EUR/USD is acting as it has for what is seemingly forever now, stopping and reversing after only a short run; support may come back into focus soon. USD/CAD is testing long-term confluent trend support. AUD/NZD is reinforcing an area of support, but interest lies in seeing that support break at some point in line with the broader trend.

Technical Highlights:

- EUR/USD reversing off trend-lines may have support in view soon

- USD/CAD trend-line, 200-day combo could put in floor

- AUD/NZD bouncing off support, but may break soon

See where our team of analysts see your favorite markets and currencies headed in the months ahead on in the Q1 Trading Forecasts.

EUR/USD reversing off trend-lines may have support in view soon

The Euro is acting like the Euro, with momentum stopping in its tracks. It’s been that kind of market and until there is evidence of it changing (and it should at some point relatively soon with vol so low), we must continue to take what is presented to us.

The turn off confluent trend-line resistance could soon have support levels in focus by way of the lower parallel off the November low and January low around 11290. If EUR/USD can hold up after the push off last month’s low, it could trade higher but will have its work cut out for it as several forms of resistance stand in its way.

EUR/USD Daily Chart (t-lines keeping lid on price)

Check out the Q1 Euro Forecast to see our analysts’ intermediate-term fundamental and technical outlook.

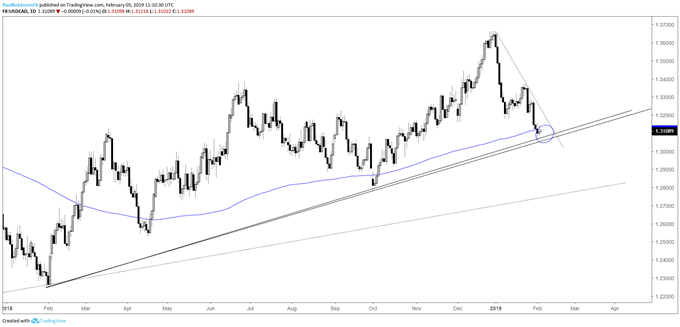

USD/CAD trend-line, 200-day combo could put in floor

The 600-point decline to start the year may be in for at least a retracement soon, with the 200-day and 1-year trend-line in the current vicinity. It’s an area we’ve looked at in recent webinars and with a little bullish price action soon it could help put in a floor. Ideally, a forceful rejection of sorts develops to help signal an increased likelihood that a reversal is underway. On the flip-side, if USD/CAD doesn't respond to support and moves horizontally, a breakdown from a consolidation may become the more likely path.

USD/CAD Daily Chart (t-line/200-day combo)

Check out the Q1 Dollar Forecast to see our analysts’ intermediate-term fundamental and technical outlook.

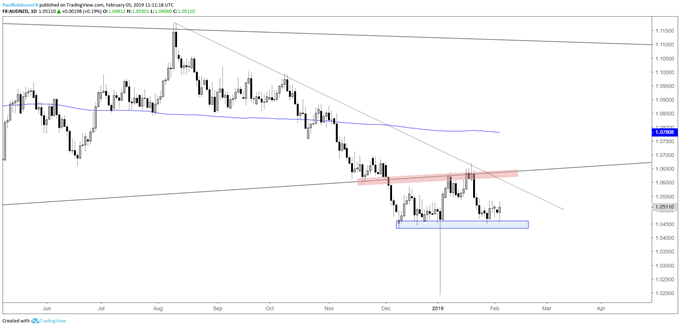

AUD/NZD bouncing off support, but may break soon

AUD/NZD is not yet of interest, but with its inability to mount much of a recovery off the 10460/30 area a break could develop soon. This would be inline with the broken 2015 trend-line/bottom of a macro wedge and more immediately the trend off the summer highs. For now it is wait-and-see, but a breakdown could have the Jan 2 (GMT time) flash-crash lows in focus at some point in the not-too-distant future.

AUD/NZD Daily Chart (Watch support)

Resources for Forex & CFD Traders

Whether you are a new or an experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX