Weekly Technical Trade Levels on USD Majors / Commodities - FOMC / BoE on Tap

- Technical trade setups we’re tracking across the USD Majors / Commodities this week

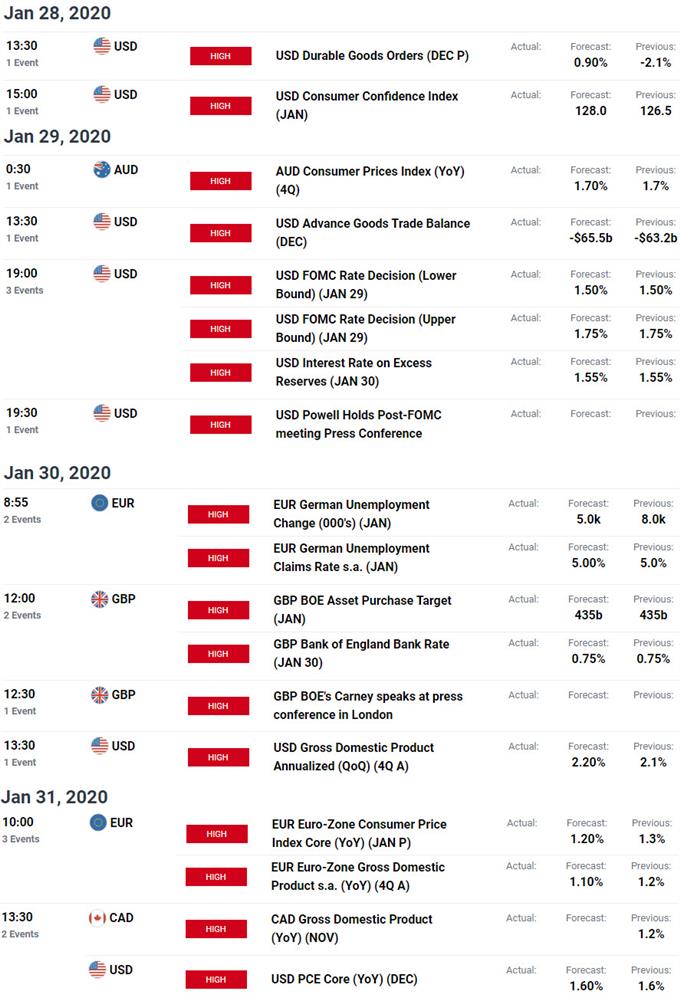

- FOMC & Bank of England interest rate decisions on tap

- New to Gold Trading? Get started with this Free How to Trade Gold -Beginners Guide

US Dollar Breakout Under Review Ahead of FOMC- Gold Prices Rally at Resistance

We’re heading into the final week of January trade with the FOMC & BoE interest rate decision on tap. The recent USD breakout is attempting to mount significant technical resistance here and heading into the releases the focus is on the Majors with numerous setups testing big inflections zones early in the week. In this webinar, we review the updated technical trade setups on DXY, EUR/USD, GBP/USD, USD/JPY, USD/CAD, AUD/USD, NZD/USD, Gold(XAU/USD), Crude Oil, USDCHF and SPX.

Key Trade Levels in Focus

US Dollar – The US Dollar Index is attempting a breakout above key long-term Fibonacci resistance at 97.87 with slope resistance eyed just higher near the 98-handle. Looking or a reaction here early in the week. Initial support 97.80 backed by 97.71 with bullish invalidation now raised to 97.62. Review my latest US Dollar Price Outlook for a closer look at the longer-term weekly DXY technical trade levels.

EUR/USD – Euro testing confluence support at 1.1018/24 into the open of the week – look for a reaction here with a break lower exposing 1.0994 & 1.0976- both levels of interest for possible downside exhaustion IF reached. Initial resistance near 1.1040 with bearish invalidation at 1.1080/92. Review my latest Euro Price Outlook for a closer look at then near-term EUR/USD technical trade levels.

USD/CAD – Price is trading into a key resistance zone early in the week at 1.3182/84 – watch the close in relation to this threshold with the immediate USD/CAD advance vulnerable while below. Weekly open support at 1.3153 backed by near-term bullish invalidation at the 1.31-handle. A topside breach from here would expose subsequent topside resistance objectives at 1.3247 and 1.3280. Review my latest weekly Canadian Dollar Price Outlook for a closer look at the USD/CAD near-term technical trade levels.

Gold– Gold testing a region of lateral resistance at 1586- watch the close with a breach exposing confluence resistance at 1595. Interim support 1568 with bullish invalidation at around ~1550.Review my latest Gold Price Outlook for a closer look at the near-term XAU/USD technical trade levels.

Crude Oil – Oil prices testing initial support targets at the 2019 low-day close at 52.29 with key Fibonacci support seen just lower at 51.34/67. Looking for a reaction off one of these levels with the immediate short-bias vulnerable while above 51.34. Initial resistance at 54.11/24 with bearish invalidation at 56.57. A break below key support exposes subsequent objectives at the 2019 lows at 50.51. Review my latest Crude Oil Price Outlook for a closer look at the near-term WTI technical trade levels.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

Key Event Risk This Week

Economic Calendar - latest economic development and upcoming event risk

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex