Talking Points:

- DXY Rebounds as U.S. Non-Farm Payrolls (NFP) Highlights Strong Job Growth, Sticky Wages.

- USD/CAD Climbs to Fresh Monthly-Highs as Canada Employment Disappoints.

- GBP/USD at Risks for Further Losses Following BoE ‘Super Thursday’ Event.

- EUR/USD Resistance Persists, GER30 Continues to Lag Behind Major Counterparts.

- USD/JPY Holds Above June-Low (108.80) as U.S. Treasury Yields Pick Up.

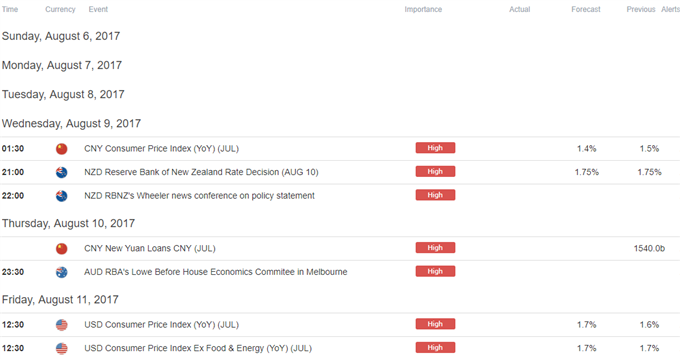

- Sign Up and Join the DailyFX Team LIVE to Cover Major Data Prints as well as the RBNZ Rate Decision.

Join DailyFX Strategists Paul Robinson, David Song and Christopher Vecchio to cover the U.S. Non-Farm Payrolls (NFP) report along with key trade setups going into the first full week of August. Highlighted setups include DXY, USD/CAD, GBP/USD, EUR/USD, USD/JPY, NZD/USD and GER30.

USD/CAD 5-Minute Chart

The U.S. dollar gained ground against its major counterparts following the better-than-expected Non-Farm Payrolls (NFP) report, while a separate report showed the Canadian economy adding 10.9K jobs in July amid forecasts for a 12.5K expansion. At the same time, a dip in Canada’s Participation Rate spurred a decline in the jobless rate as discouraged worked left the labor force, and the mixed development may encourage the Bank of Canada (BoC) to endorse a wait-and-see approach at the next policy meeting on September 6 after raising the benchmark interest rate for the first time since 2010.

USD/CAD Daily Chart

Download the DailyFX 3Q Forecasts

The shift in USD/CAD behavior may continue to unfold in the second-half of 2017 as the BoC changes its tune and appears to be on course to further normalize monetary policy over the coming months. However, dollar-loonie may stage a larger rebound over the coming days as the pair finally breaks the bearish formation carried over from June, while Relative Strength Index (RSI) continues to come off of oversold territory.

In turn, topside targets are on the radar ahead of the U.S. Consumer Price Index (CPI) amid the string of failed attempts to close below the 1.2420 (61.8% expansion) hurdle. Next topside target comes in around 1.2710 (50% expansion) followed by the Fibonacci overlap around 1.2770 (38.2% expansion) to 1.2780 (38.2% expansion).

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.