- Technical trade setups we’re tracking into the start of the week

- Check out our New 2019 projections in our Free DailyFX USD Trading Forecasts

- Live Weekly Trading Webinars on Mondays on DailyFX at 8:30ET

New to Forex Trading? Get started with this Free Beginners Guide

USD Ranges Narrow as Majors Consolidate into Critical Levels

The majors have continued to narrow into broader consolidation / congestions patterns with numerous setups starting the week at-or-near range extremes yet again. The economic docket is light this week and the focus is on a reaction in price at these critical levels for guidance. In this webinar we review updated technical setups on DXY, EUR/USD, NZD/USD, AUD/USD, AUD/NZD, Gold, Crude Oil (WTI), USD/CAD, USD/CHF and EUR/CHF.

Why does the average trader lose? Avoid these Mistakes in your trading

Key Trade Levels in Focus

DXY – Focus is on key resistance at the 2018 high-week close at 97.42 and the 61.8% retracement at 97.87– both levels of interest for possible exhaustion. Initial Support at 96.84 backed by key support 95.66/94 and bullish invalidation at 95.03.

EUR/USD – Focus is on a break of a critical range between 1.1186 – 1.1347. Topside breach above needed to validate the breakout – Support break below 1.1130s to mark resumption lower.

NZD/USD – Break of monthly opening-range leaves risk lower sub-6730. Upcoming support targets at the lower parallel around ~6650s backed by the 61.8% retracement at 6633.

USD/CAD – Focus is on a break of a well-defined range between 1.3284-1.3403. Ultimately a breach above 1.3447 is needed to validate resumption higher. A break sub-1.3234/48 (bullish invalidation) is needed to validate a breakdown.

Gold – Price it is testing the yearly range lows– Near-term risk is lower sub-1291 with support eyed at 1275/76 backed by 1253/58- look for a bigger reaction there If reached. A topside breach looks to challenge 1302 (bearish invalidation).

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

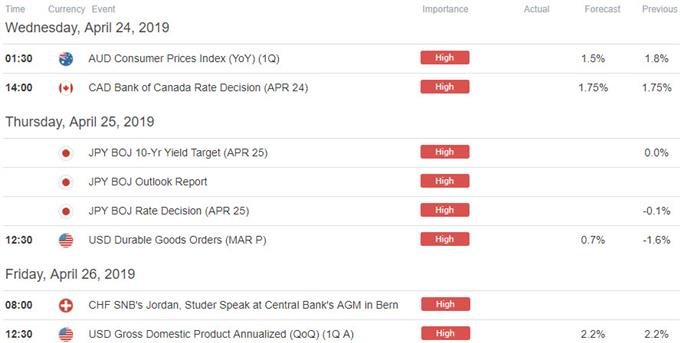

Key Event Risk This Week

Economic Calendar - latest economic developments and upcoming event risk

Active Trade Setups:

- Gold Price Outlook: XAU Bears Grind into Support at Fresh 2019 Lows

- Kiwi Price Outlook: New Zealand Dollar Recovery could be Short-Lived

- Aussie Price Outlook: Australian Dollar Breakout Faces First Test

- Canadian Dollar Price Outlook: USD/CAD Eyes Breakout as Loonie Coils

- Euro Price Outlook: EUR/USD Trade Levels Ahead of ECB

Learn how to Trade with Confidence in our Free Trading Guide

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex