It has been a somewhat sluggish trading environment, but there are still opportunities. We re-examined a set-up in GBP/CAD discussed on Wednesday, which has worked out nicely. In the week ahead, favoring strength in USD/JPY, EUR/USD potentially testing the major 11500-thresold, and in AUD/NZD coiling up price action looks set to lead to a one-way move.

Technical Highlights:

- EUR/USD 11500 floor may be tested soon

- USD/JPY reversal-bar at confluence of support

- AUD/NZD wedge on 4-hr set to break

To check out our intermediate-term fundamental and technical outlook on major markets and currencies, see out the DailyFX Q3 Forecasts.

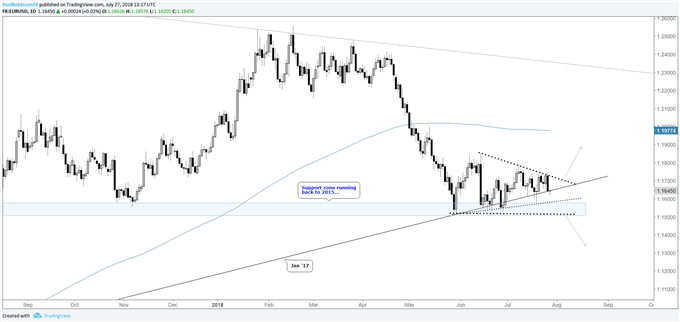

EUR/USD 11500 floor could soon be in for a test

The euro was swatted down yesterday, with the decline coming from the top of the developing wedge dating back to June. With price traversing down towards 11600 the risk next week is for another test of the 11500-line, a level which has been thoroughly tested on three occasions.

Whether one views the past couple of months as a symmetrical triangle or descending wedge, in either case 11500 is significant should we see it in the days ahead. The thinking on this end, is that it may hold on another attempt, initially, but eventually fail. However, not looking to establish a position from the short side until support is broken, as the wedge could also break to the topside and squeeze the euro higher.

EUR/USD Daily Chart (Wedge keeps developing, 11500 big)

Check out the Q3 Euro Forecast for a broader fundamental and technical view

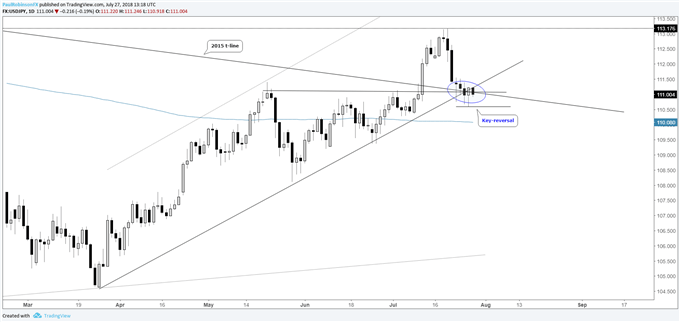

USD/JPY reversal-bar at confluence of support

The recent decline in $/yen is finding buyers at a confluence of support via a retest of the recently broken 2015 trend-line, March trend-line, and price support from around the top of the ascending wedge it broke free from on 7/11. With yesterday’s second reversal day in four sessions, as long as the low at 110.59 isn’t broken on a closing basis the bias is for a rally to ensue in the days ahead.

USD/JPY Daily Chart (Reversal at confluence of support)

Check out the Q3 JPY Forecast for a broader fundamental and technical view

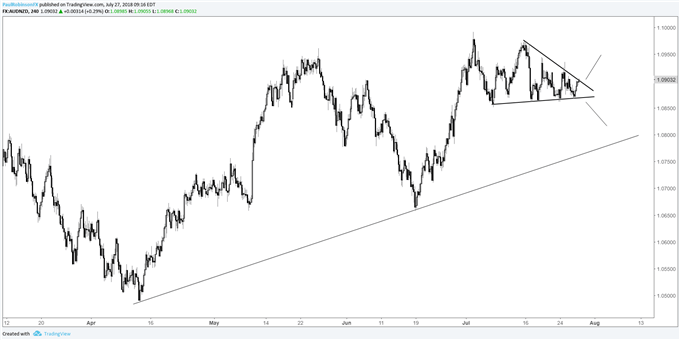

AUD/NZD wedge on 4-hr set to break

AUD/NZD has spent a good chunk of the month coiling up into a wedge; with it now close enough to the apex that a break could come at any time. Which way? Not trying to play the prediction game, instead waiting for a 4-hr closing candle outside of the pattern. The measured move, based on the height of the pattern, points to about a 120-point move coming. The move could be truncated if a bearish break develops towards the trend-line from April, but it could still offer short-term geared traders a relatively clean trade with decent risk/reward. There looks to be larger potential on a topside breakout.

AUD/NZD 4-hr Chart (Wedge ready to break soon)

Resources for Index & Commodity Traders

Whether you are a new or an experienced trader, DailyFX has several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX