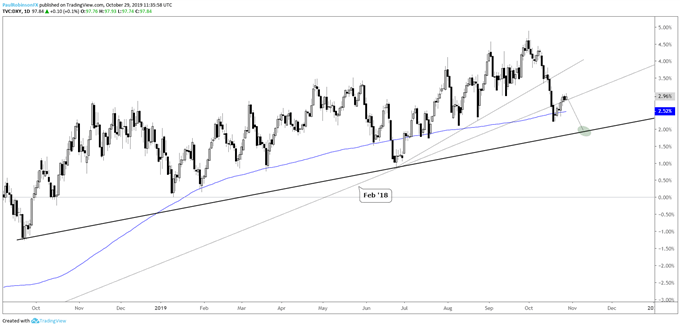

In today’s webinar we looked at a number of USD charts, including the US Dollar Index (DXY) chart itself. Is the recent low the beginning of another surge back to cycle highs since the 2018 low, or is strength only a countertrend move setting up for more selling soon? The FOMC coming up on tomorrow could have much to say about this, or simply be a source of volatility that only muddles the picture further. Wait-and-see looks like a prudent approach from this seat...

US Dollar Index (DXY) (Low or bounce?)

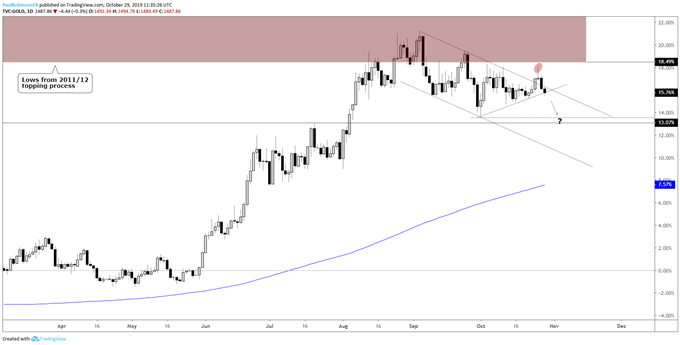

Gold came out of a bull-flag pattern only to post a reversal immediately after. This casts a shadow of doubt on it rallying further, and could lead to the commodity making another leg lower in the digestion period that began early last month.

Gold Price Chart (reversal after bull-flag break put on brakes to upside)

For the full set of technical details and charts, check out the video above…

Resources for Index & Commodity Traders

Whether you are a new or an experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, and trading guides to help you improve trading performance.

We also have a series of guides for those looking to trade specific markets, such as the S&P 500, Dow, DAX, gold, silver, crude oil, and copper.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX