BITCOIN OUTLOOK: BTC PRICE VOLATILITY COULD BE OVERLOOKED AS CRYPTO MAY REPLACE GOLD

- Real Vision’s Raoul Paul hosts an interview with Barry Silbert, founder and CEO of Digital Currency Group, who discuss the foundations of bitcoin and blockchain technology

- BTC price outlook remains upbeat despite the recent crypto carnage due to Bitcoin’s long-term viability and overall utility that is not offered by traditional fiat currency

- Take a look at this article on Bitcoin vs Gold to discover the major differences and similarities between bitcoin and gold or check out this Guide to Day Trading Bitcoin

Raoul Paul of Real Vision holds an interview with founder and CEO of Digital Currency Group (DCG), Barry Silbert, who is a pioneer in the cryptocurrency market and digitalization of financial assets. Despite the series of booms and busts, the narrative around crypto regarding its future place within the global financial system remains unchanged after the price of bitcoin inked a parabolic surge throughout 2017.

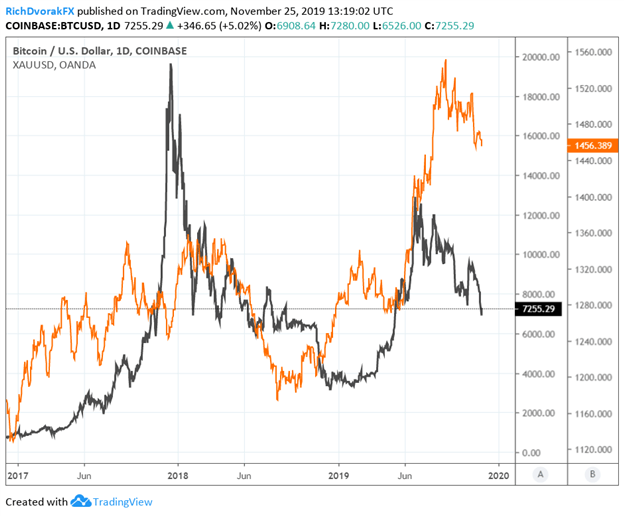

Bitcoin and cryptocurrencies in general have already changed how investors think about the crypto asset class and not just for speculation, says Barry, but also for its store of value characteristics. Barry tells Raoul Paul his controversial opinion how he believes investors will replace gold in their portfolios with bitcoin over the next couple decades as the utility (i.e. benefits) of crypto trumps that of gold and other precious metals. Yet, others still argue how bullion remains attractive.

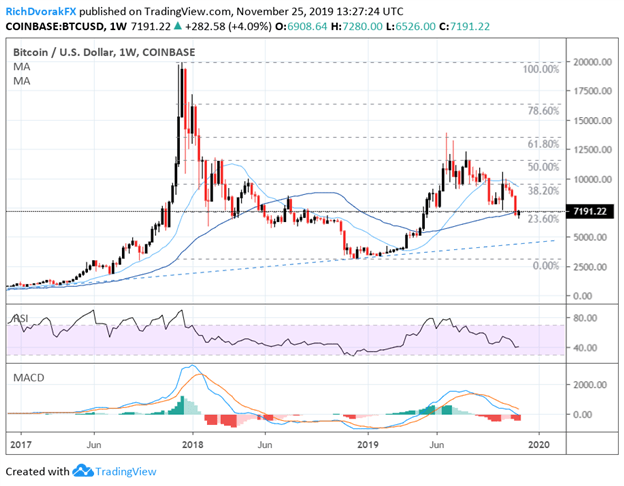

BITCOIN (BTC) PRICE CHART: WEEKLY TIME FRAME – DECEMBER 2015 TO NOVEMBER 2019

Chart created by @RickDvorakFX with TradingView

The market cap of Bitcoin has ballooned from a few billion dollars back in 2014 to the $130 billion total value of Bitcoin circulating currently. Barry, who was on the forefront of skyrocketing btc prices when the cryptocurrency was trading around $300, argues that the crypto asset class is here to stay in light of the growing financial infrastructure and global acceptance.

Bitcoin trading has become increasingly popular, for example, which has provided liquidity for the digital currency. In fact, cryptocurrency speculators will soon start to trade US regulated bitcoin derivatives such as futures and options contracts. The expanding financial infrastructure could facilitate access for additional traders to enter the crypto market and potentially open up the door to institutional investors.

CHART OF BITCOIN (BTC/USD) VS SPOT GOLD (XAU/USD): DAILY TIME FRAME – DECEMBER 2016 TO NOVEMBER 2019

Chart created by @RickDvorakFX with TradingView

Yet, Barry points out that the crypto asset class journey is not straightforward. The use case for bitcoin and blockchain is still under development, but there is great potential to be unlocked. As such, the primary use case for bitcoin and crypto is speculation – that is not necessarily a bad thing. In order for bitcoin to reach its potential utility the size of the crypto asset class needs to continue to grow alongside expanding volume and velocity of transactions, which benefits from speculation.

This increases the liquidity of bitcoin as it is exchanged in and out of different currencies. Buying into the hypothesis that bitcoin will replace gold is the belief that there will be a convergence between the $8 trillion gold market and $125 billion bitcoin market. Bitcoin bulls are also betting on the possibility that substantial technological advancements might be made with blockchain technology, which could potentially become intertwined with the underpinnings of the global financial system.

--- Produced by Real Vision©

BITCOIN TRADING RESOURCES

- Read up on the latest Bitcoin News & Analysis

- The IG Client Sentiment Report details the latest trader sentiment and bitcoin market positioning

- Download the DailyFX Forecasts for comprehensive fundamental and technical outlook on a variety of currencies and asset classes