Australian Dollar, New Zealand Dollar, AUDNZD, RBA, RBNZ – Talking Points

- RBA surprises market with 25 bps rate hike

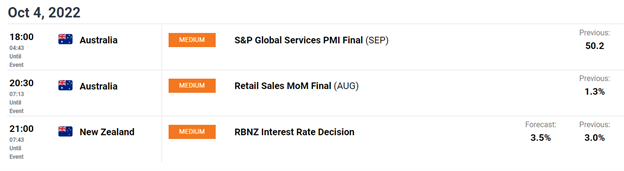

- RBNZ set for 50 basis point rate hike tonight

- AUDNZD eases from top of channel to trendline support

AUDNZD has cooled its yearly advance following the surprise smaller-than-expected Reserve Bank of Australia (RBA) rate hike overnight. The RBA elected to raise by just 0.25% after frontloading rate hikes earlier this year in the fight against inflation. The disappointment saw the Australian Dollar sink as traders adjusted to a central bank that appears to be shifting away from oversized rate hikes.

The RBA’s decision to move ahead with a quarter point rate hike represents a break in the trend of G7 central banks, with many electing for larger sized hikes in the battle against inflation. This may signal that the RBA’s tightening campaign is coming to an end, as rates now sit in restrictive territory. RBA Governor Philip Lowe acknowledged the need to remain committed in the battle against inflation, saying “the board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that.”

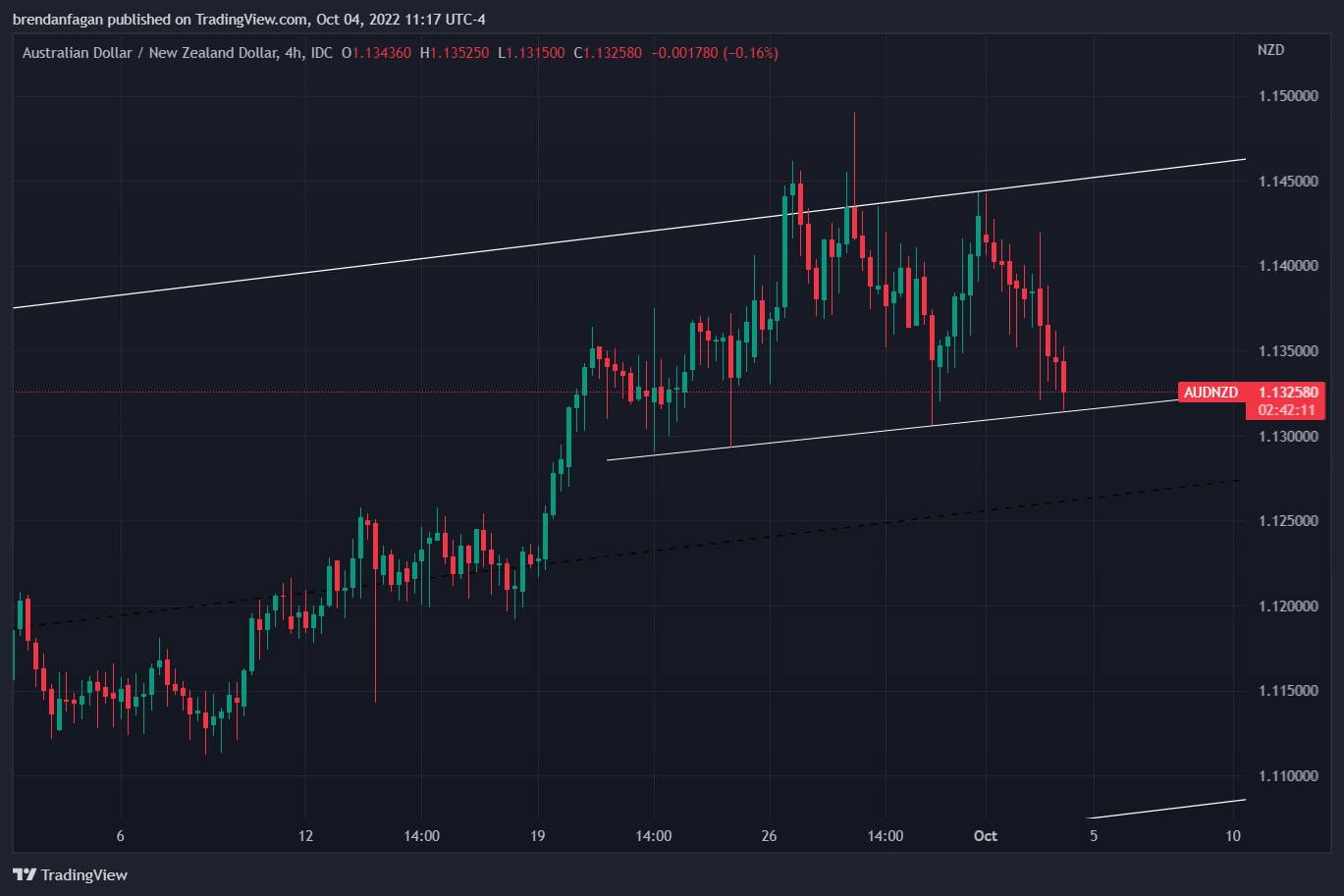

AUDNZD has pushed higher all year as the Australian economy continues to hold up well in light of global developments. Despite the strong data, AUDNZD changed course ahead of this week’s RBA meeting after failing to push higher to the 1.15 area. The recent advance also failed at key trendline resistance, a major area that has defined the upper bound of the bullish trend for the last 12 months. This rejection has seen the cross fall to recent trendline support ahead of tonight’s key RBNZ meeting. All eyes now shift to the RBNZ for near-term direction, as the tone of tonight’s rate hike could make or break this recent pullback.

AUDNZD 4 Hour Chart

Chart created with TradingView

Following the overnight disappointment out of the RBA, the Reserve Bank of New Zealand (RBNZ) is slated to raise the Official Cash Rate (OCR) by 50 basis points to 3.50%. At its previous policy meeting, the RBNZ delivered a hawkish hike citing upside revisions to inflation forecasts. The RBNZ has continued to indicate that financial conditions need to tighten while also saying that the current pace of tightening remains adequate. Traders will likely be looking into the statement associated with tonight’s decision for clues as to forward guidance.

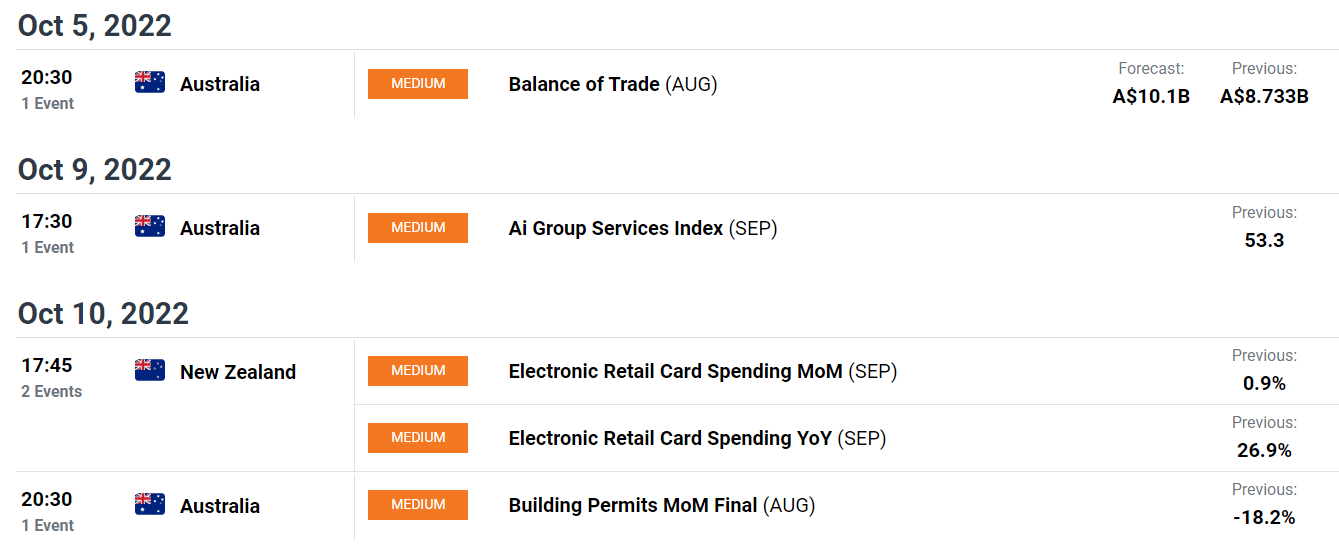

Antipodean Economic Calendar

Courtesy of the DailyFX Economic Calendar

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

RESOURCES FOR FOREX TRADERS

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

--- Written by Brendan Fagan

To contact Brendan, use the comments section below or @BrendanFaganFX on Twitter