WHY IS THE VIX SO LOW DESPITE LOOMING RISKS TO GLOBAL OUTLOOK?

- The VIX Index is trading at multi-week lows driven predominantly by improving US-China trade relations and substantial monetary policy stimulus from central, but another factor has suppressed global volatility

- Global volatility across asset classes are at risk of experiencing another shock event like ‘Volmageddon’ witnessed early last year

- A market selloff in response to a destabilizing market catalyst such as an abrupt rise in US-China trade tensions stands to be exacerbated by traders unwinding short-volatility positions

Real Vision’s Mike Green hosts Andy Scott, managing director at Societe Generale, for a conversation on structured volatility products and how global volatility could be at risk of a sudden surge. Andy discusses the VIX Index – Cboe’s 30-day implied volatility on the S&P 500 Index – and the major players steering the global volatility market.

Andy Scott of SocGen argues that the collapse in global interest rates and yield-starved investors have primarily contributed to the ongoing suppression of global volatility and the VIX index. With the risk-free rate of interest (e.g. long-dated sovereign government bond yields) is no longer appealing, investors begin to search for and exploit other trading opportunities to meet their return objectives. Andy details how underwriting options (i.e. selling volatility) and trading structured volatility products are examples of income-producing strategies carried out by market participants like insurers and big banks.

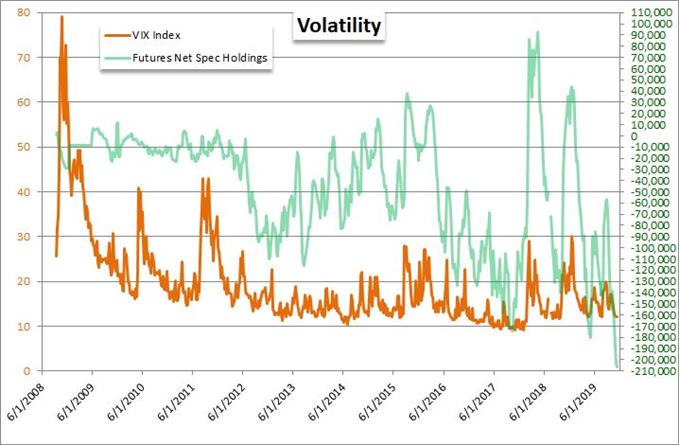

VIX INDEX & NET-SPECULATIVE POSITIONING (CHART 1)

Underwriters (sellers) of options seek to enhance their yield – and ultimately boost their total return – by collecting the premiums paid by the options buyers. Also, due to this global yield suppression, market participants need to sell increasingly more volatility to achieve the same income objective owing to diminishing marginal returns. Volatility is subsequently crushed largely due to the supply and demand dynamics of this trade along with a bit of mean-reversion, which is predicated on the assumption that grey swan events will fail to materialize. In other words, this concept is predicated on the idea that equities will continue to march higher and be able to weather small selloffs and minor influxes of volatility.

Though with the VIX Index and net-speculative positioning fluctuating around extreme lows – while several risks to economic outlook and global stock indices are still at large – a destabilizing event that materially damages market sentiment and facilitates a surge in uncertainty could cause traders to unwind short volatility positions.

This would likely exacerbate a selloff across equities, particularly if ‘peak vega’ is reached, which is the inflection point where the major short volatility market players are forced to monetize losses and go long volatility. Alas, when faced with a stressed environment there is an inflection point where these option underwriters previously selling volatility are forced to hedge and go long volatility which can exacerbate a market selloff.

--- Produced by Real Vision©

TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.