- Technical trade setups we’re tracking into the start of the week on the US Dollar Majors

- Check out our 2018 3Q projections in our Free DailyFX USD Trading Forecasts

- Live Weekly Trading Webinars on Mondays on DailyFX at 8:30ET

New to Forex Trading? Get started with this Free Beginners Guide

US Dollar Testing Yearly Highs Post-NFP, FOMC

Here we go again- This is the eighth attempt for the DXY to breach above the 200-week moving average and the focus is on this threshold heading into the start of the week. The summer doldrums are upon us and while markets remain range-bound, a broader look at price still has the majors pressing critical inflections zones early in the month. Patience pays during these time periods; remember, times of contracting price action typically precede larger surges in volatility. Simply put, things can / will change quickly- be ready and know the trading levels.

Key Trade Levels in Focus

DXY – Looking for resistance ahead of yearly highs- Near-term support still 94.20/24

USD/JPY – Looking for resistance ahead of the monthly open at 111.88- Key support still 110.70/88.

EUR/USD – Testing critical support zone at 1.1529/54. Key resistance at 1.1616

GBP/USD – Key support confluence rests at 1.2877, looking for a reaction there. Resistance at 1.3164

AUD/USD – The focus is on a break of the 7327-7500 zone with the RBA on tap tonight

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

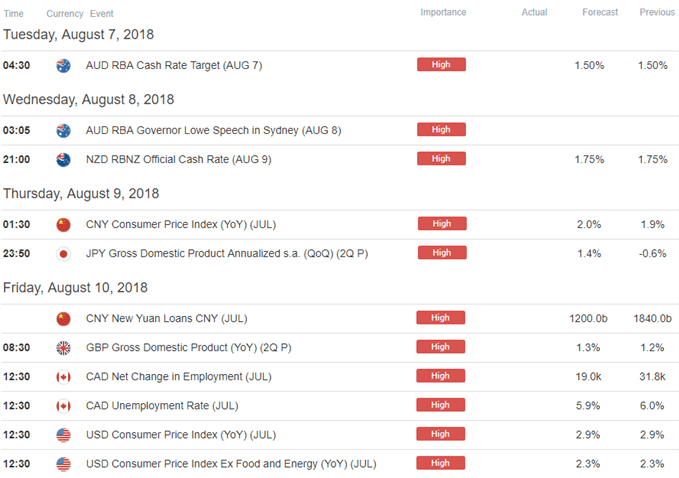

Highlighting this week’s economic calendar will be RBA (Reserve Bank of Australia) & RBNZ (Reserve Bank of New Zealand) interest rate decisions, Japan & UK 2Q GDP and the US Consumer Price Index (CPI) on Friday. In this webinar we review updated technical setups on DXY, EUR/USD, GBP/USD, GBP/JPY, AUD/USD, USD/CAD, NASDAQ, Crude, Gold, Bitcoin (BTC/USD) and USD/JPY.

Why does the average trader lose? Avoid these Mistakes in your trading

Key Event Risk This Week

Economic Calendar - latest economic developments and upcoming event risk

Weekly Technical Updates:

- Euro vs US Dollar (EUR/USD)

- Aussie vs Japanese Yen (AUD/JPY)

- British Pound (GBP/USD)

- Australian Dollar (AUD/USD)

- Euro vs Japanese Yen (EUR/JPY)

- New Zealand Dollar (NZD/USD)

- Japanese Yen (USD/JPY)

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com