- Technical trade setups we’re tracking into the start of the week

- Check out our 2018 4Q projections in our Free DailyFX USD Trading Forecasts

- Live Weekly Trading Webinars on Mondays on DailyFX at 8:30ET

New to Forex Trading? Get started with this Free Beginners Guide

EUR/USD in Consolidation ahead of ECB - Breakout Pending

Euro is trading within the confines of a multi-month consolidation formation with price testing the upper-bounds ahead of the ECB interest rate decision this week. The immediate risk is for failure up her but we’re on the lookout for possible price exhaustion ahead of structural support early in the week. In this webinar we review updated technical setups on DXY, EUR/USD, USD/CAD, Gold, USD/JPY, AUD/USD, Dow (US30), DAX (GER30), GBP/USD, and Crude Oil (WTI).

Why does the average trader lose? Avoid these Mistakes in your trading

Key Levels in Focus

DXY – Well-defined monthly opening-range between 96.40 and the November close at 97.20 (near-term bearish invalidation).

EUR/USD – Initial support at 1.1350 with bullish invalidation at 1.1318. Close above 1.1426 needed to fuel next leg higher in Euro targeting 1.1472 & 1.1515/24.

AUD/USD – Risk is lower but we’re looking for support ahead of 7140 IF Aussie is to maintain the October advance. Initial resistance with the 100DMA (~7235) with 7327/36 still critical.

Gold – Topside resistance targets at 1252, the 200DMA (~1255) and 1262. Initial support 1236 with broader bullish invalidation steady at 1214/15.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy – Next Episode on Friday 12/14 at 10:30am ET

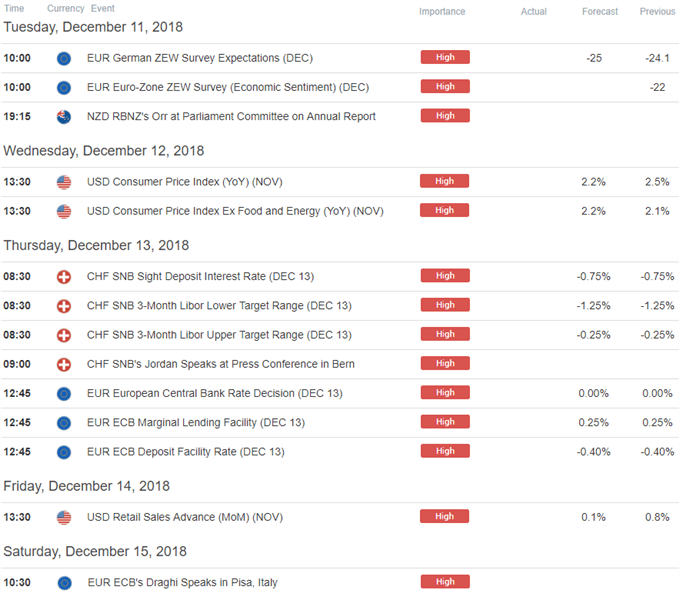

Key Event Risk This Week

Economic Calendar - latest economic developments and upcoming event risk

Active Trade Setups:

- Gold Technical Outlook: Price Breakout Approaching Initial Targets

- USD/CAD Technical Outlook: Initial Targets for Post-NFP Reversal

- NZD/USD Price Outlook: Pending Bull Flag Breakout in Kiwi

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com