Germany 40 (Dax) Talking Points

- DAX 40 relief rally muted by technical resistance

- German stocks remain resilient despite heightened geopolitics

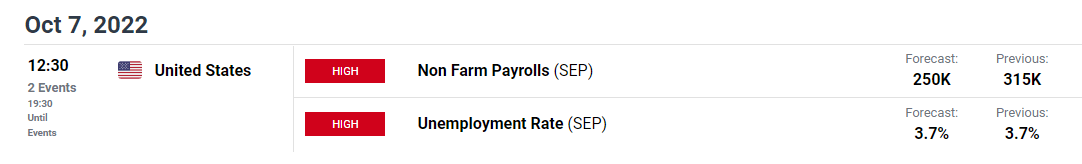

- Will US NFP (Non-farm payrolls) data drive price action?

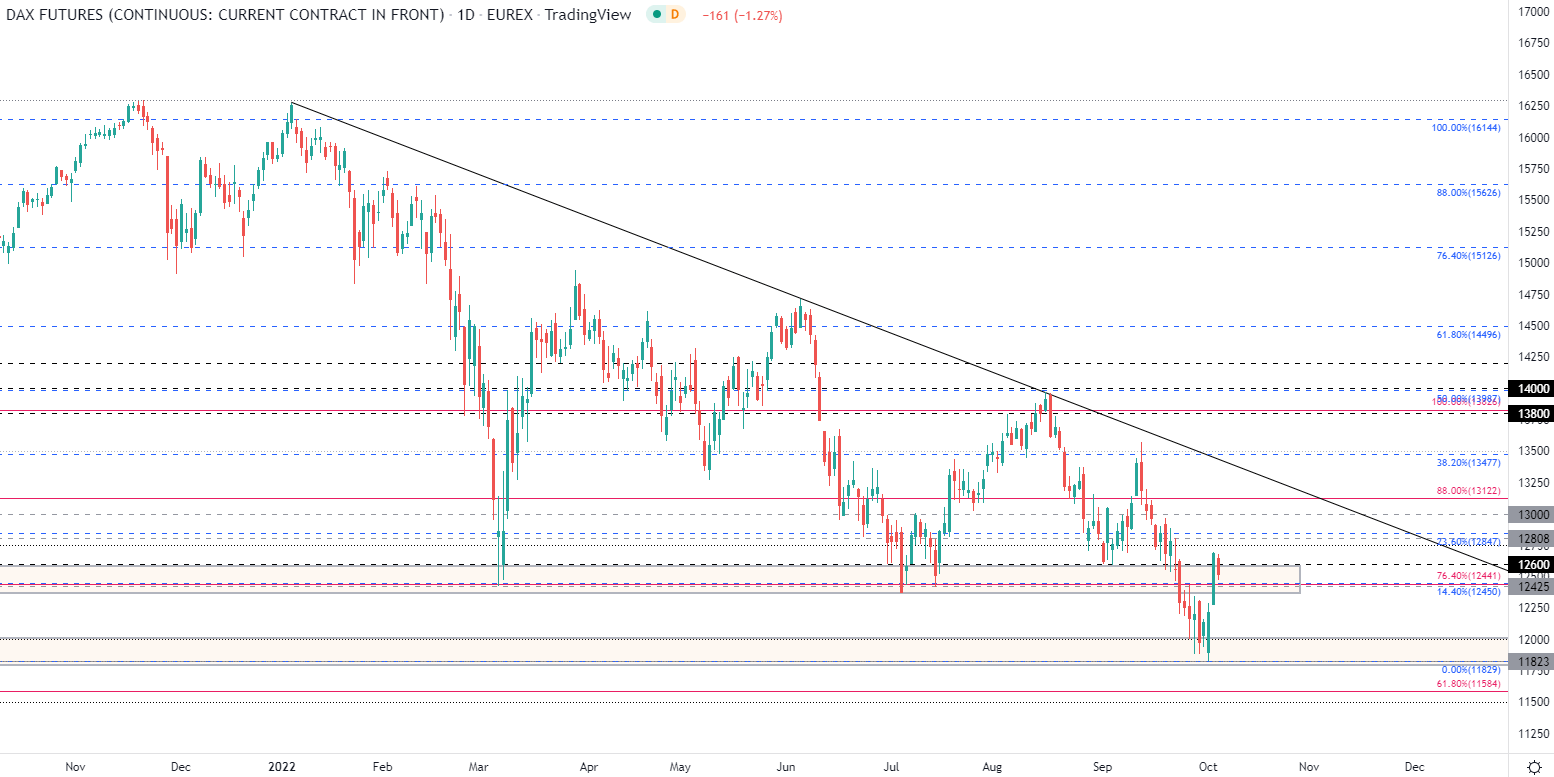

Dax Price Action – Resistance Levels Remain at Prior Support

A rebound in risk trends on Tuesday allowed Germany 40 (DAX) to climb higher, driving prices back towards another big zone of psychological resistance currently holding at 12,700.

With a strong downtrend persisting since the start of the year, a break of 12,133 (the 50% Fibonacci level of the 2020 – 2021) allowed bears to push through 12,000 before finding support at a 21-month low of 11,829.

But after failing to gain traction below 11,800, a temporary relief rally and a hold above the above-mentioned levels eased selling pressure, pushing Dax through prior resistance turned support at 12,443 (the 23.6% Fibonacci of the 2020 move).

Dax (Germany 40) Daily Chart

Chart prepared by Tammy Da Costa using TradingView

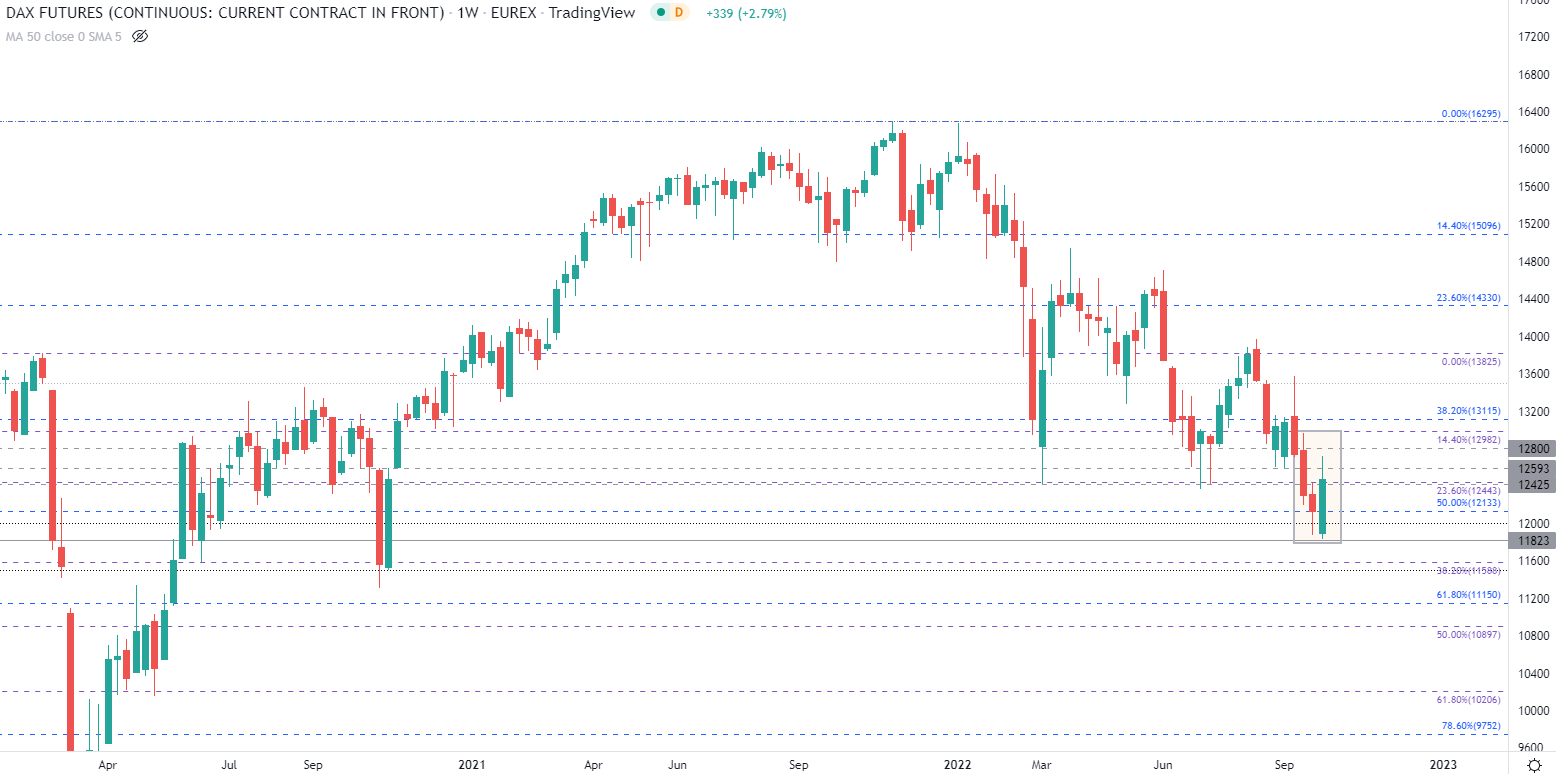

Following a rebound off the recent low, a mild correction has resulted in a potential formation of a bullish engulf on the weekly chart providing a glimmer of hope for bulls.

Dax (Germany 40) Weekly Chart

Chart prepared by Tammy Da Costa using TradingView

In technical analysis, this reversal pattern usually occurs at the bottom of a downtrend providing some reprieve for buyers. However, with oil cuts and inflation still in the spotlight, all eyes have turned to tomorrow’s US job data (the NFP report) which may set the stage for the Fed’s next move.

DailyFX Economic Calendar

For the bullish reversal pattern to hold, DAX would need to close the week above 12,308 (the prior week open) before making its way higher. With the major stock index currently testing the 12,400 - 12,800 zone, additional upside momentum could see 13,000 coming back into play.

However, if selling pressure increases, a break below 12,443 and below 12,000 may open the door for a probable retest of 11,800 and a possible resumption of the bear trend.

--- Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter:@Tams707