The U.S. Dollar Index (DXY) is sitting on a significant threshold of support that could make or break the Dollar for the foreseeable future. AUDUSD remains a targeted pair for lower prices, chart could be setting up for a short soon. GBPUSD is trying to forge a bottoming pattern on long-term trend support, may set longs up for a shot higher. Gold is ricocheting off resistance, no big surprise given its significance.

Technical Highlights:

- Dollar Index (DXY) at confluence of support

- AUDUSD short set-up may mature soon

- GBPUSD inverse H&S pattern in the works

- Gold bangs it heads up against major resistance

Fresh Q2 Forecasts are out for major markets and currencies. Check them out on the DailyFX Trading Guides page.

Dollar Index (DXY) at confluence of support

The US Dollar Index (DXY), as discussed yesterday, is at a big spot on the charts. The trend-line (underside of longer-term wedge) is in conjunction with the 200-day, creating a strong line of support. Hold and the choppy upward trend since last year will remain intact, fold below and it could be enough to set off a chain of selling.

US Dollar Index (DXY) Daily Chart (t-line/200-day)

Find out where our analysts see USD heading in the coming weeks based on both fundamental and technical factors – Q2 USD Forecast

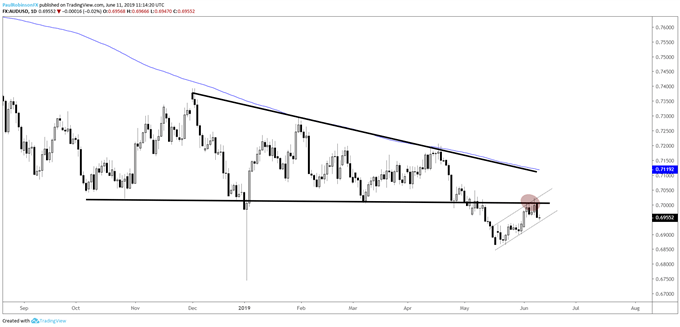

AUDUSD short set-up may mature soon

AUDUSD broke a big-picture descending wedge a few weeks back, which sets the stage for lower prices. In the near-term we have seen a retest of the wedge-break and in the process of retesting a bear-flag/channel is forming. A successful retest of the longer-term formation and break of the underside trend-line of the short-term pattern could set shorts up nicely in the days ahead.

AUDUSD Daily Chart (testing bottom of wedge)

AUDUSD 4-hr Chart (bear-flag/channel)

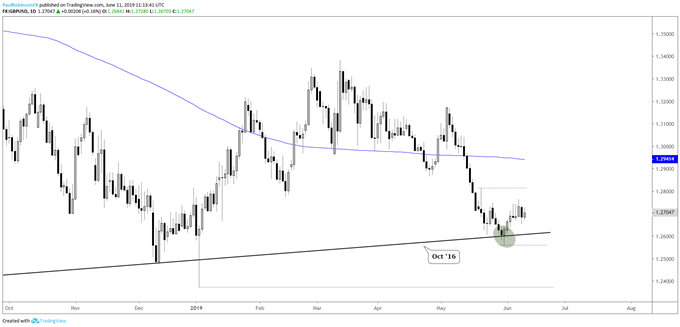

GBPUSD inverse H&S pattern in the works

GBPUSD recently tagged an important trend-line dating back to the October 2016 flash-crash low, and with that it has thus far held. Developing on top of this trend-line is a short-term inverse head-and-shoulders (H&S) pattern. A break above the neckline (12763) will validate the pattern and should set into motion upside momentum.

Further contracting of price could alternatively lead to a wedge, which could also set into motion an upside breakout, or result in a move back to the 2016 trend-line. The bottom line is that the backdrop of long-term support suggests we see an upside breakout, but we need to first wait for validation as a downside failure can’t be ruled out.

GBPUSD Daily Chart (above big trend-line)

GBPUSD 4-hr Chart (inverse head-and-shoulders)

Find out where our analysts see the Pound heading in the coming weeks based on both fundamental and technical factors – Q2 GBP Forecast

Gold bangs it heads up against major resistance

Gold ran up into the major resistance zone everyone has been focused on, and on its first attempt to trade through it was rejected. Nothing new here for gold to look good then suddenly not as longer-term range conditions persist. As long as the 1340s up to 1375 remain in place gold will find it hard to trade higher. A failed rally from here, resulting in a lower-high, may set up for another swing lower.

Gold Daily Chart (turned off long-term resistance)

Find out where our analysts see gold heading in the coming weeks based on both fundamental and technical factors – Q2 Gold Forecast

Resources for Forex & CFD Traders

Whether you are a new or an experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX