- Key technical setups we’re tracking head of FOMC, BoE & RBNZ

- Check out our 2018 projections in our Free DailyFX Trading Forecasts

- Live Weekly Trading Webinars on Mondays on DailyFX at 13:30 GMT (8:30ET)

FOMC to Drive Dollar Price Action

The Federal Reserve monetary policy meeting starts tomorrow with the release of the committee’s updated projections on growth, inflation and employment slated for the Wednesday. Newly minted Fed Chairman Jerome Powell is expected to hike interest rates by 25bps at his inaugural address with market participants awaiting the highly anticipated interest rate dot-plot and quarterly projections.

The US Dollar is under pressure to start the week with the DXY continuing to consolidate just below the March high-day reversal close at 90.24. The price analog we’ve been tracking from the 1994 decline suggests the risk remains for a new low in the index before turning higher and heading into this week’s event risk we’ll be looking for a possible exhaustion high in the index.

Key Levels in Focus

DXY – Risk is lower while below monthly open resistance at 90.67- Key support / bullish invalidation at the low-day reversal close at 89.08

EUR/USD – Price remains constructive near-term while above 1.2240 with a b reach above the yearly high-day close at 1.2409 needed to mark resumption of the broader uptrend.

GBPUSD – monthly OR break leaves risk higher into the March close- Key resistance at the yearly high-day close at 1.4134. Outlook remains constructive while above 1.3850s.

USD/CAD – Critical resistance being tested at 1.3103/32- Looking for signs of exhaustion while below this threshold. Initial support rests with Friday’s low ~1.2920s.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

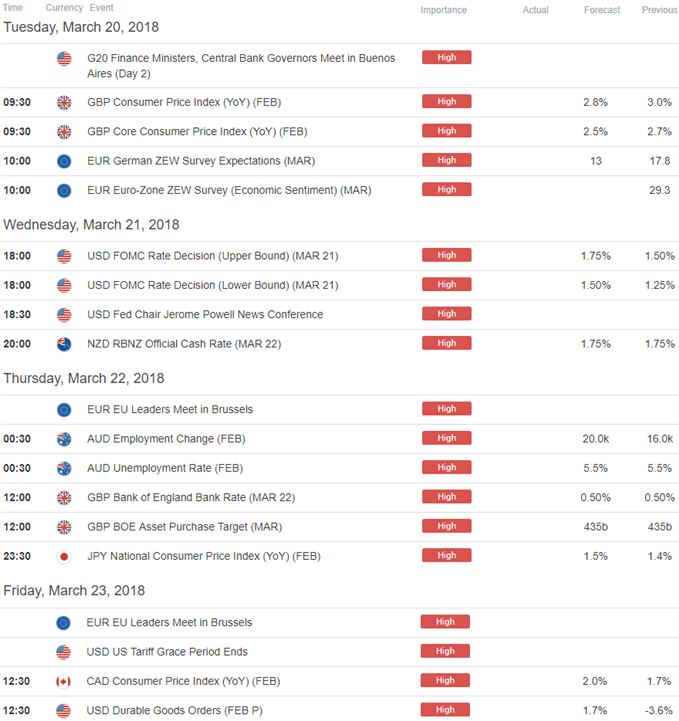

Keep in mind, it’s a BIG week for event risk with central bank rate decision on tap from the FOMC, BoE (Bank of England) and the RBNZ (Reserve Bank of Australia) on tap. In this webinar we review Updated technical setups on DXY, EURUSD, USDCHF, EURAUD, AUDUSD, AUDJPY, USDCAD, GBPUSD and GBPJPY.

New to Forex? Get started with this Free Beginners Guide

Key Data Releases

Other Setups in Play:

- EUR/USD Technical Outlook: Price Sell-off to Offer Opportunity

- EUR/AUD Technical Outlook: Monthly Price Reversal Under Review

- BTC/USD Technical Outlook: Bitcoin Prices Vulnerable to Deeper Losses

- AUD/JPY Price Analysis: Yearly Low Exposed After Early-March Reversal

Why does the average trader lose? Avoid these Mistakes in your trading

---Written by Michael Boutros, Currency Strategist with DailyFX

To receive Michael’s analysis directly, please sign-up to his email distribution list

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com