Natural Gas is an important source of energy that can be used for heating, cooling and electricity generation. It also powers manufacturing and is a key ingredient in industrial products, including fertilizers and pharmaceuticals. Today, it is also one of the most traded commodities in the world. In this article, discover what Natural Gas is, it’s history as a tradeable asset and what affects Natural Gas prices.

WHAT IS NATURAL GAS AND WHAT IS IT USED FOR?

Natural Gas, like coal and crude oil, is a fossil fuel that formed over millions of years from the remains of decayed plants and animals, which were compressed deep beneath the earth’s surface and exposed to heat and pressure.

First harnessed as an energy source in 18th-century Britain, Natural Gas truly began to come into its own in the 20th century, when the construction of pipelines opened up many new markets worldwide.

HISTORY OF NATURAL GAS

The history of Natural Gas goes back to Ancient China when, around 500BC, the first crude pipelines were formed out of bamboo shoots to transport the commodity where it was seeping above ground. Skip forward two millennia and commercialization paved the way for Natural Gas to light houses and streetlights in 18th century Britain. The US experienced its first manufactured gas in 1816, and in 1885 the invention of the Bunsen burner allowed for an adjustable flame and new possibilities for cooking and heating.

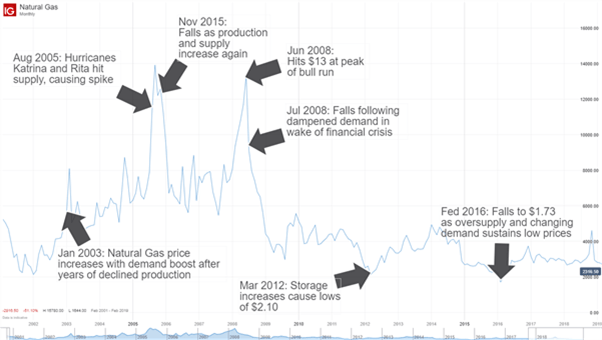

By 2009, 8%of the total 850 000 km³ of estimated remaining recoverable reserves of Natural Gas, had been used. As a traded commodity, Natural Gas has historically seen volatility caused by factors explained below, although since 2010 the price has hovered below the $4.00 mark (measured per Metric Million British Thermal Unit or MMBtu) with oversupply, storage increases and changing patterns of demand.

The below chart illustrates some of the big price movements since the turn of the century, and why they happened.

NATURAL GAS PRICES (2000-2019)

WHO ARE THE BIGGEST NATURAL GAS PRODUCERS?

The top 10 Natural Gas producers possess almost 80% of the world’s reserves of this fossil fuel. As of 2018 data, these regions – along with their average annual outputs (measured in billions of cubic meters) – are:

- United States – 766.2

- Russia – 598.6

- Iran – 184.8

- Qatar – 164

- Canada – 149.9

- China – 138.4

- European Union – 118.2

- Norway – 117.2

- Saudi Arabia – 102.3

- Indonesia – 86.9

Source: The World Factbook, CIA (2018)

By company, the largest players in the Natural Gas market as of 2019 are Gazprom, Royal Dutch Shell, Exxon Mobil, PetroChina, and BP.

WHAT AFFECTS NATURAL GAS PRICES?

The major factor that affects natural gas prices is supply and demand, and this in turn is determined by elements such as production volume, storage levels, economic growth, competing fuels, and weather.

Production Volume

Any disruptions to production – such as adverse weather hampering drilling – can cause supply to drop and Natural Gas prices to spiral upwards.

Storage Levels

Storehouses of Natural Gas help to avoid shortages in times of high demand and to absorb excess production. If stores run low, the price of this commodity usually rises.

Economic Growth

In thriving economies, the commercial and industrial sectors tend to consume more energy, leading to increases in Natural Gas prices.

Competing Fuels

Competition from other energy sources, such as Coal or solar power, can drive Natural Gas prices down.

Weather

In addition to affecting production levels, weather conditions – such as cold snaps or heatwaves – can also heighten demand for Natural Gas.

TRADING NATURAL GAS

Natural Gas can be traded in a range of ways, from natural gas futures and options in the commodities market, to exchange-traded funds (ETFs). Where permitted, spread betting and CFD trading can also be used to speculate on whether Natural Gas will go up or down in price. Read more on how to trade Natural Gas and discover the technical analysis strategies that can help you trade this commodity more consistently.

Reasons to Trade Natural Gas

Natural Gas is a popular commodity to trade for many reasons, such as the increasing demand for cleaner fossil fuels and its potential for volatility, and the liquid nature of the market.

Growth Potential

Energy-sector giants such as Total SA and Exxon Mobil are committing substantial resources to help broaden the uses and availability of Natural Gas, a sign that they believe in its future.

Clean Fossil Fuel Demand

Natural Gas burns cleaner and produces fewer carbon emissions than its fossil fuel cousins, Coal and Crude Oil – making it a popular (and less-regulated) choice in an environmentally conscious era.

Technological Development

The imminent development of a technique to mass-produce Compressed Natural Gas (CNG) – which can be transported without the need for pipelines – could open up many new marketplaces.

Potential Volatility

While the commodity has seen prices stay stagnant since around 2010, periods of extreme volatility are always possible with energy assets, and can be capitalized on by savvy traders.

Liquidity

Due to Natural Gas being a popular asset to trade, there will normally be a large volume of buyers and sellers active in this market. This liquidity increases the likelihood of traders being able to enter and exit positions at the price they want.

FURTHER READING ON NATURAL GAS AND COMMODITIES

Keep up to date with Natural Gas prices with our live chart and expert news and analysis.