- Trade setups we’re tracking across the USD Majors / Commodities into the start of August

- Check out our New 2019 projections in our Free DailyFX USD Trading Forecasts

- Live Weekly Trading Webinars on Mondays on DailyFX at 8:30ET

New to Forex Trading? Get started with this Free Beginners Guide

US Dollar (DXY) Testing Multi-Year Resistance Slope- Gold Breakout in Focus

Its been a volatile monthly open with last week’s massive range in the DXY paring back a large portion of the July gains. Gold has broken to six-year highs as risk markets trade heavy into the start of August trade- a close look at the levels across the commodity bloc shows some stretched markets across the board. In this webinar we review updated technical setups on DXY, EUR/USD, USD/CHF, USD/CAD, GBP/USD, USD/JPY, AUD/USD, NZD/USD, NZD/JPY, Gold, Crude, Silver and SPX.

Why does the average trader lose? Avoid these Mistakes in your trading

Key Trade Levels in Focus

DXY – Risk is lower while below the monthly open / slope resistance near ~98.60- initial resistance at the weekly open at 98.12. Slope support rests near ~97.30- a break lower targets the 61.8% retracement at 96.52.

EUR/USD – Euro turned from slope support last week with the reversal targeting topside targets near the upper parallel (currently ~1.1240s). Ultimately a breach above 1.1265 would be needed to suggest a more significant low was registered last week. Initial support 1.1106/12 with bullish invalidation set to the monthly open at 1.1075.

USD/JPY – Price posted an outside weekly reversal off resistance last week with the decline now targeting confluence near-term support at the lower parallel around 105.55. Look for a reaction there- resistance at 106.78 backed by 107.21 with bearish invalidation at 107.60. A break lower expose 104.65.

Gold – A breach above the 100% extension at the 1451 target keeps the focus higher while above with the next major resistance targets at 1482. Near-term bullish invalidation now raised to 1433.

Silver – Focus in XAG/USD remains on the key resistance confluence at 16.61/66- immediate long-bias at risk while below. Initial support around ~16.10 with near-term bullish invalidation now raised to the 2017 open at 15.89. A topside breach would keep the focus on 17 & 17.31/52.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

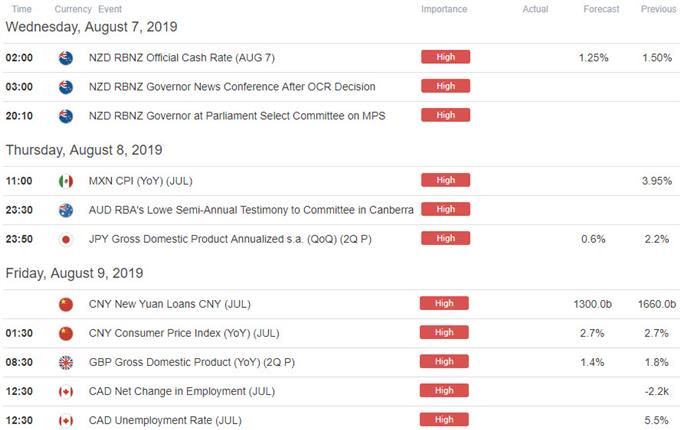

Key Event Risk This Week

Economic Calendar - latest economic developments and upcoming event risk

Learn how to Trade with Confidence in our Free Trading Guide

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex