The Euro is doing its best to hang onto support but is starting to look like it might want to break. If it does this could lead to some decent momentum. JPY-pairs are weakening, in focus are CHFJPY and AUDJPY as they put in price patterns. Gold continues to hold up well, now trying to rally after tagging off on confluent support.

Technical Highlights:

- EURUSD teetering, may finally see follow-through

- CHFJPY & AUDJPY posting bearish-looking formations

- Gold trying to put together a rally off confluent support

See where our team of analysts see your favorite markets and currencies headed in the months ahead on in the Q1 Trading Forecasts.

EURUSD teetering, may finally see follow-through

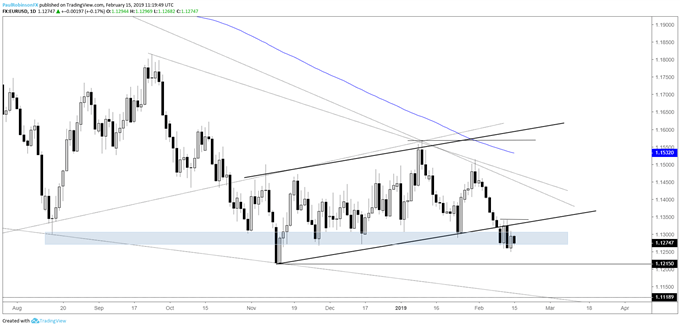

EURUSD swung around a bit the past few days as it trades around significant support. It does appear to be weakening and on that long-awaiting momentum may soon arrive. As long as it stays below 11340 the outlook is bearish, with a beak below 11215 seen as getting the Euro really rolling downhill.

EURUSD Daily Chart (Support barely holding)

Check out the Q1 Euro Forecast to see our analysts’ intermediate-term fundamental and technical outlook.

CHFJPY & AUDJPY posting bearish-looking formations

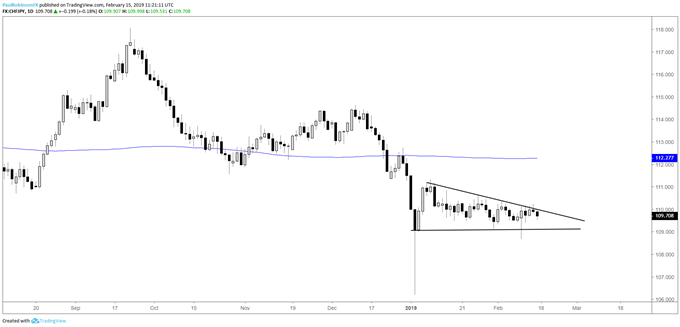

Since the flash-crash to start the year, JPY-pairs have been repairing their charts and the further we get away from that event the better. The descending wedge building in CHFJPY is nearing full maturity and is poised to break soon. The trend and pattern type favor a downside break leading to a retest or worse of the flash-crash low down near 10600.

CHFJPY Daily Chart (Descending wedge)

Check out the Q1 JPY Forecast to see our analysts’ intermediate-term fundamental and technical outlook.

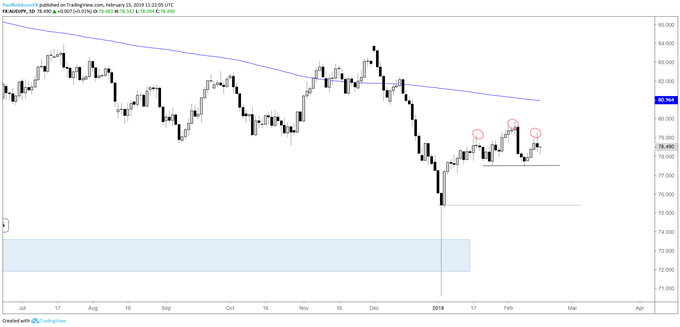

AUDJPY has been struggling, and with it the right shoulder of a head-and-shoulders pattern may have been cemented with yesterday’s reversal. A close below 7744 will have the neckline broken, with the close of the flash-crash day as the first target at 7540.

AUDJPY Daily Chart (H&S forming)

Gold trying to put together a rally off confluent support

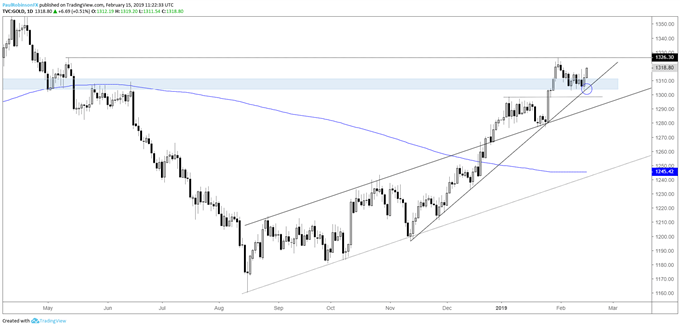

Gold had been hanging onto the zone above 1300, but as of yesterday it not only shown more evidence of wanting to hold support created last year, but it also held the trend-line from November. This confluent support and the initial thrust off of it is viewed as a positive even if the Dollar looks like it might want to rally as well. A breakdown below support will be reason to flip a neutral to bullish bias in reverse.

Check out the Q1 Gold Forecast to see our analysts’ intermediate-term fundamental and technical outlook.

Gold Daily Chart (Confluent support holding)

Resources for Forex & CFD Traders

Whether you are a new or an experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX