November FOMC Preview:

- It’s widely anticipated that the FOMC will formally announce that it will taper asset purchases over the next few months

- Attention will be on Fed Chair Jerome Powell’s press conference at 14:30 EDT/18:30 GMT as the FOMC will not release a new Summary of Economic Projections (SEP) this month.

- We’ll discuss how markets may react to the November Federal Reserve rate decision starting at 13:45 EDT/17:45 GMT. You can join live by watching the stream at the top of this note.

Here Comes the Taper

Over the past few months, the tone from Federal Reserve policymakers has changed. In August, Fed Chair Jerome Powell suggested that the inflation mandate “was met” at the Jackson Hole Economic Policy Symposium. Towards the end of last month, Fed Chair Powell said that “the risks are clearly now to longer and more persistent bottlenecks, and thus to higher inflation.” A taper announcement at the November Fed meeting has been clearly telegraphed, and thus may not come as a surprise to markets.

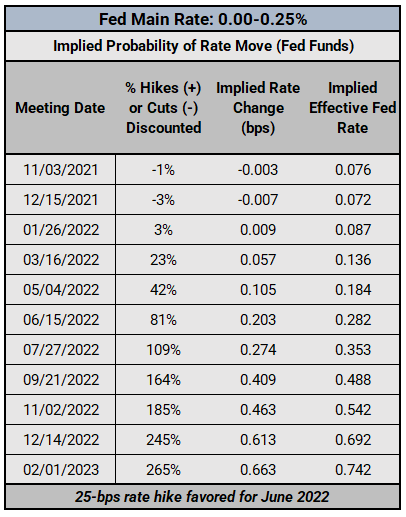

Federal Reserve Interest Rate Expectations (November 3, 2021) (Table 1)

Rate hike expectations escalated dramatically throughout October. At the beginning of October, roughly two weeks removed from the September Fed meeting, markets were in a 104% chance of the first hike in December 2022; that’s a 100% chance of a 25-bps hike and a 4% chance of a 50-bps hike. Overall, the first hike was anticipated in September 2022.

Now, just ahead of the November Fed meeting, Fed funds futures are discounting an 81% chance of a 25-bps rate hike in June 2022, having pulled forward the timeline from September 2022. Rates markets have not been more aggressive on Fed tightening since the pandemic began.

Taper and Rate Hike Timeline

By any measure, it appears that markets are well-adjusted to the extremely likely scenario that the FOMC will announce that it will taper its asset purchases over the next few months. Based on market expectations and historical precedent during the 2013/2014 taper period, the timeline the next few months is projected as such:

- November 2021 = taper targets announced, reduction by $15B/month beginning immediately from $120B in asset purchases in October to $105B in asset purchases

- December 2021 = $90B in asset purchases

- January 2022 = $75B in asset purchases

- February 2022 = $60B in asset purchases

- March 2022 = $45B in asset purchases

- April 2022 = $30B in asset purchases

- May 2022 = $15B in asset purchases

- June 2022 = no more asset purchases

- June through September 2022 = first opportunity for Fed to hike main rate by 25-bps

We’ll discuss how markets may react to the November Federal Reserve rate decision starting at 13:45 EDT/17:45 GMT. You can join live by watching the stream at the top of this note.

--- Written by Christopher Vecchio, CFA, Senior Strategist