Australian Dollar Talking Points

AUD/USD snaps the series of lower highs and lows carried over from last week after failing to defend the May 2020 low (0.6373), and recent developments in the Relative Strength Index (RSI) raises the scope for a near-term rebound in the exchange rate as the oscillator climbs out of oversold territory.

AUD/USD Rebound Pulls RSI Out of Oversold Territory

AUD/USD bounces back from a fresh yearly low (0.6363) as the US Dollar weakens against all of its major counterparts, and the move above 30 in the RSI may keep the exchange rate afloat over the coming days as it offers a textbook buy signal.

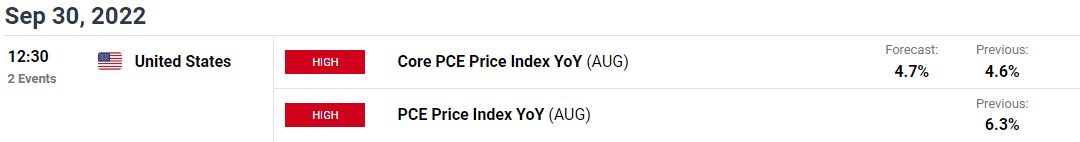

However, the update to the US Personal Consumption Expenditure (PCE) Price Index may drag on AUD/USD as the core rate, the Federal Reserve’s preferred gauge for inflation, is expected to increase to 4.7% in August from 4.6% the month prior, and signs of sticky price growth may encourage the Federal Open Market Committee (FOMC) to retain its approach in combating inflation as the Summary of Economic Projections (SEP) show a steeper path for US interest rates.

As a result, an uptick in the US PCE report may generate a bullish reaction in the US Dollar as it fuels bets for another 75bp Fed rate hike, and the recent rebound in AUD/USD may end up being short-lived as the Reserve Bank of Australia (RBA) acknowledges “the case for a slower pace of increase in interest rates.”

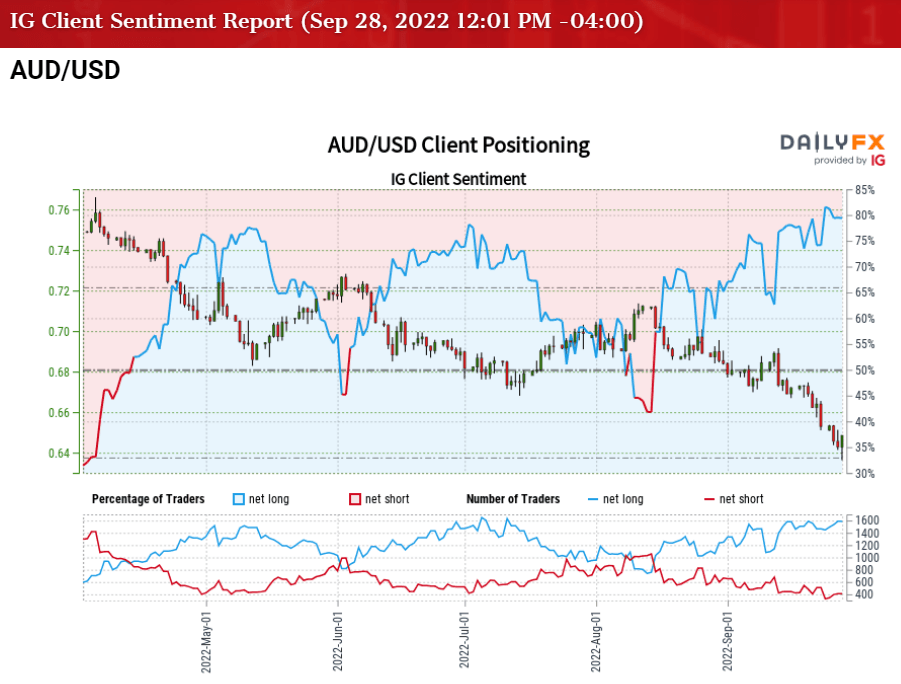

Nevertheless, recent price action raises the scope for a larger recovery in AUD/USD as it snaps the series of lower highs and lows carried over from last week, and a further advance in the exchange rate may alleviate the tilt in retail sentiment like the behavior seen earlier this year.

The IG Client Sentiment report shows 76.12% of traders are currently net-long AUD/USD, with the ratio of traders long to short standing at 3.19 to 1.

The number of traders net-long is 9.89% lower than yesterday and 10.95% lower from last week, while the number of traders net-short is 9.29% lower than yesterday and 10.20% lower from last week. The decline in net-long interest has alleviated the crowding behavior as 78.27% of traders were net-long AUD/USD earlier this week, while the drop in net-short position comes as the exchange rate bounces back from a fresh yearly low (0.6363).

With that said, AUD/USD may come under pressure should the update to the US PCE report fuel speculation for another 75bp Fed rate hike, but recent developments in the Relative Strength Index (RSI) raises the scope for a larger recovery in the exchange rate as the oscillator climbs out of oversold territory to offer a textbook buy signal.

Introduction to Technical Analysis

Market Sentiment

Recommended by David Song

AUD/USD Rate Daily Chart

Source: Trading View

- AUD/USD clears the May 2020 low (0.6373) as it registers a fresh yearly low (0.6363), but the exchange rate appears to be finding support around the 0.6370 (78.6% expansion) area as it snaps the series of lower highs and lows carried over from last week.

- The Relative Strength Index (RSI) highlights a similar dynamic as it climbs out of oversold territory to offer a textbook buy signal, and AUD/USD may stage a larger rebound as long as the oscillator holds above 30.

- A close above the Fibonacci overlap around 0.6460 (61.8% retracement) to 0.6530 (61.8% expansion) may push AUD/USD back towards 0.6650 (50% expansion), with the next area of interest coming in around 0.6760 (50% retracement) to 0.6770 (100% expansion).

Trading Strategies and Risk Management

Becoming a Better Trader

Recommended by David Song

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong