- Technical trade setups we’re tracking into the start of the week on the US Dollar Majors

- Check out our 2018 3Q projections in our Free DailyFX USD Trading Forecasts

- Live Weekly Trading Webinars on Mondays on DailyFX at 8:30ET

New to Forex Trading? Get started with this Free Beginners Guide

US Dollar Remains on the Defensive Post-Jackson Hole

The US Dollar Index (DXY) has remained on the defensive into the start of the week with the majors stretching into key inflection zones across the board. While the medium-term outlook remains weighted to the downside in the greenback, prices may be vulnerable near-term with a pullback to offer more favorable entries this week. Here are the levels that matter this week.

Key Levels in Focus

DXY – Look for initial support at 94.92/96 – break lower targets monthly open support at 94.56. Resistance at 95.70s.

EUR/USD – Initial support 1.1570, bullish invalidation 1.1510- Key resistance 1.1660/70- breach targets 1.1750.

USD/JPY – Focus on possible support at 110.60/80 (near-term bullish invalidation) – key resistance still 111.40/48.

Gold - Looking for a stretch into resistance at 1214/15- constructive while above 1195. Topside breach targets 1223.

Why does the average trader lose? Avoid these Mistakes in your trading

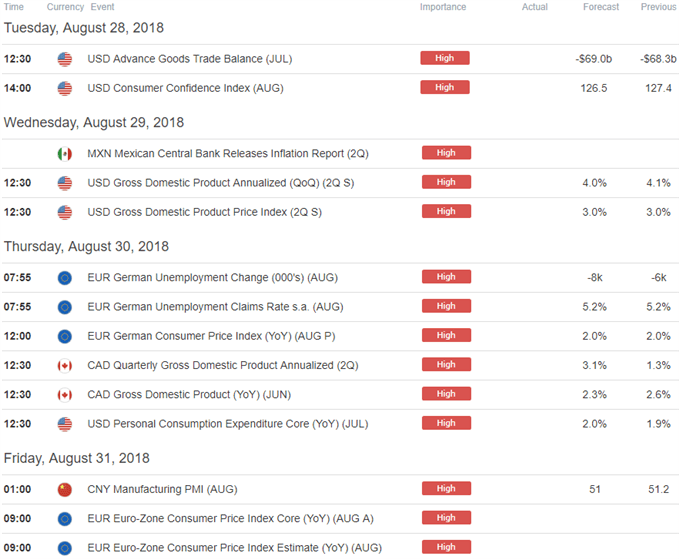

Highlighting this week’s economic calendar will be the second read on US 2Q GDP and the Personal Consumption Expenditure (PCE- the Fed’s preferred inflationary gauge) on Thursday. Canada 2Q GDP and Eurozone CPI are also on tap this week and may offer further volatility in the respective pairs. Keep your eyes on the headlines as the tariff skirmish continues with news wires reporting a deal is forthcoming regarding NAFTA (specifically Mexico) early in the week.

In this webinar we review updated technical setups on DXY, EUR/USD, GBP/USD, USD/JPY, USD/CHF, Gold, NZD/USD, AUD/USD, AUD/NZD, Crude, USD/CAD, SPX, and NASDAQ.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

Key Event Risk This Week

Economic Calendar - latest economic developments and upcoming event risk

Active Trade Setups:

- USD/JPY Price Outlook: Yen Reversal Faces Initial Resistance Hurdles

- Gold Price Outlook: XAU/USD Reversal Constructive Above 1180

- EUR/USD Price Outlook: Euro Constructive Above 1.14

- AUD/USD Price Outlook: Aussie Recovery Faces Major Resistance Hurdle

- USD/CHF Price Outlook: Pending Swissy Technical Breakout

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com

https://www.dailyfx.com/calendar?ref=SubNav?ref-author=Boutros