The Dow Jones rallied strongly yesterday after starting out the weak on a neutral note; this has confluent resistance in focus. The DAX is also nearing a cross-road of resistance it must overcome in this current sequence of strength if it is to continue higher. Crude oil contracts are stuck in the mud despite being oversold, may lead to more losses this week.

Technical Highlights:

- Dow Jones nearing 200-day, t-line

- DAX approaching confluent t-lines

- Crude oil contracts stuck in the mud

Make more informed decisions by checking out our trading forecasts and educational resources on the DailyFX Trading Guides page.

Dow Jones nearing 200-day, t-line

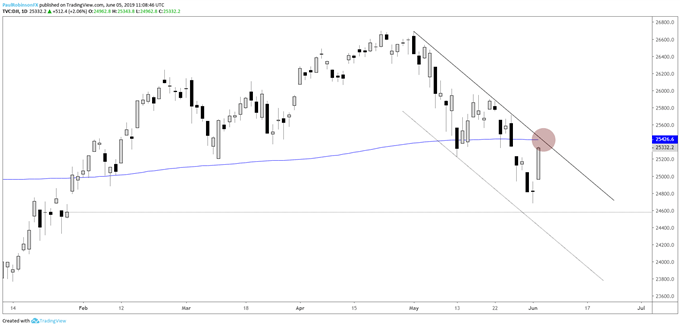

The Dow Jones lifted nicely yesterday, breaking back through resistance just over 25200. This has the 200-day MA in focus along with a trend-line from the May high running down in confluence with the moving average.

This could provide a good little test here today. Given the power of the surge off the low, though, as we are seeing now futures are indicating higher on the open and they may stay that way. A break above resistance doesn’t put the market in the clear but does at the very least put a pause on shorts.

Dow Jones Daily Chart (watch 200-day/t-line)

Check out the Q2 Equities Forecast for the intermediate-term fundamental and technical outlook.

DAX approaching confluent t-lines

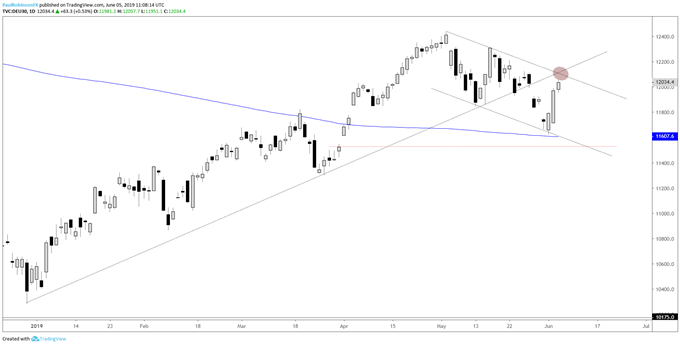

The DAX is in rally mode after hitting the lower parallel tied to the trend-line off the May 3 high. The bounce has that top-side trend-line in focus as resistance along with the underside of the recently broken December trend-line.

DAX Daily Chart (confluent t-lines near)

Crude oil contracts stuck in the mud

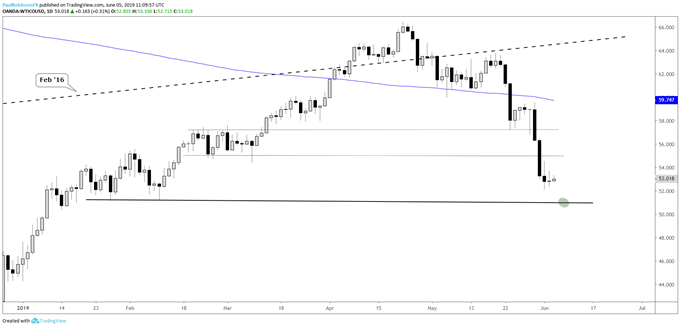

WTI crude oil is failing to do much here despite a bounce in stocks. The ‘dead-in-water’ look it is sporting suggests another leg lower is coming. On the hourly time-frame there is a triangle forming which may indeed be what leads price lower. Watch a pair of lows that supported crude back in February around 51.15 as the next level of support on further selling. If the triangle is broken to the upside then expect some form of a recovery, but it may be a tough ride higher as it goes counter-trend.

WTI Crude Oil Daily Chart (watch 51.15 on further weakness)

WTI Crude Oil Hourly Chart (symmetrical triangle)

Check out the Q2 Crude Oil Forecast for the intermediate-term fundamental and technical outlook.

Brent crude oil is sporting a bit more of a bullish posturing that WTI, but still failing to get much ‘oomph’ so far off the lows. Right now, though, given the pattern in WTI, it is the preferred contract to watch at the moment.

Brent Crude Oil Daily Chart (confluent support at risk of breaking)

Resources for Index & Commodity Traders

Whether you are a new or an experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, and trading guides to help you improve trading performance.

We also have a series of guides for those looking to trade specific markets, such as the S&P 500, Dow, DAX, gold, silver, crude oil, and copper.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX