- USD Technical setups we’re tracking into key event risk this week

- Check out our 2018 USD projections in our Free DailyFX Trading Forecasts

- Live Weekly Trading Webinars on Mondays on DailyFX at 13:30 GMT (8:30ET)

USD Majors Face Slew of Headline Risks

It’s a week packed with major event risk and for the USD, the focus is on whether the recent pullback from resistance in the Dollar Index (DXY) has further to go. We reviewed recent setups highlighted on the USD crosses and heading into the start of the week, the levels are clear.

Key Levels in Focus

DXY – Initial resistance at 93.91 Bearish invalidation at 94.33. Initial support at 92.96 & 92.28/44

EUR/USD – Key near-term support at1.1616/36. Resistance 1.1827 backed by 1.1910 & 1.1947/61

AUD/USD – Constructive while above 7513. Topside resistance objectives at 7632 backed by 7689 & 7709 (head & shoulders measured objective)

GBP/USD – Key resistance at 1.3495-1.3504 (near-term bearish invalidation). Initial support 1.33 backed by 1.3182

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

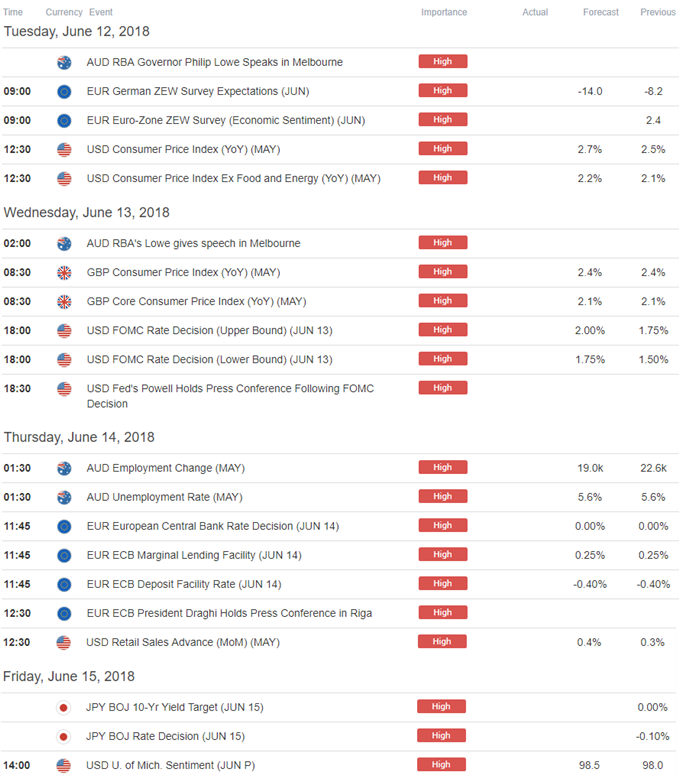

Highlighting this week’s economic calendar are central bank interest rate decisions from the FOMC, the ECB (European Central Bank) and the BoJ (Bank of Japan). Keep in mind we also have the Nuclear Summit in Singapore with the meeting between President Trump and Kim Jong Un likely to keep the market headline driven over the next 24 hours. In this webinar we review updated technical setups on DXY, EUR/USD, USD/JPY, GBP/USD, AUDUSD, USDCAD, Gold, AUD/JPY, Silver, USD/CHF and EUR/GBP.

New to Forex? Get started with this Free Beginners Guide

KeyEvent Risk This Week

Economic Calendar - latest economic developments and upcoming event risk

Other Setups in Play:

- XAU/USD Technical Outlook: Gold Price Breakout Pending

- USD/JPY Technical Outlook: Decision Time for the Japanese Yen

- GBP/USD Technical Outlook: Sterling Rebound Eyes Initial Resistance

- AUD/USD Technical Outlook: Aussie Rebound Testing Key Resistance Hurdle

- USD Threatens June Correction- Dollar Crosses in Focus (Webinar)

Why does the average trader lose? Avoid these Mistakes in your trading

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com