Talking Points:

- GBP/USD's charge this past week was the most productive for bulls in two months

- Other Sterling crosses showed limited gains for the currency, suggesting the Dollar's slide carried the bulk of the move

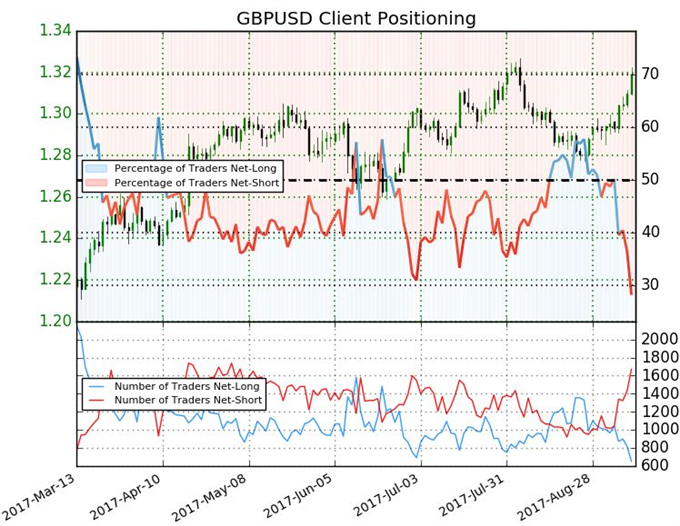

- Speculative positioning shows retail traders are heavily net short, but will Brexit and BoE focus bear out their views

What makes for a great trader? Strategy is important but there are many ways we can analyze to good trades. The most important factor is our own psychology. Download the DailyFX Building Confidence in Trading and Traits of Successful Traders guides to learn how to set your course from the beginning.

The Cable has proven itself one of the least motivated of the Dollar-based crosses in large part due to the fundamental restraint on the Sterling. Yet, despite the curbs on the Pound, GBP/USD managed a remarkable charge through this past week. In fact, the bullish run through the period was the most productive in two months. That run has moved the pair up to a trendline that has formed since the initial panic of the Brexit vote settled after June 24th, 2016. This chart pattern alone would not carry much weight, but the general conditions surrounding this pair and the Pound in particular present a unique backdrop that can skew the probabilities between progress and retreat moving into the week and weeks ahead.

When we take stock of the performance of other Sterling-based crosses, it was clear that - with the exception of a modest tail wind Friday amid a round of data - there was little consistency for the UK-based currency. From GBP/JPY to GBP/CAD to GBP/AUD, we see very different standings for the world's fourth most liquid currency. That suggests that much of what we see in the GBP/USD's performance was based on the Dollar's drive. On that front, we have seen a considerable drive. The Dollar has stumbled throughout 2017 with varying degrees of intensity depending on what the counterpart happens to be. With the DXY Index clearing support that had held back the bearish tide the past two-and-a-half years, it would seem that we are progressing to the next stage of escalation. Yet, that would be difficult to sustain. As with the growing restrictions for equities, risk assets and the Sterling itself; the Dollar increasingly finds itself an outlier in a complacent financial world. And, stand outs eventually revert to norms.

With a moderate degree of technical resistance overhead, the fundamental and conditional factors are more likely to determine the next phase for this pair. For market conditions, the restrictions on deeper financial trends and breakouts will certainly rub off on the Cable. In fact, this pair tends to hold limited attachment to considerations like risk trends which carries some of the greatest risks for stretched markets. On the fundamental side, the presence of key event risk later in the week - in the form of the BoE rate decision and the US CPI as well as consumer sentiment report - will act to throttle drive in the first half of the period. In the absence of conviction and momentum at technical boundaries, it is easier to motivate correction. We focus on the trade potential of GBP/USD in this weekend Quick Takes video.

To receive John’s analysis directly via email, please SIGN UP HERE.