- Technical setups we’re tracking into month / quarter open

- Check out our 2018 projections in our Free DailyFX Trading Forecasts

- Live Weekly Trading Webinars on Mondays on DailyFX at 13:30 GMT (8:30ET)

SPX / AUDUSD Eyeing Critical Support into April Open

It’s the start of a new week, month & quarter with our immediate focus on the initial opening ranges. The S&P 500 and Aussie continue to trade just above key support into the start of the week and with broader markets still closed for Holiday, we’ll be looking for the return of full market participation to offer guidance on highlighted setups.

We also discussed the recent break in correlation between the USDJPY & U.S. Treasury yields and highlighted the implications for price heading into Q2. The TNX finally turned from a long-term slope confluence and suggest further downside pressure is likely in yields- will the Japanese yen catch a bid after last week’s sell-off? USD/JPY does look poised for some pullback here but the near-term focus leaves room for another stretch higher.

Key Levels in Focus

SPX500 - Focus is on critical support at 2586/92; Near-term bearish invalidation now 2676

EURUSD - Risk is lower while below the yearly high-day close at 1.2409- Support targets 1.2275 & 1.2230

USDCAD - Looking to fade a rally towards resistance at 1.2970s- Key support 1.2789

AUDUSD - Critical support at 7637 & 7612- looking for a strong reaction off one of these levels to offer a low

USDJPY – Near-term support 106.10, 105.82 & 105.54 (bullish invalidation) - Resistance targets at 107.21

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

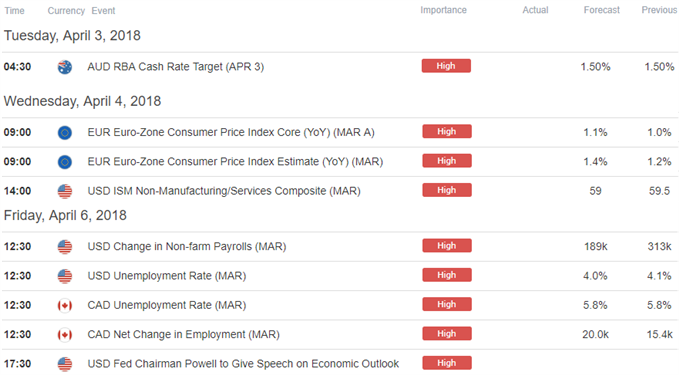

Highlighting this week’s event risk will be the RBA (Reserve Bank of Australia) Interest rate decision tomorrow night and U.S. NFPs (non-farm payrolls) / Canada Employment on Friday. In this webinar we review updated technical setups on SPX, DXY, EURUSD, USDJPY, TNX, USDCAD, GBPCAD, AUDUSD, GBPUSD and EURGBP.

New to Forex? Get started with this Free Beginners Guide

Key Data Releases

Other Setups in Play:

- EUR/USD Uptrend Remains Viable If Price Can Hold Above these Levels

- USD/JPY Price Outlook: Is a Low in Place?

- Weekly Technical Outlook: USD, S&P 500, Bitcoin at Key Levels

- SPX Technical Outlook: Price Probing Critical Support- Levels to Know

Why does the average trader lose? Avoid these Mistakes in your trading

---Written by Michael Boutros, Currency Strategist with DailyFX

To receive Michael’s analysis directly, please sign-upto his email distribution list

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com