Canadian Dollar, USD/CAD, OPEC Cuts? Technical Analysis – Asia-Pacific Briefing:

- Canadian Dollar weakens despite Saudi Arabia oil production cuts

- Failure of broader OPEC+ coordination meant WTI filled the gap

- Slowing global growth may keep oil prices pressured for time being

Canadian Dollar Takes Little from Another OPEC Meeting

The Canadian Dollar weakened against the US Dollar over the past 24 hours. This is despite relevant news in the crude oil space. Over the weekend, the latest OPEC meeting concluded with Saudi Arabia cutting production by about 1 million barrels per day (bpd) from July. It was a rather unusual meeting, with the coalition failing to come to a wide agreement on the need to cut output to revive oil prices.

Even though WTI gapped over 4 percent higher to start the trading week on this news, within 24 hours the commodity filled it, ending the session unchanged. From a fundamental standpoint, the road ahead remains tough for crude oil. Global monetary policy tightening is working as a brake for growth. This was recently seen in the form of disappointing manufacturing data out of China.

With that in mind, if there is no comprehensive coordination between OPEC+ members, it might be difficult for one nation alone to prop up the market. This is relevant to Canada and USD/CAD because oil is a key local export. A material deviation in the price trajectory of the commodity could have key implications for the economy, inflation and the Bank of Canada.

In the meantime, the Loonie might remain focused on the ongoing story of where global growth is heading. Looking at the remaining 24 hours, the economic docket is rather light outside of the Reserve Bank of Australia rate decision. But, USD/CAD might remain focused on market sentiment. A rather pessimistic Wall Street trading session could spell cautious headwinds for the currency ahead.

Canadian Dollar Technical Analysis

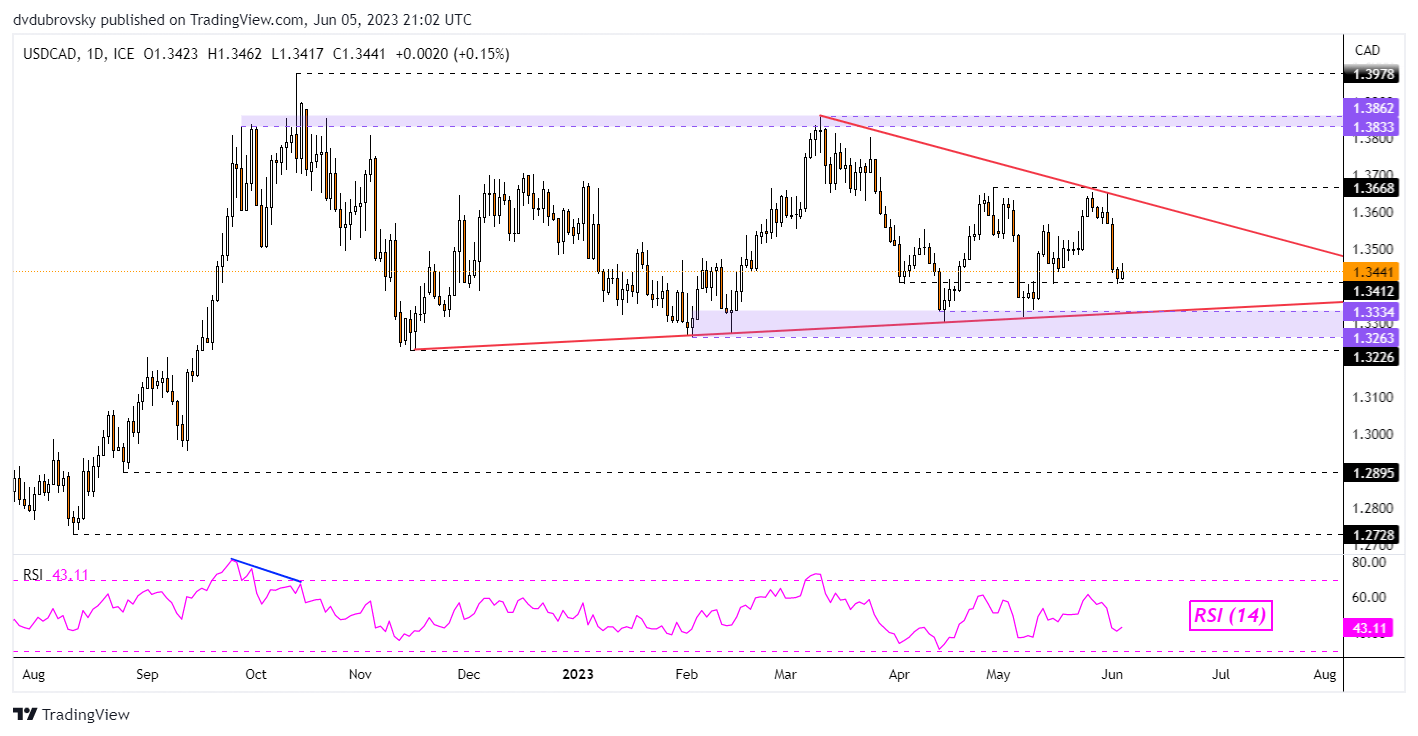

On the daily chart, USD/CAD appears to have support around the 1.3412 inflection point. A turn higher from here places the focus on a falling trendline from March. This could hold as resistance. Meanwhile, a drop through the inflection point exposes a rising trendline from November, which may hold as support. As such, consolidation might be the path ahead for the Loonie until meaningful breakouts are achieved.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

USD/CAD Daily Chart

--- Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com