Crude oil is stuck between levels, but still pointed higher and poised to trade that way before possibly becoming exhausted. Gold is breaking down from a descending wedge formation with only one more threshold left to keep it from falling much further. The Dow is in a wedge formation awaiting a break while in Germany the DAX is trading at trend-line resistance.

Technical Highlights:

- Crude oil rally consolidating between levels, still bullish

- Gold is ready to trade lower, has one more line of support

- Dow in wedge, DAX at trend-line resistance

Make more informed decisions by checking out our trading forecasts and educational resources on the DailyFX Trading Guides page.

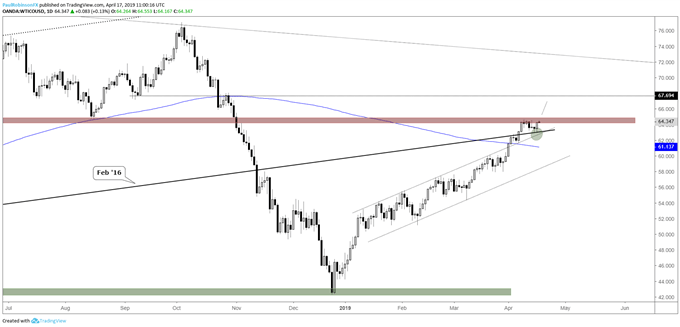

Crude oil rally consolidating between levels, still bullish

Crude oil is stuck between price resistance and sloping support. You have levels keeping a lid on oil from last year during the summer months, while an upper parallel from early this year along with the slope from Feb 2016 keeping price heading higher. The consolidation is likely to lead to a move higher, looking at the 67s at this time as the next stopping point on a firm breakout.

Crude oil Daily Chart (consolidating between levels)

Check out the Q2 Crude Oil Forecast for the intermediate-term fundamental and technical outlook.

Gold is ready to trade lower, has one more line of support

Gold is trading below wedge support at 1281. This has the pattern triggered and ready for gold to move lower in the days/weeks ahead. There is trend-line support from August to think about, and it may be enough to spur a bounce near-term. However, that isn’t expected to last as broader bearish forces look set to push gold much lower.

Gold Daily Chart (Wedge-break, Aug t-line last big support)

Check out the Q2 Gold Forecast for the intermediate-term fundamental and technical outlook.

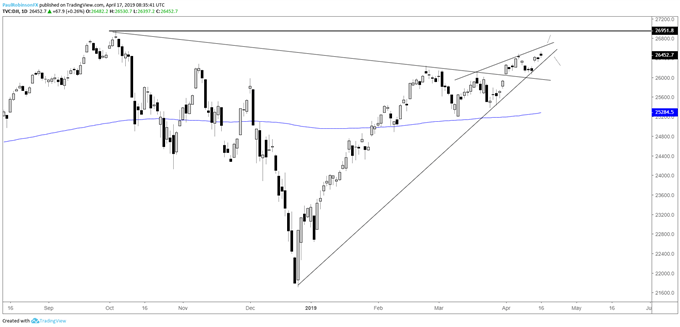

Dow in wedge, DAX at trend-line resistance

The Dow is working its way higher in a rising wedge formation, which should set into motion either a move to the old high at 26951 or spark a sell-off. At this time, the benefit of the doubt lies with higher prices, but volatility is expected to uptick around record levels should they soon be met or exceeded.

Dow Daily Chart (Rising wedge, near record highs)

Check out the Q2 Equities Forecast for the intermediate-term fundamental and technical outlook.

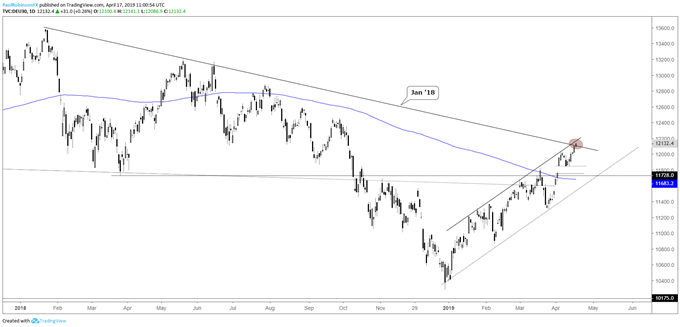

The DAX is trading around the trend-line off the record high and upper portion of a parallel extending higher from earlier this year. It’s an important spot for the market and if price action were to turn decisively bearish here soon then traders may be able to switch gears towards shorts. For now, though, outlook is neutral to bullish.

DAX Daily Chart (trading at resistance lines)

Resources for Index & Commodity Traders

Whether you are a new or an experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, and trading guides to help you improve trading performance.

We also have a series of guides for those looking to trade specific markets, such as the S&P 500, Dow, DAX, gold, silver, crude oil, and copper.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX