US Dollar Talking Points:

- The US Dollar will likely remain in the spotlight through the end of this week as a large amount of attention remains on the Jackson Hole Economic Symposium.

- In this webinar, I took a step back to look at longer-term setups in the effort of devising strategy parameters for the weeks/months ahead.

- DailyFX Forecasts are published on a variety of markets such as Gold, the US Dollar or the Euro and are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

It’s a tricky time for short-term traders as a number of themes remain in the headlines and this will likely remain the case through the conclusion of the Jackson Hole Economic Symposium. Of particular note, the US Dollar is in focus as there’s a large amount of discern around forward-looking policy. Markets are looking for an aggressive dovish flip at the Fed with as much as 75 basis points of additional softening by the end of the year. The Fed, on the other hand, appears hesitant to commit to any additional cuts right now. This puts the US Dollar in a rather vulnerable state and, as such, this webinar takes a step back to look at the bigger picture in the effort of keying-in on strategy parameters in the weeks and months ahead.

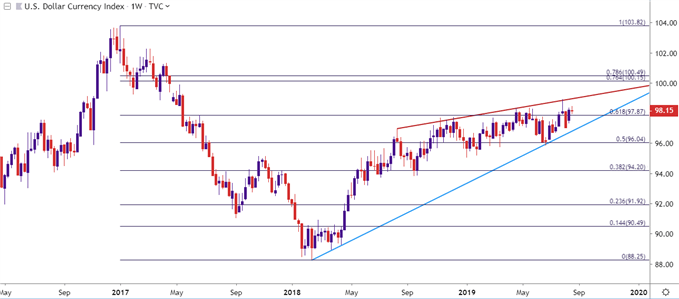

US Dollar Rising Wedge, Will Bulls Abate?

At this stage, the ‘cleanest shirt in the dirty laundry’ theme still holds. While the Fed appears nowhere near tighter policy, they’re also one of the least-dovish CB’s at the moment. And despite a rising set of risks in the backdrop, they’ve appeared rather unconcerned with factors like yield curve inversion or deep negative yields in Europe. But, for how much longer can FOMC policy diverge from that of the rest of the developed world? This puts more attention on the short-side of the currency as there’s a lot more to price-out here than elsewhere when/if they do inevitably become more dovish. This may show at the September rate decision but, more likely, October would be the time to look for this after the bank comes to the table ‘not dovish enough’ with a 25 basis point rate cut in September.

US Dollar Weekly Price Chart

Chart prepared by James Stanley; US Dollar on Tradingview

EUR/USD: The ECB is One Central Bank That Hasn’t Been So Shy

While the Fed appears to be trying to strike a tone of stability without admitting that last December’s rate hike was a mistake, the ECB remains very dovish and in recent weeks, we’ve seen the bank’s sensitivity to spot rates take center-stage. After the July ECB rate decision, when the Euro gained as the bank wasn’t as dovish as expected, ‘sources’ informed Bloomberg that the bank had pretty much already decided on a rate cut for December. Curiously, this was something that could’ve been mentioned in the presser… Nonetheless, this provided a quick dash of weakness in the Euro but, it was the FOMC rate cut a week later that helped to create a fresh two-year-low.

If we do see the Fed remaining in a relatively-hawkish pattern, the short-side of the Euro could come back into play very soon with targets set towards 1.1000 followed by the 1.0800 handle.

EUR/USD Monthly Price Chart

Chart prepared by James Stanley; EURUSD on Tradingview

GBP/USD: Long-Term Techs Come into Help Set Support

Cable put in some rip today on the back of some ‘not as bad as expected’ news on the Brexit-front, giving rise to the idea that Boris Johnson’s negotiation strategy may be bearing fruit. The pair ran into a long-term trend-line in early-August and a few weeks later that price has helped to hold the lows. This can keep the door open for topside scenarios as there are likely a lot of longer-term short positions that have yet to cover.

GBP/USD Monthly Price Chart

Chart prepared by James Stanley; GBPUSD on Tradingview

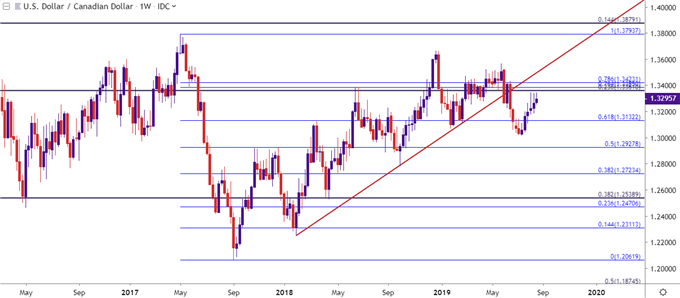

USD/CAD Reversal Potential Continues to Brew

Canadian inflation came out above expectations last month and the pair has continued to soften around resistance at three-week-highs, taken from around 1.3345. This keeps the door open for short-side swings in the pair, particularly should support at 1.3250 give way.

USD/CAD Weekly Price Chart

Chart prepared by James Stanley; USDCAD on Tradingview

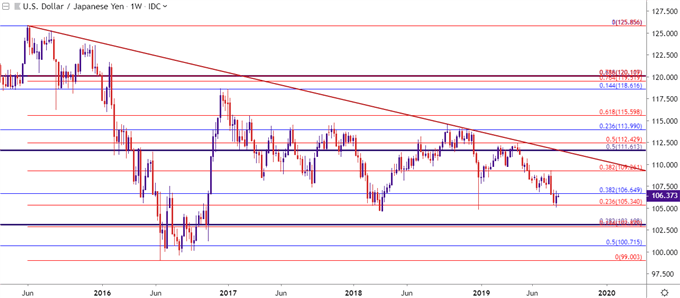

USD/JPY Digs for Support Near Two-Year-Lows

The anti-risk Yen has been in favor over the past four months, but so far in August support has continued to show above the 105.00 psychological level. This can keep the door open for bullish reversals in the pair and, as shown on shorter-term charts such as the four-hour, an ascending triangle has set-in that could assist with bullish entry protocol.

USD/JPY Weekly Price Chart

Chart prepared by James Stanley; USDJPY on Tradingview

USD/CHF: Door Opening for Bigger-Picture Reversal?

Word of the Swiss National Bank actively intervening to cap Franc strength has reset the tables a bit on the USD/CHF pair. While previously a bearish trend continued to drive, support has now set and a shorter-term bullish backdrop has started to appear. The fact that the SNB may be actively attempting to drive-down the value of the Franc makes the topside of the pair as attractive, particularly if the Fed is going to avoid trying to give too many signals of future softening.

USD/CHF Four-Hour Price Chart

Chart prepared by James Stanley; USDCHF on Tradingview

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts have a section for each major currency, and we also offer a plethora of resources on Gold or USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX