Weekly Technical Trade Levels on USD Majors / Commodities

- Technical setups we’re tracking across the USD Majors / Commodities this week

- Updated trade levels on US Dollar, EUR/USD, AUD/USD, USD/CAD, Gold, SPX & more!

- New to Gold Trading? Get started with this Free How to Trade Gold -Beginners Guide

Dollar Losses Mount, Support in View– Gold Rebound Faces First Major Test

The US Dollar losses have continued to mount over the past two weeks with DXY down more than 1.8% off the September high. The moves takes USD majors into key pivot zones into the start of the week and we’re looking for possible inflection on some of these recent stretches. Meanwhile, a multi-week rally in gold is now testing medium-term downtrend resistance and leaves the recovery vulnerable into the start of the week. An in-depth look at the technical levels for the Dollar Index, EUR/USD, AUD/USD, USD/CAD, Gold, USD/JPY, NZD/USD, USD/CHF, SPX500 & GBP/USD.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

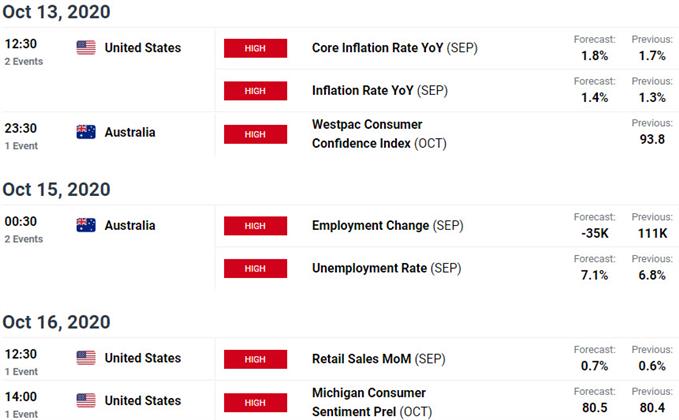

Key Event Risk This Week

Economic Calendar - latest economic development and upcoming event risk

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex