- Trade setups we’re tracking across the USD Majors / Commodities this week

- Check out our New 2019 projections in our Free DailyFX US Dollar Trading Forecasts

- Live Weekly Trading Webinars on Mondays on DailyFX at 8:30ET

New to Forex Trading? Get started with this Free Beginners Guide

US Dollar Starts the Week at Support – Gold Price Consolidation in Focus

The levels are clear heading into the start of the week across the US Dollar Majors and after last week’s sell-off in DXY, the index opens the week just above near-term support. Gold prices are on the defensive but remain within the confines of a well-defined consolidation pattern within the monthly opening-range. We’re also on the lookout for near-term exhaustion in crude as oil prices continue to probe a key resistance range at 60.06/45. In this webinar we review updated technical setups on DXY, EUR/USD, AUD/USD, NZD/USD, USD/CAD, Gold, Crude Oil (WTI), SPX (S&P 500), USD/CHF and GBP/JPY.

Key Trade Levels in Focus

DXY – Focus is on near-term support around ~96.72. Initial resistance 97.10 with bearish invalidation at 97.37/45. Downside support objectives at 96.51 & 96.31. Key yearly open support at 96.14 (critical).

EUR/USD – Initial support at 1.1241 - constructive while above 1223/30. Subsequent topside resistance objectives at 1.1296-1.1303 & 1.1328/31.

AUD/USD – Aussie testing key resistance at the yearly open / 61.8% Fibonacci extension at 7042/44. Initial support at 7005 backed by 6965–bullish invalidation now raised to 6914. A topside breach targets the 7075 backed by the April open at 7121.

NZD/USD – Risk for topside exhaustion here as we test the monthly opening-range highs. Initial yearly open support at 6705 backed by the weekly open at 6687- a break there would risk a larger correction towards slope support. Topside resistance with the upper parallel (currently ~6750s) backed by 6766 – looking for a bigger reaction there IF reached.

Gold – Gold prices are in consolidation just below the late 2013-swing highs at 1433. XAU/USD has carved a well-defined monthly opening-range - look for the break. Downside support 1373 backed by 1366. A topside breach would keep the focus on subsequent resistance objectives at 1451 & 1482.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

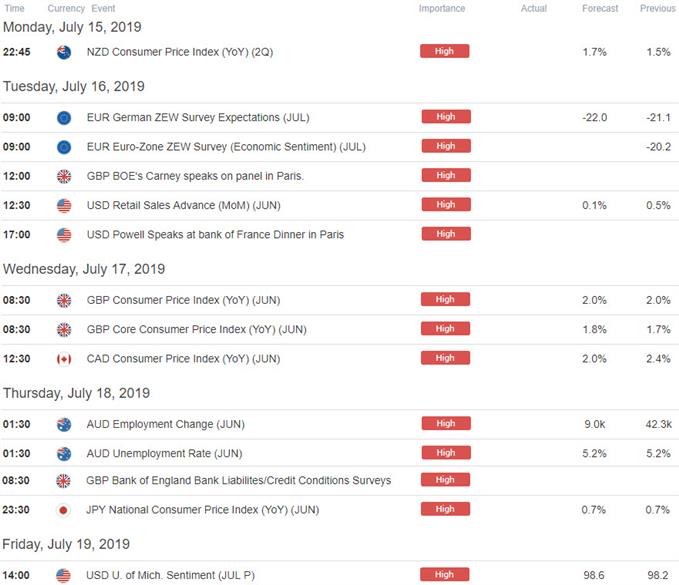

Key Event Risk This Week

Economic Calendar - latest economic developments and upcoming event risk

Learn how to Trade with Confidence in our Free Trading Guide

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex