DAX 40 News & Analysis

- Dax (Germany 40) futures aim to clear technical resistance

- USD weakness fuels demand for risk assets

- Dow Jones (DJIA) futures retest 30,000 - Q3 earnings drive market action

Dax 40, FTSE 100, Dow Jones head higher – USD weakness & lower yields buoy gains

Dax, FTSE and Dow Jones have opened the week higher as a weaker US Dollar (USD) and lower Yields boost demand for risk assets.

With Germany 40 futures heading back towards 12,700, UK 100 is holding above 6,855 while Dow Futures retest 30,000.

Although interest rates and recession fears continue to rise, major stock indices have shrugged off recent losses as investors shift their attention to Q3 earnings.

What is Earnings Season & What to Look for in Earning Releases?

Dax 40 Technical Analysis

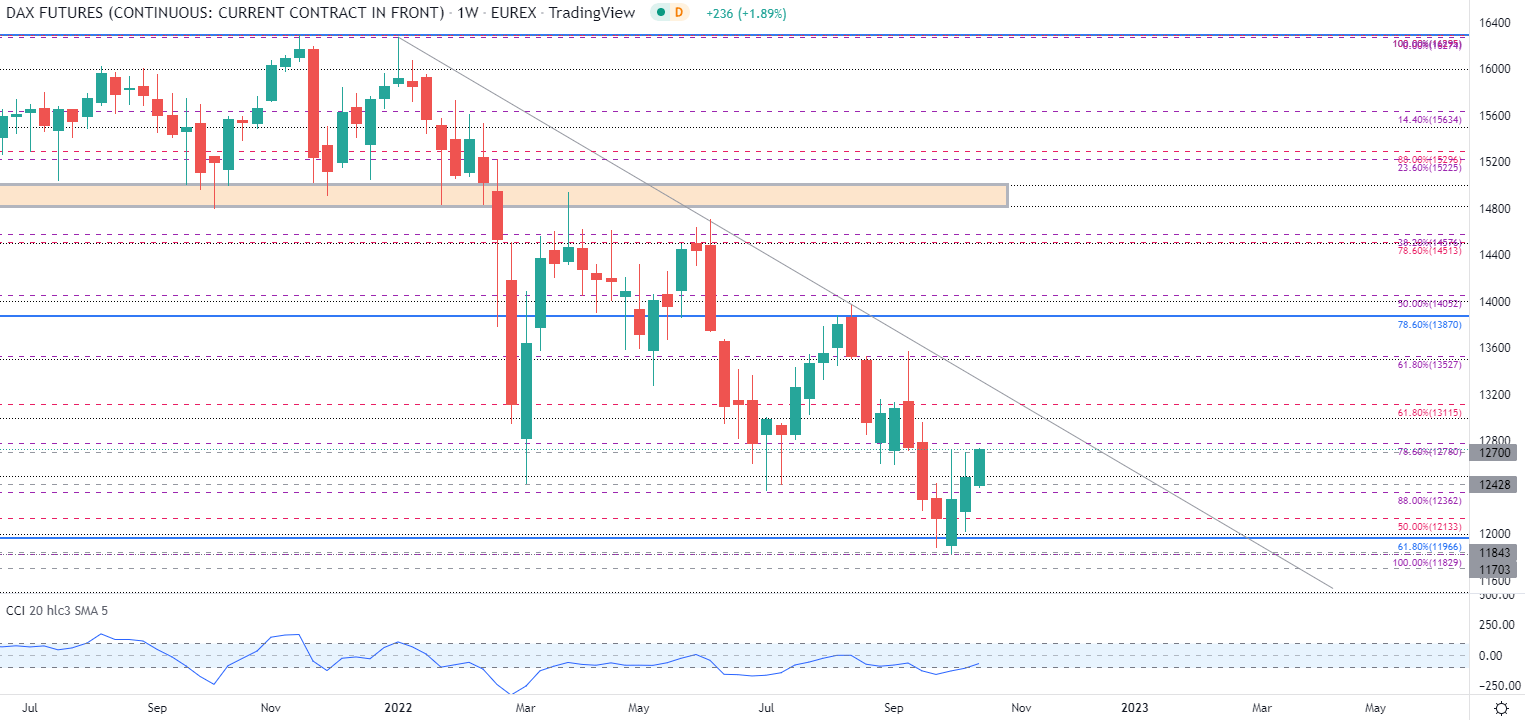

As Dax futures aim for their third consecutive week of gains, both psychological and technical levels continue to provide support and resistance for the European index. With the 12,700-psych level currently in play, the weekly CCI (commodity channel index) has risen back from oversold territory (a possible suggestion that the bears may be running out of steam).

Dax (German 40) Futures Weekly Chart

Chart prepared by Tammy Da Costa using TradingView

Meanwhile on a shorter timeframe, the daily chart below highlights the upcoming zones of confluency that may continue to assist in driving price action for the imminent move.

With the 78.6% Fibonacci retracement of the 2022 move providing an additional layer of resistance at 12,780, a move higher could see bulls driving prices back towards the August high of 12,847. However, if 12,700 fails to hold, a drop back towards 12,400 and below 12,000 may pave the way for another bearish move.

Dax 40 Futures Daily Chart

Chart prepared by Tammy Da Costa using TradingView

Dax 40 Sentiment

| Change in | Longs | Shorts | OI |

| Daily | -21% | 5% | -3% |

| Weekly | 1% | -6% | -4% |

Further Reading

- Learn to trade stocks with our beginner’s guide to stock trading.

- Find out everything you need to know on the types of stocks.

- How does the stock market impact the economy?

--- Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707