- Review of current / active setups into the weekly open

- Review the Foundations of Technical Analysis mini-series

- Join Michael for Live Weekly Trading Webinars on Mondays at 12:30GMT

U.S. Non-Farm Payrolls were just the catalyst we were looking for with the DXY reversing sharply off resistance on Friday. The majors remain in focus and while there aren’t too many compelling entries to start the week, the levels are pretty clear.

Swissie remains my favored trade at the moment and I want to see if price can hold below the 9833 threshold early in the week. Interim support rests at 9773 with a break lower targeting the median-line, currently ~9700.

Aussie is coming off a key near-term support confluence at 7735/50 and we’re looking for a reaction off that mark early in the week. A breach above 7826 would be needed to suggest a more significant near-term low is in place.

New to FX? Review this Free Beginners Guide to get started!

Bitcoin rallied into a key resistance range today at 4600/61. Our outlook remains constructive while above 4453 with a breach higher targeting the record high-close at 4921. Meanwhile, Ethereum prices have set an impressive monthly opening-range just below resistance at 312/21 – look for the break this week with broader bullish invalidation steady at 234. A topside breach subsequent resistance targets at 350/55.

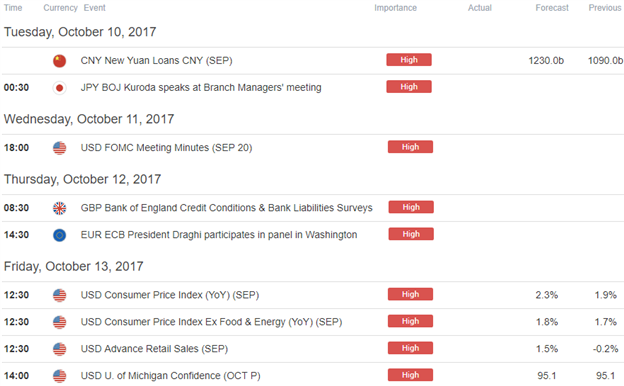

In this webinar we reviewed current & pending setups and updated technical levels on DXY, USDCHF, Bitcoin, EURUSD, GBPUSD, AUDUSD, AUDNZD, USDCAD, XPDUSD, Gold and GBPJPY. Highlighting this week’s economic docket will be the U.S. Consumer Price Index (CPI) and advanced retail sales data on Friday.

Join Michael for his bi-weekly Webinar on the Foundations of Technical Analysis this Friday- Register for Free Here!

---

Key Data Releases

Check out this week’s DailyFX Webinar Schedule

Other Setups in Play:

- USD/CHF Rally Eyes Major Resistance Ahead of NFP

- Crude Oil Price Analysis– Losses to Persist Near-term

- Bitcoin Prices Pause at Resistance, Retains Bullish Posture

See our NEW 4Q Projections in our Free DailyFX Trading Forecasts.

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list.