Recession Talking Points:

- Liquidity is a principal market concern this week as we enter the belly of the summer trading lull

- The Jackson Hole symposium is without doubt the top fundamental event ahead which draws a direct line to monetary policy

- Principal concern for global markets is more likely to be recession fears while trade wars will likely stir with headlines

Do you trade on fundamental themes or event risk? See what live events we will cover on DailyFX in the week ahead as well as our regular webinar series meant to help you hone your trading.

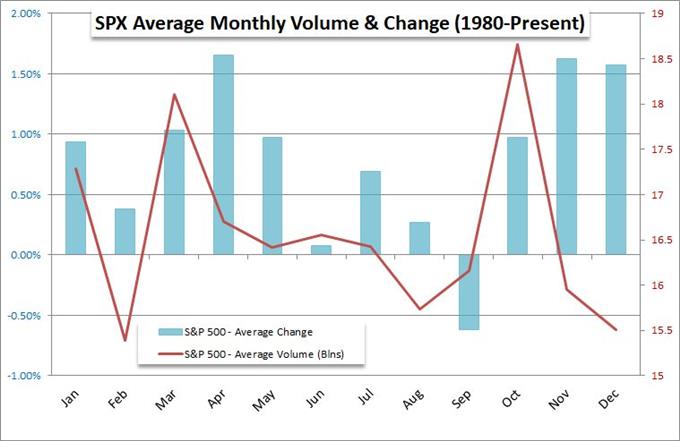

The traditional economic docket for high-level data releases this week is fairly light, but that doesn't account for the deepening concern around three critical fundamental themes driving the markets forward: recession fears, trade wars and the fight building around global monetary policy. Before we consider what these themes can wrought for market influence, we first need to account for the seasonal conditions that are compounding ongoing structural issues. Already dealing with a growing stretch in speculative positioning that has spilled heavily into leverage, we are now passing through the absolute lull in seasonal quiet that distorts conditions through the Northern Hemisphere's summer. While thin markets most often translates into stalled efforts to prompt trends, it can also amplify unexpected volatility.

S&P 500 Seasonality Chart by Month

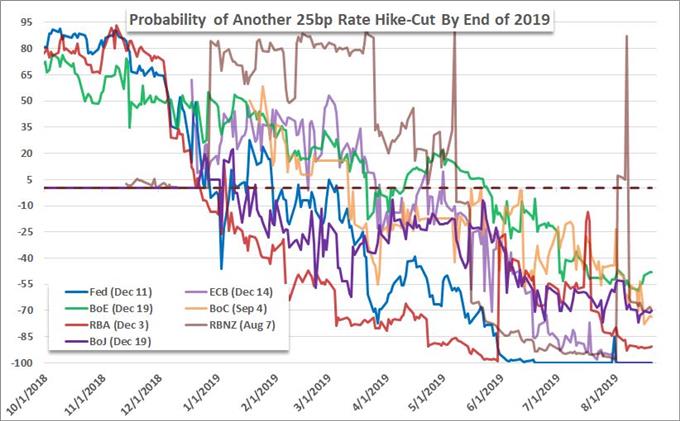

We are facing plenty of scheduled and - more troubling - unscheduled but highly probable systemic event risk moving forward. Most of the attention will go towards speculation surrounding the intent and efficacy of monetary policy. That is owing to the Jackson Hole Symposium scheduled from Friday through Sunday. The event's theme is the challenges facing monetary policy, which happens to be an acute market concern as well. Of course, the questions of how aggressive the major banks will be in preempting serious problems ahead, the fight for independence from political influence (as is currently being tested between Powell and Trump) and what can be done if we exhaust the influence of rates and QE are not likely to be covered in earnest. Markets will judge nonetheless.

Trade wars is another theme that continues to rumble in the background thanks to the frequency with which the US and China have reversed course on their relationship and the frequency of updates on this particular front. We already started the new week with fresh headlines of concern which officials are attempting to play down on both sides of the economic battle front. We are all too familiar with how quickly this confrontation can flare up and trigger a panicked market response, so it will not be easy for markets to just overlook the threat it poses over short and long-term. Yet, with the next known upgrade not until the September 1st induction of the new wave of tariffs on China, attention will be pulled forward until that definitive update is offered.

My baseline concern for the markets at large remains the fears from the market that an economic throttling is on the horizon. It is difficult to alter engrained market fear when there is very little data to support a genuine reach in speculative views. Officials are attempting it certainly, however, with many governments and central banks attempting to repeat optimism as a mantra hoping that it will stick in the psyche of the consumers, business leaders and investors that would need to make it a reality. If market participants are willing to base their assessments on signals like the yield curve inversion, tension will remain high. And, while we are likely to get a sense of this course with the Symposium (and the G-7 leaders' summit over the weekend), it is likely that we see a flighty market respond to any sign of trouble in the interim - whether data based or sheer market speculation.

US 10-Year to 3-Month Treasury Yield Curve Overlaid with S&P 500 in Blue (Monthly)