- Trade setups we’re tracking across the USD Majors this week- FOMC / BOE on tap

- Check out our New 2019 projections in our Free DailyFX USD Trading Forecasts

- Live Weekly Trading Webinars on Mondays on DailyFX at 8:30ET

New to Forex Trading? Get started with this Free Beginners Guide

US Dollar Majors in Focus heading into FOMC / BOE

It’s a big week of event risk with the FOMC & BOE interest rate decisions highlighting the economic docket. The levels are clear and while the US Dollar Index (DXY) could make another run at the highs, we’re generally looking for topside exhaustion IF price is indeed heading lower. In this webinar we review updated technical setups on DXY, EUR/USD, USD/CHF, AUD/USD, NZD/USD, EUR/NZD, USD/CAD, USD/JPY, Gold, Crude Oil (WTI), GBP/USD, GBP/JPY, SPX (S&P 500).

Why does the average trader lose? Avoid these Mistakes in your trading

Key Trade Levels in Focus

DXY – Interim resistance at 97.58/64 backed by 97.87 (key). Downside support / near-term bullish invalidation at 97.17 – look for a reaction there IF reached.

EUR/USD – Price is rebounding off Fibonacci support at 1.1205with more significant support just lower at 1.181/86 – both areas of interest for possible exhaustion. Initial resistance 1.1251/56 with a breach above near-term downslope resistance needed to suggest a larger turn is underway in Euro.

GBP/USD – Near-term bearish invalidation at 1.2632/36 heading into FOMC / BOE interest rate decisions. A break of the May lows would expose 1.2470.

AUD/USD – Price breakdown targeting key lateral support at 6855 & 6828 – looking for a reaction off one of these levels. Monthly open resistance at 6926 with a breach above 6944 needed to shift the broader focus higher in Aussie. A downside break would expose the yearly lows at 6745.

Gold – The gold price rally failed at slope resistance last week on building divergence and leaves the immediate advance at risk into the start of the week. Interim support at 137 backed by 1322. A topside breach targets subsequent resistance objectives at 1366.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

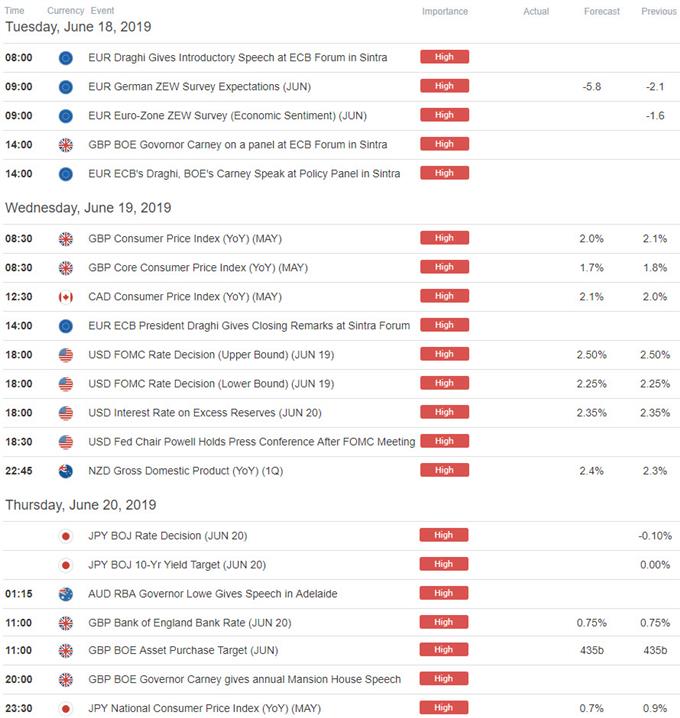

Key Event Risk This Week

Economic Calendar - latest economic developments and upcoming event risk

Learn how to Trade with Confidence in our Free Trading Guide

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex