market

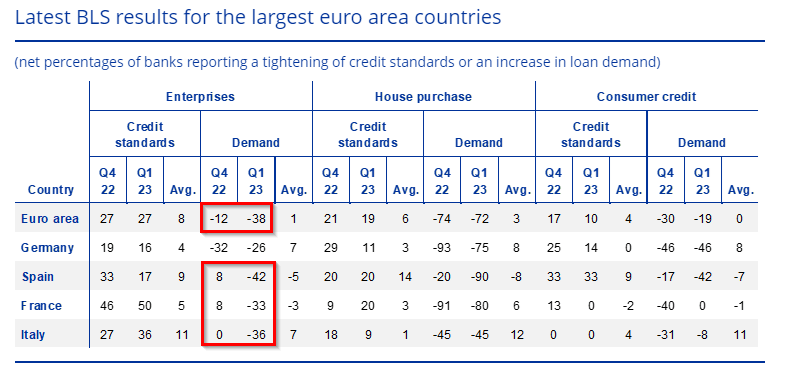

Ahead of the ECB’s interest rate decision last week, updated credit data revealed not only a reduction in general credit standards but, and possibly more ominously, a sizeable reduction in the demand for credit.

Tighter credit conditions have been considered ‘par for the course’ since the banking instability of March with have resurfaced so a lesser degree in early May. However, the massive drop in the demand for credit provides worrying insight into the market’s appetite for credit at such high interest rates. If businesses shy away from credit, it can affect investment, capital expenditure and overall economic activity. If credit markets are turning lower, this may weigh on the DAX at such elevated levels.

ECB Bank Lending Survey Showing Demand Contraction

Source: ECB, prepared by Richard Snow

DAX Technical Analysis – Key Levels to Watch

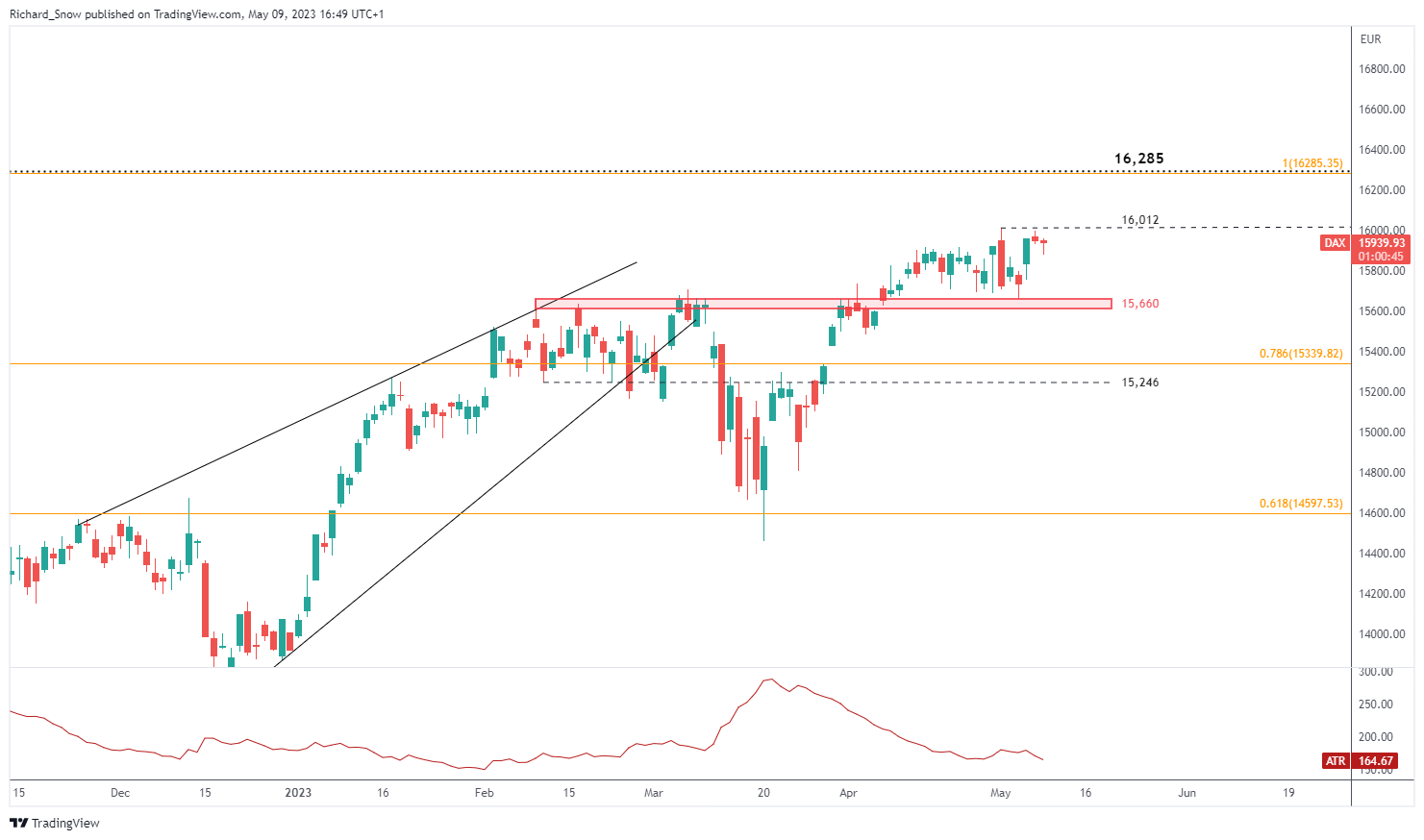

The daily DAX chart shows prices attempting a retest of the 16,012 level before turning slightly lower in what has proven to be two days of reduced volatility. In fact, the ATR indicator shows a stark drop-off in volatility ever since the banking rout in March and such an environment is not conducive to breakouts.

Given a propensity to range trade from here, resistance remains at 16,012 with support at 15,660.

DAX Daily Chart

Source: TradingView, prepared by Richard Snow

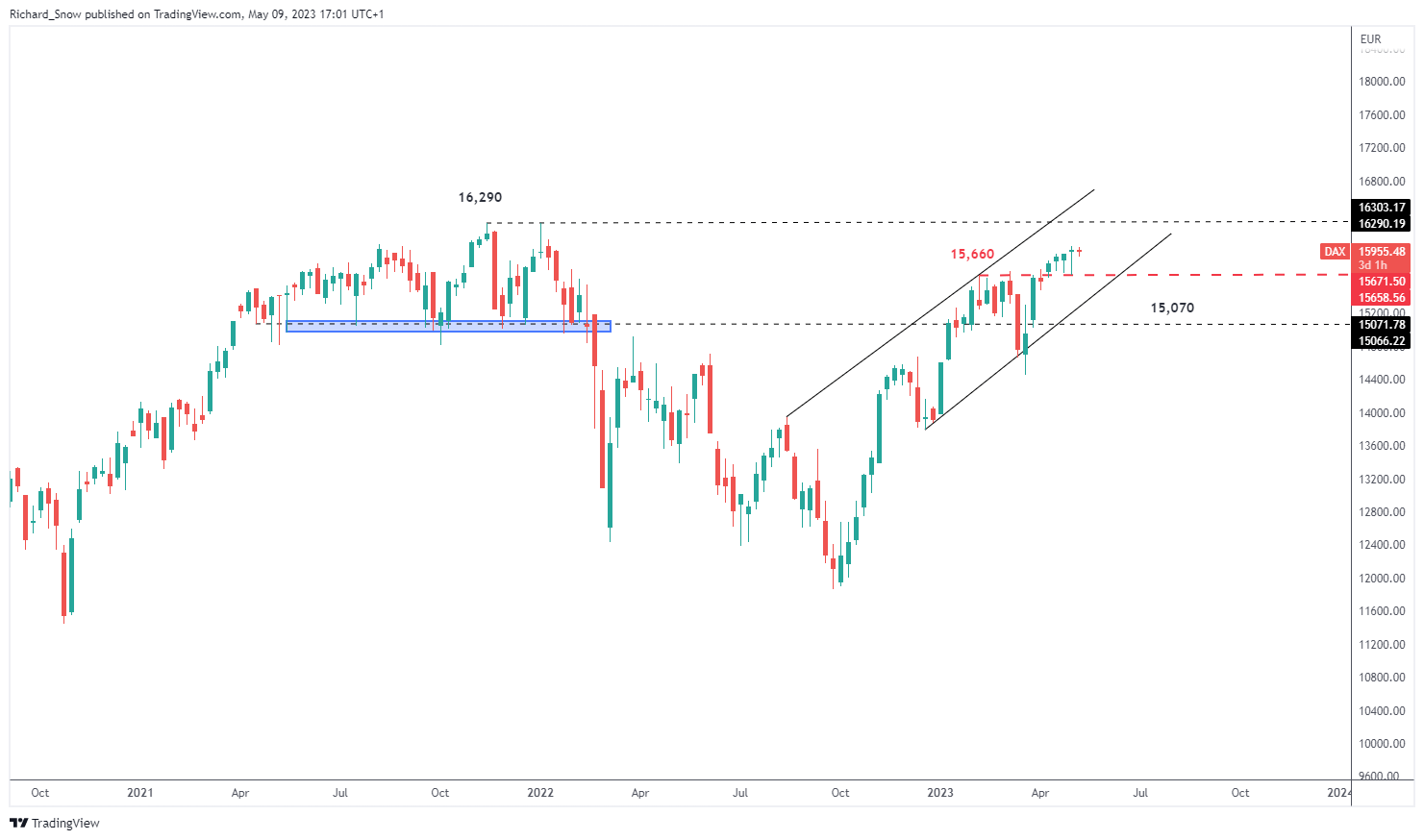

The weekly DAX chart reveals the index remains within the long-term ascending channel, having surpassed 15.660 – the next level of significance that needs to hold if a bullish continuation remains on the cards.

DAX Weekly Chart

Source: TradingView, prepared by Richard Snow

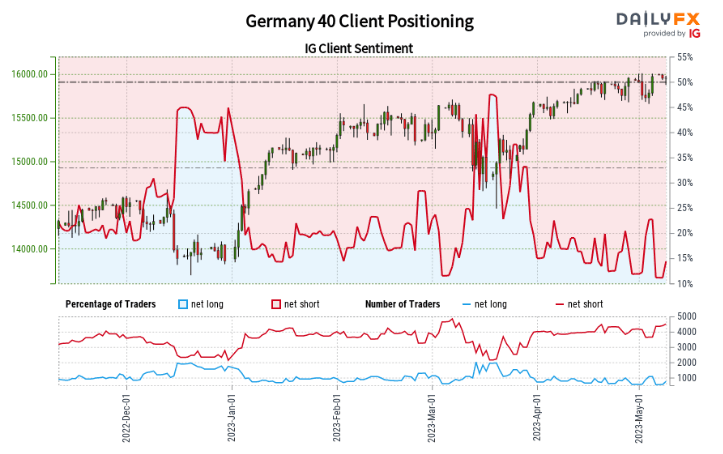

IG Retail Traders Reduce Overwhelming Net-Short Positioning

Germany 40:Retail trader data shows 21.81% of traders are net-long with the ratio of traders short to long at 3.59 to 1.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests Germany 40 prices may continue to rise.

The number of traders net-long is 39.12% higher than yesterday and 4.98% higher from last week, while the number of traders net-short is 7.07% lower than yesterday and 3.98% higher from last week.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current Germany 40 price trend may soon reverse lower despite the fact traders remain net-short.

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX