Talking Points:

- In a broad and complex financial world, looking to critical exemplars is a necessary short-cut for many's analysis

- The qualities of a true benchmark for broader assessment include popularity, liquidity and its essentialism

- We look at the VIX volatility index, the FAANG stock group, the Dollar and the US economy as various benchmarks

See how retail speculative traders are positioning in the FX majors, indices, gold and oil intraday using the DailyFX speculative positioning data on the sentiment page.

Most market participants don't have time to fully analyze the backdrop of the currency, region, asset class or market that they intend to trade. So, a natural shortcut is taken to make markets seem more manageable and to make trading decisions a reasonable conclusion. However, the effort to boil such an expansive universe into easily digestible bullets can lead us to oversimplify and ultimately into poor trades. Filtering such wide and comprehensive markets into something that is more readily translated into sound investments is an understandable endeavor, but efforts to simplify should not sacrifice quality when it comes to evaluating markets. Selecting robust benchmarks as standard bearers for a larger segment of the market is critical.

Too often, traders who witness a remarkable burst of volatility in a particular asset will assign that performance an influence that significantly overstates its reach. A strong NZD/USD swing for example doesn't necessarily signal a leading development for the market-wide bearing for the Greenback. That is a good example of the 'tail wagging the dog' attribution. It is highly unlikely a leading signal and instead more reasonably interpreted as an isolated move leveraged by the New Zealand Dollar rather than the benchmark counterpart. As with general statistics and econometrics, there are two ways to better identify assets or markets that are indicative of more systemic influences: either look for a larger sample size (more assets) or key in on particularly critical barometers (what I would consider 'benchmarks'). Most assets wouldn't qualify. Some of the critical attributes of a benchmark includes popularity, liquidity and systemic use.

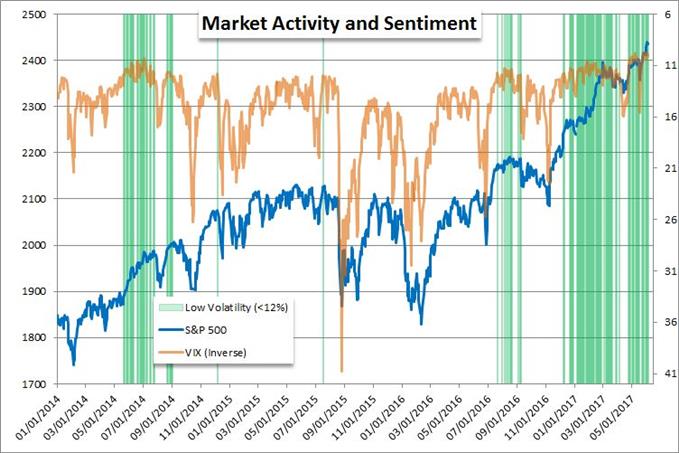

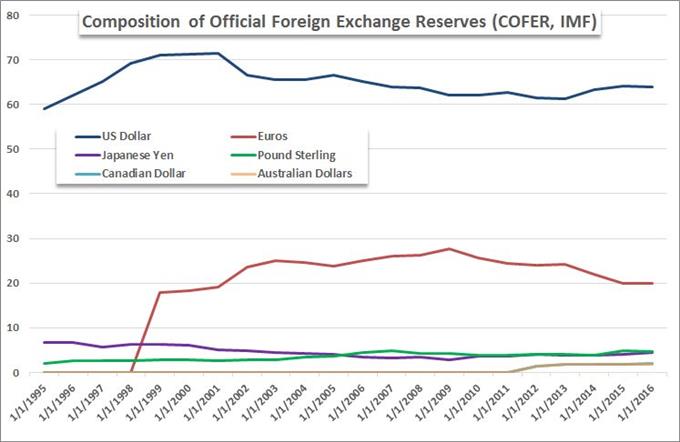

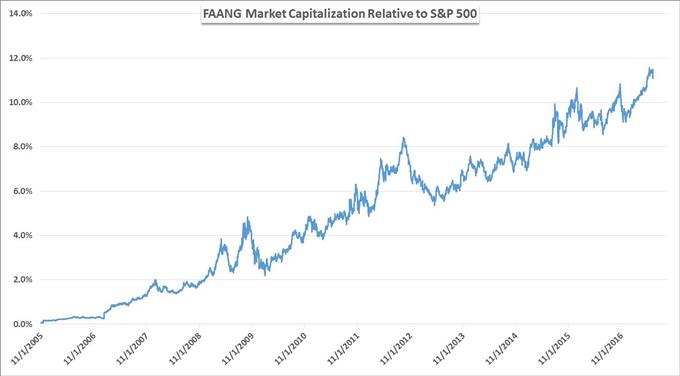

For 'popularity,' the importance is broad recognition that can single-handedly alter the course of capital transfer around the financial system. The VIX is a good example of this attribute. This derivative index is not itself tradable, but its use has been heavily warped by the development of this volatility product's use as an asset class. Just as important is the concept of liquidity. There needs to be a deep enough market that the signal of capital flow can be readily interpretted a signal that a deeper current change has occurred for the financial markets. The FAANG (Facebook, Apple, Amazon, Netflix and Google) collective covers both of those themes well. This group of only 5 stocks accounts for 11 of the market cap of the S&P 500. Then there is the systemic players. The Dollar could be readily argued in this category, but we could also raise the focus to national level. The US can easily stand in as a benchmark and leader for the global economy. We discuss the attributes of a good benchmark in today's Strategy Video.

To receive John’s analysis directly via email, please SIGN UP HERE