Crude Oil, PMI, FDIC, OPEC+ Gap, Federal Reserve, ECB, Fibonacci – Talking Points

- Crude oil has traded in the range so far this week on mixed data

- Support at a Fibonacci level has been tested several times but has held so far

- If the Fed and ECB tighten policy, will recession fears be stoked to send WTI lower?

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Crude oil failed to hold onto Friday’s gains at the start of this week and is listing lower going into the Tuesday session.

A holiday-impacted trading day saw a mixed bag of data that saw sentiment sway to and fro. Markets appear poised ahead of several central bank monetary policy decisions later this week.

On Monday, Chinese manufacturing PMI came in at 49.2 for April instead of the estimated 51.4 and 51.9 prior. Non-manufacturing PMI was 56.4 rather than the 57.0 anticipated and 58.2 previously. The less-than-rosy outlook for growth in world’s second-largest economy seemed to undermine crude.

Then later on, the US manufacturing ISM for April was 47.1, beating the forecasts of 46.8 and 46.3 previously but still in contractionary territory below 50 for the diffusion index.

On a brighter note, US construction spending in March grew by 0.3% month-on-month, beating the 0.1% anticipated and the revised -0.3% prior.

The Federal Deposit Insurance Corporation (FDIC) announced that JP Morgan would be acquiring the beleaguered First Republic Bank. This appeared to lift Treasury yields along the curve and the US Dollar got a general boost across the board, undermining WTI.

The price action has consolidated since the middle of last week after filling in the gap created by the OPEC+ announcement of a cut to production of 1.1 million barrels per day that kicked in at the start of this week.

Looking ahead, the Federal Reserve and the European Central Bank (ECB) will be meeting on Wednesday and Thursday respectively.

Both banks are forecast to raise rates by 25 basis points by the market. Although the tightening is anticipated, any deviation from this expectation might see volatility for crude tick higher.

Update crude oil prices can be found here.

CRUDE OIL (WTI) TECHNICAL ANALYSIS

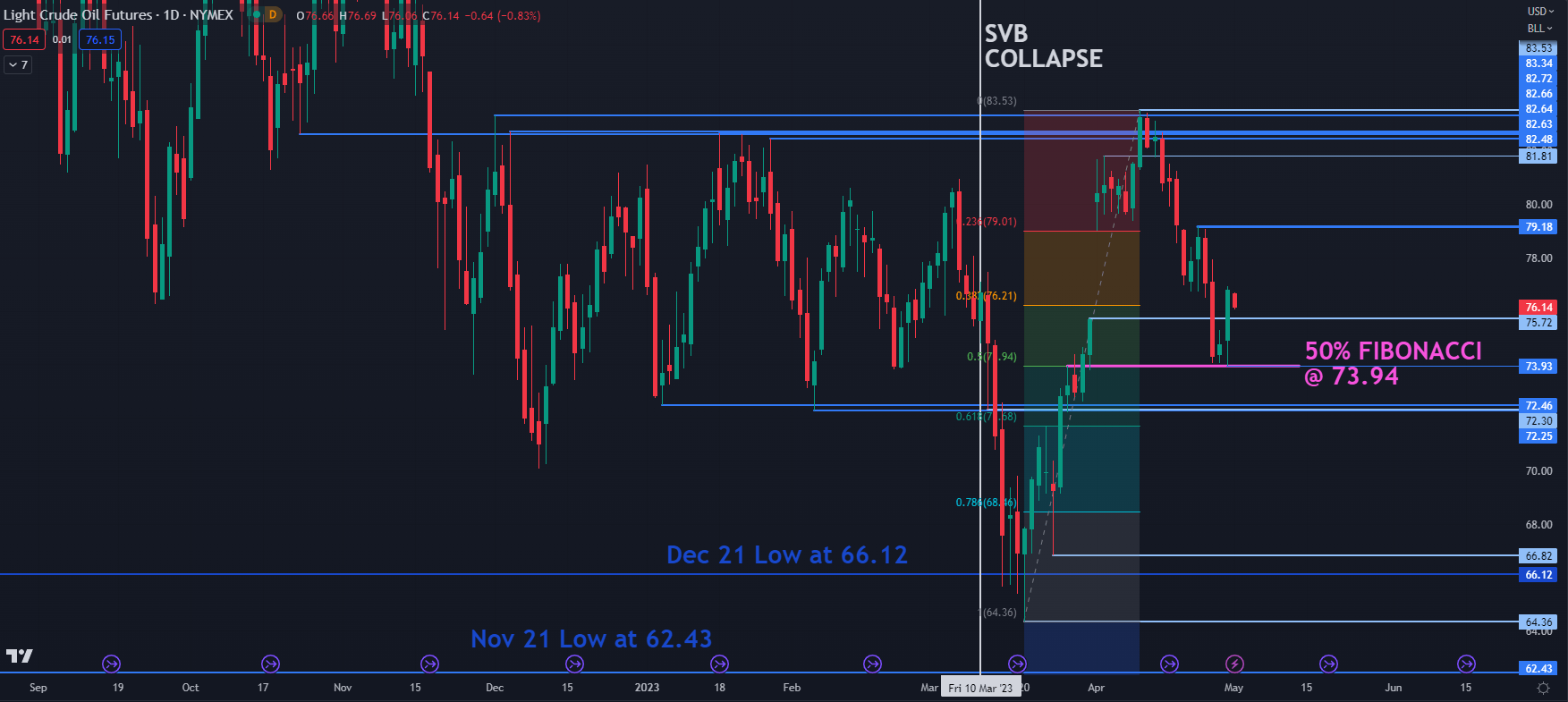

WTI crude appears to have retreated into a range trading type environment after bouncing off the 50% Fibonacci Retracement level of the move from 64.36 to 83.53 at 73.94.

That level may continue to provide support ahead of the breakpoints and prior lows in the 72.25 – 72.46 area.

On the topside, resistance could be at the recent high of 79.18. Further up, there are a series of breakpoints and previous peaks in the 82.50 – 83.50 area that may offer a resistance zone.

--- Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter

--- Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter