Talking Points:

- The Fed's monetary policy intentions seem to generate little interest from the Dollar much less broad risk trends recently

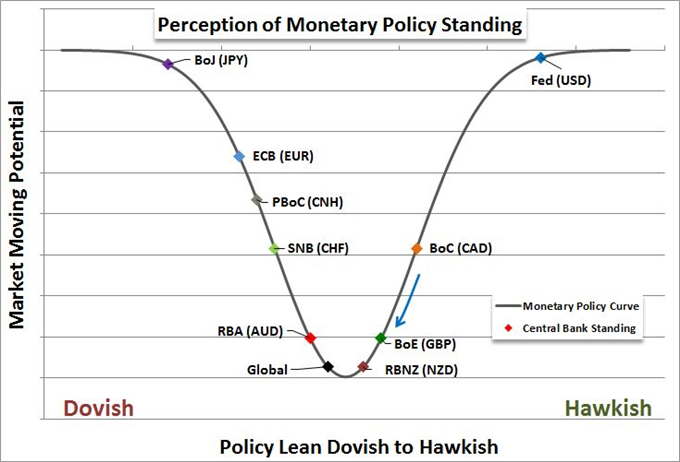

- What truly matters is the actions and outlook for the world's most dovish policy groups: the ECB and BoJ

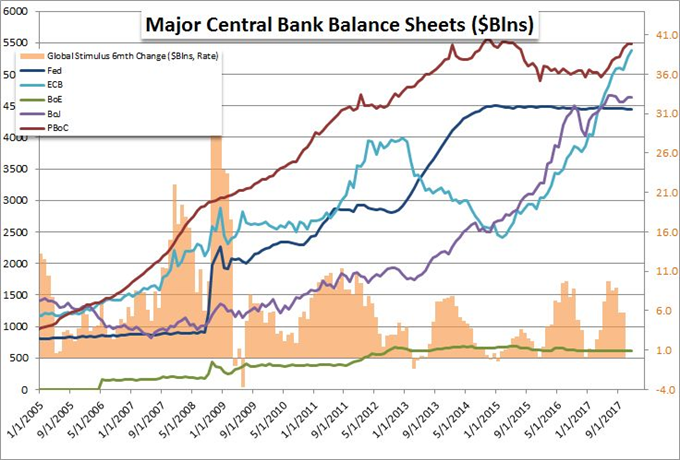

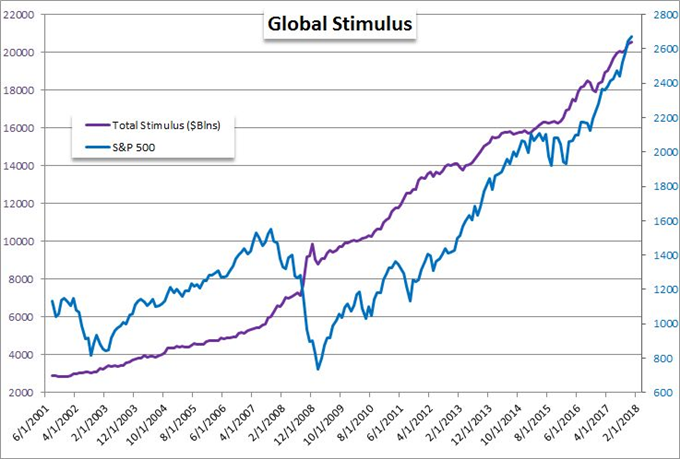

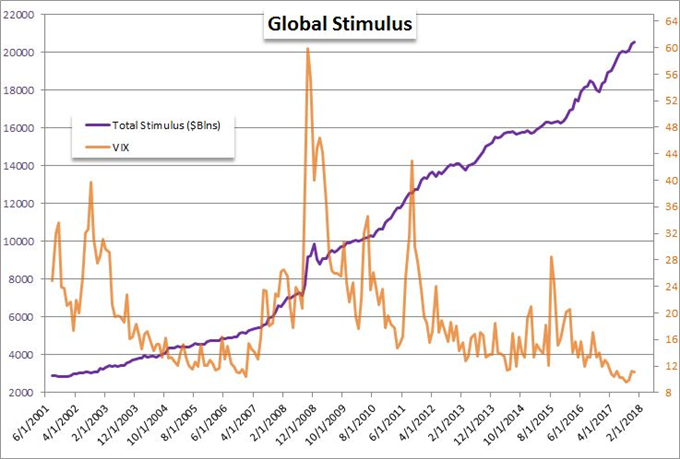

- The flush of accommodation by the world's largest central banks played a critical role in driving risk trends

What are the DailyFX analysts' top trading ideas for 2018 and key lessons to take away from 2017? Sign up for both on the DailyFX Trading Guides page.

I think few would disagree with the notion that global monetary policy has played a crucial role in stabilizing and lifting the global financial markets this past decade. Those that are more forgiving would say that they merely pulled the oxygen out of the fire that was the Great Financial Crisis and allowed recovery to take root. The more pessimistic amongst us however would say the central banks efforts took a turn to speculative seeding rather than virtuous economic support some years ago. I fall into the latter category. While the quick actions of the Fed and some of its peers helped stave off a full seizure global markets, they far overstayed their use in the growth role starting in earnest around 2013. Beyond that point, their maintenance of near zero rates (and further lowering for some) along with massive stimulus infusions traced specifically to the investor rather than wage earner.

What's more, not only did the extremely accommodative monetary policy regimes support speculative ambition, they essentially forced them upon the markets. A necessary side effect of low interest rates is low returns. So investments in traditional assets that return a combination of capital gains and 'income' (interest, yield, dividends, etc) would turn fully dependent on the former. To compensate for the lack of known return in the future, market participants grew increasingly dependent on exposure to assets that would promise steady advance in price and in turn hang all their dependence on the permanence of low volatility. Over the months and years, the exposure grew along with risk and thereby dependence on the world's largest policy makers. With benchmarks like the S&P 500 hitting record highs, the stakes have grown to extreme heights. Yet despite that, we have seen the first moves towards 'normalization' met with a certain degree of calm and perhaps even enthusiasm. The Fed has engaged a gradual but steady policy of rate hikes and even started down the road of reducing its large asset-backed security and Treasury holdings. To a lesser extent, the BoC and BoE have initiated opening moves to tighten; and the high yield currency banks (the RBA and RBNZ) are likely next in line. Yet, risk has not lost its nerve.

The calm may soon be lost however as the frog realizes the water is starting to boil. The lynch pin in the global monetary policy - risk appetite connection is the actions of the world's most dovish, major central banks. So far, the European Central Bank (ECB) and Bank of Japan (BoJ) have maintained their diet of regular asset purchases. That monthly increase in their balance sheets has more than offset the modest unwinding the Fed is doing - and certainly the neutral standing of the other players. Yet, those programs will inevitably end; and the global balance sheet will start to recede. Recognition and response by speculative appetites will no doubt come before that official change in bearing. And so, the focus is on speculation for what the European and Japanese banks intend. We have seen the ECB already take steps to reduce ('taper') purchases at the start of this year and they have stated a full stop may come after September - they said that in 2017 for last September as well though. Arguably, the most important component of the entire theme is the BoJ. They have given no indication of an end - whether with a specific time or even in theory. Yet, a likely change in technical application of the stimulus effort recently triggered fear that they are doing just that by stealth. The market's concern is clear - and understandable when we consider the implications. We discuss why the ECB and BoJ hold the keys to general risk trends going forward in today's Quick Take Video.

To receive John’s analysis directly via email, please SIGN UP HERE.