US Dollar Price Action Setups

This is a live webinar being hosted over the Youtube platform, and upon conclusion, the archive will be available in the above video player.

The focus for today’s webinar is price action across FX pairs along with a couple of key commodity and equity market indices after yesterday’s FOMC rate decision. That rate decision produced a volatile move in the US Dollar, with the currency dropping around the release of the statement; but soon after finding support and rallying through the press conference.

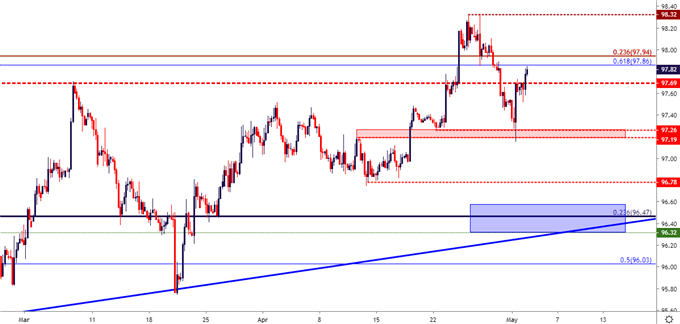

US Dollar Four-Hour Price Chart

Chart prepared by James Stanley

That US Dollar strength remains in to today’s trade, and tomorrow brings the Non-Farm Payroll report out of the United States. The expectation is for +190k jobs to have been added in the month of April, and this has the potential to keep the US Dollar and, in-turn, major currency pairs on the move.

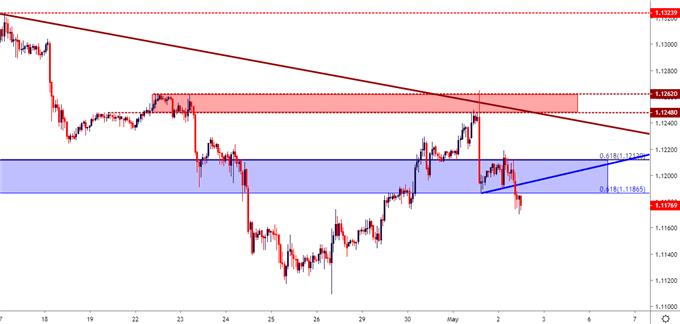

EUR/USD is interesting ahead of tomorrow. Yesterday’s initial move of USD-weakness saw the pair pop-up to last week’s highs, finding a bit of resistance in the zone that runs from 1.1250-1.1262. That zone held the highs as bears quickly came back, and price action pushed back-down to prior range support, the zone that runs from 1.1187-1.1212. We’ve since seen price make a push below this zone, but this may be more of a ‘trap setup’ considering the driver on the calendar for tomorrow.

EUR/USD Hourly Price Chart

Chart prepared by James Stanley

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts for Q2 have a section for each major currency, and we also offer a plethora of resources on USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX