AUD/USD is lacking immediate clarity but with a little more time it could be ready to make a break for it out of a contracting price pattern. EUR/CAD remains broadly tilted lower and if a clean technical situation is to remain then it needs to turn down soon. AUD/NZD is forming a small wedge right on long-term support, it’s make or break time. U.S. stocks lifted hard this past week but things could take a turn lower as the recent rally looks like nothing more than a bounce.

Technical Highlights:

- AUD/USD wedging up, setting up for a breakout

- EUR/CAD trend is lower, at trend-line

- AUD/NZD is forming a small wedge on long-term trend support

- S&P 500 bounce may have or be very near ending

See where our team of analysts think your favorite markets and currencies are headed into year-end in the DailyFX Q4 Forecasts

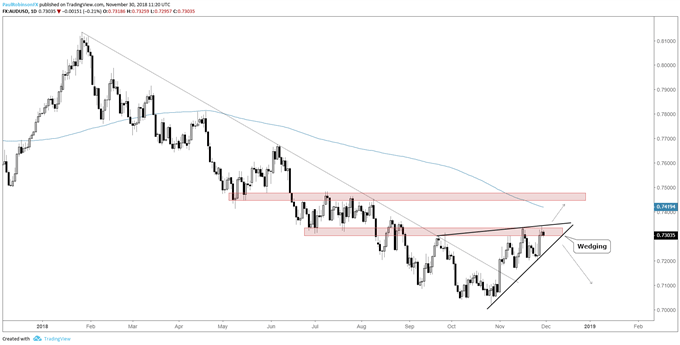

AUD/USD wedging up, setting up for a breakout

AUD/USD has been gradually working its way higher since climbing above the trend-line which held the trend firmly intact for most of the year. The gradual move higher is starting to show the outline of a wedge formation which indicates after the recent choppiness a sustained move may be near.

Aussie is currently struggling around resistance in the vicinity of 7300, but a break higher out of the developing wedge could have the next resistance zone in the mid-7400s in focus. If, however, an eventual downside resolution takes shape then despite the trend-line breaking the move off the October low will have proven merely corrective.

We’ll need to be patient in waiting for a confirmed break, but it may be just around the corner…

AUD/USD Daily Chart (Wedging)

See what key fundamental and technical factors are expected to drive the US Dollar through year-end in the Q4 USD Forecast

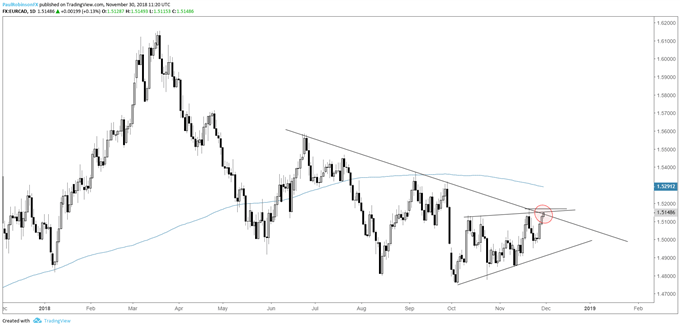

EUR/CAD trend is lower, at trend-line

EUR/CAD is one I have been watching with interest as the trend off he March high is clearly down, and with it trend-line resistance this would be a good time for it to post a high and turn back lower. If it does a further corrective pattern could build before trading lower. A break above the trend-line doesn’t necessarily turn the picture positive but warrants caution from the short-side.

EUR/CAD Daily Chart (At t-line resistance in weak trend)

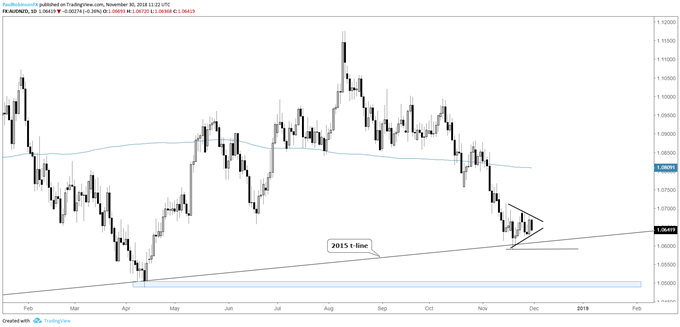

AUD/NZD is forming a small wedge on long-term trend support

Recently, I covered an AUD/NZD short as it started to lift off the 2015 trend-line. The trade from the head-and-shoulders took some time to play out, but the next set-up could be a quick one as the pattern is most visible on the 4-hr time-frame.

The wedge on the 4-hr chart is very near breaking and may do so today. If it breaks along with the low of the pattern at 10589 a move to support surrounding 10500 could quickly develop, or worse given the significance of the long-term trend-line.

It is a wedge and it is at support, so we can’t rule out a break to the upside. A break to the upside will immediately face trend-line resistance, but again given the significance of the long-term trend-line it may be a minor stopping point as broader forces come into play off the multi-year trend-line.

AUD/NZD 4-hr Chart (Wedge)

AUD/NZD Daily Chart (Sitting on 2015 t-line)

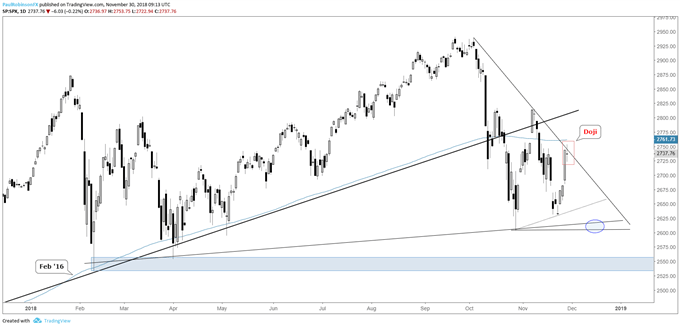

S&P 500 bounce may have or be very near ending

The S&P 500 sprung higher this week with vigor but within the context of the overall trend and tone it doesn’t appear it will be lasting. If yesterday’s Doji are any indication then the bounce could have already concluded. If we see material weakness today then look for another leg lower to develop next week. For more details, check out this earlier piece on U.S. indices.

S&P 500 Daily Chart (Doji at Trend-line)

For the DailyFX intermediate-term fundamental and technical take, see the Q4 Global Equities Forecast

Resources for Index & Commodity Traders

Whether you are a new or an experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX