This past week the Euro has been stuck in an unusually and unsustainably tight range, breakout imminent. AUDNZD is a pair I’ve been tracking for a while, and with double daily reversal bars recently it should be ready for another leg lower in the sessions to come. Gold was once a champ on the top-side but has found saturation around big long-term levels, this has an important test of channel support likely to unfold in the days ahead.

Technical Highlights:

- EURUSD tight range to break very soon

- AUDNZD looking to make good on reversals at prior support

- Gold is trading heavy, test of important support likely soon

- S&P 500 turned off 2800/17 zone yesterday

See where our team of analysts see your favorite markets and currencies headed in the months ahead on in the Q1 Trading Forecasts.

EURUSD tight range to break very soon

The Euro has been stuck in a very tight range, an unsustainable situation. There were a couple of scenarios we discussed today based on the 4-hr chart. If the ascending wedge resolves higher EURUSD will quickly run into trend-line resistance and could make for a pop-and-drop false breakout, while a break of the lower-side trend-line of the pattern will have it moving back downhill in-line with the broader trend.

EURUSD 4-hr Chart (Wedging)

Check out the Q1 EURUSD Forecast to see our analysts’ intermediate-term fundamental and technical outlook.

AUDNZD looking to make good on reversals at prior support

AUDNZD posted back-to-back reversal days around former support (now resistance), with the latter candlestick the most convincing. As long as price doesn’t close above 10490 look for pressure to remain on the cross, with the bigger picture objective for a move to develop down to parity or worse.

AUDNZD Daily Chart (path of least resistance is lower)

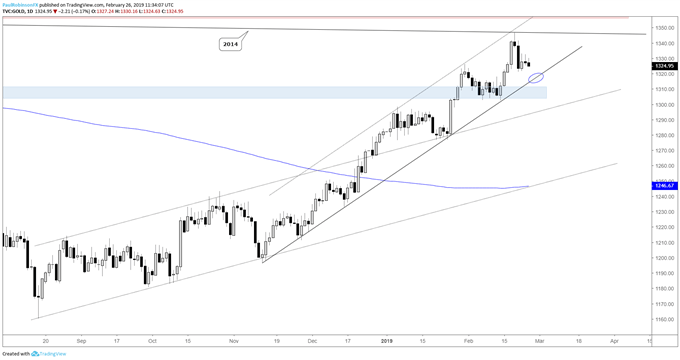

Gold is trading heavy, test of important support likely soon

Gold posted a weekly reversal bar last week, but still has solid trend support not far below. Looking for a test of the November trend-line to occur soon, and with it we will see what gold is made of. A breakdown will confirm and further along last week’s reversal and potentially send gold materially lower.

Check out the Q1 Gold Forecast to see our analysts’ intermediate-term fundamental and technical outlook.

Gold Daily Chart (support test coming)

S&P 500 turned off 2800/17 zone yesterday

The S&P traded up into the 2800/17 zone yesterday and found sellers as anticipated. We’ll find out very soon as to whether they want to show up in larger numbers and finally test the rally off the December low. In tomorrow’s weekly indices & commodities webinar I’ll delve further into the situation…

S&P 500 Daily Chart (2800/17 zone is significant)

Check out the Q1 Equities Forecast to see our analysts’ intermediate-term fundamental and technical outlook.

Resources for Forex & CFD Traders

Whether you are a new or an experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX