S&P 500, Netflix, USDCNH and EURUSD Talking Points:

- While the Nasdaq 100 and S&P 500 closed slightly higher through Wednesday’s close, there was little genuine risk appetite to register a true break – much less trend

- The coronavirus remains a high-profile theme as vaccine hopes rise but hope centered on earnings and the tech sector focus critical weight on Netflix’s after-hours update

- Top event risk through the upcoming session includes the China 2Q GDP, UK and Canadian employment reports, US retail sales and ECB rate decision

A Loaded Risk Backdrop Still Looking for a Spark

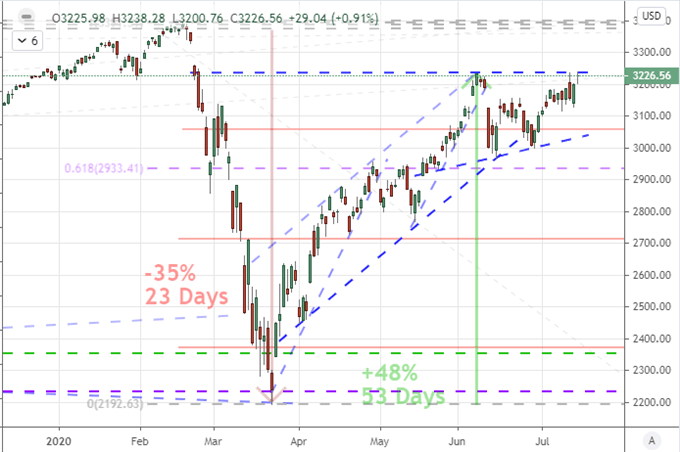

Depending on what benchmark you prefer, this past session offered up risk appetite of dubious quality. The major US indices managed to advance through Wednesday’s close, but there wasn’t much enthusiasm to measure beyond that concentrated group. With recession fears, coronavirus risks, trade war revival and earnings reality on tap moving forward; it comes as little surprise that speculative confidence is a little shaky. Nevertheless, the S&P 500 and Nasdaq managed to notch gains through their respective days. For the former, a very narrow body ‘doji’ candle leaves much to be desired with range resistance directly above. That said, the tech-heavy index posting a loss from open to close (though not close to close) is even more suspect. Ultimately, I am of the mind that fresh motivation is necessary to push markets to genuine confidence ahead.

Chart of Nasdaq 100 Index with 20-Day, 200-Day Moving Averages and Consecutive Days (Daily)

Chart Created on Tradingview Platform

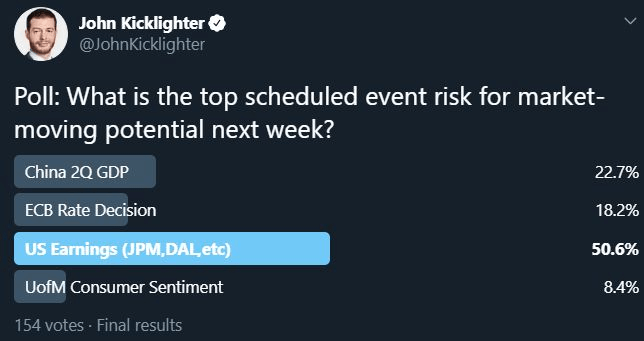

Speaking of sentiment, there seem to be two higher profile, conflicting themes fighting for attention. Though it was preciously a case of one side fueling hope and the other despair, there is now a considerable level of conflict in the influences of pandemic considerations and US earnings. For the headlines around coronavirus cases and deaths, the best we could hope for previously was the market’s discounting the risk. Recently, however, the interpretation that a vaccine is close at hand as gained meaningful traction. This past session Moderna reported favorite results from its stage one trials while Oxford was reportedly seeing a breakthrough of its own. As for US earnings the favorable backdrop will be put to serious test. Optimism for a strong recovery from April and May’s severe economic slump has fueled a remarkable level of enthusiasm. Yet, you couldn’t push confident forecasts much higher than they already are with the likes of the FAANG members. Now with Netflix earnings due Thursday afterhours, reality will be upon us.

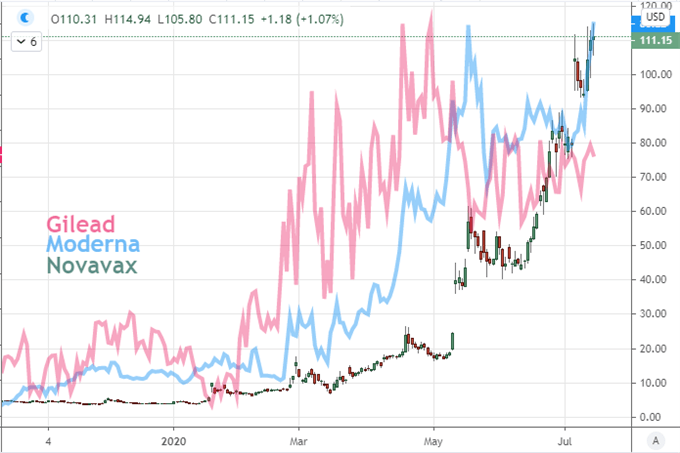

Chart of Netflix Overlaid with Ratio of Nasdaq to S&P 500 (Daily)

Chart Created on Tradingview Platform

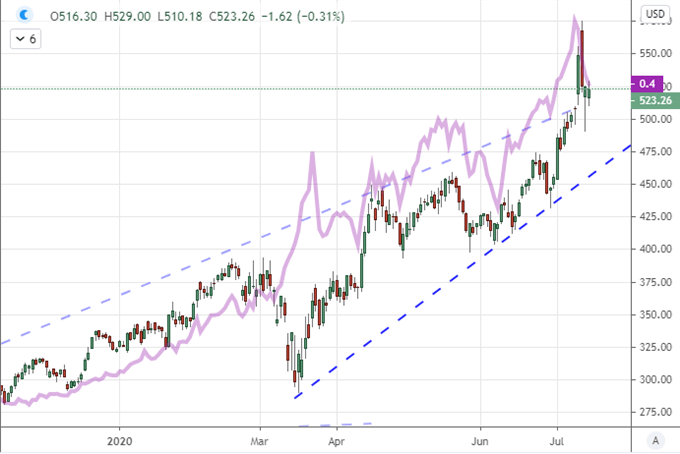

The Top Thematic and Scheduled Event Risk Ahead

Starting from the systemic fundamental themes for sheer market reach, my poll at the start of the week set earnings as a top speculative theme. This past session saw strong trading revenue from Goldman Sachs and a disappointing reflection of economic health from Alcoa, but neither of these would truly carry the weight of sentiment on their shoulders. Ahead, we have more banking sector insight between Morgan Stanley and the Bank of America with a spot of consumer staples from Johnson & Johnson; but my focus remains on the sector that has led the speculative charge: tech giants. Netflix isn’t the most prominent of the tech players, but it is the first to hit the earnings calendar. As such, it will carry an inordinate weight. That said, an ‘after the close release’ will likely create greater anticipation than reaction.

Poll of the Top Market Moving Event Risk Next Week

Poll from Twitter.com, @JohnKicklighter Handle

In contrast to US earnings there enthusiasm has been the default interpretation, there has been a far more critical interpretation of the Covid-19 headlines. Yet, despite the near-record highs in cases of infection for US and World figures; an optimism is starting to show through in hopes for a viable vaccine. This past session is was reported that Moderna determined its trial was ‘safe’ and induced an immune response through Phase 1 trials. Meanwhile, a Telegraph article suggested Oxford was reporting a breakthrough of its own with production of a T-cell antibody response in its program. Is there a medical solution to the pandemic in the near distance that won’t require an immediate shutdown? This is what investors are weighing – whether they realize it or not.

Chart of Gilead, Moderna and Novavax Stock Price (Daily)

Chart Created on Tradingview Platform

For Volatility, Watch These Pairs

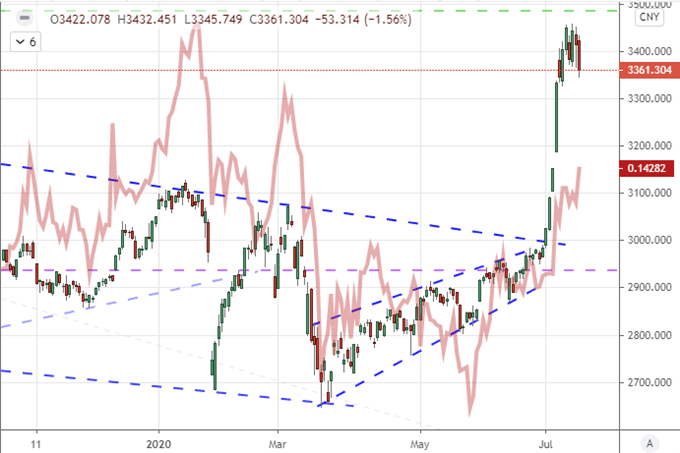

From the open-ended and systemic influences to the more targeted and localized event risk, there are some key updates due over the coming session. The most prominent release on tap has to be the run of 2Q GDP and June economic data from China during the Asian session. While the second largest economy in the world is clearly important to global sentiment, the influence over the course of the data means there is going to be limited response to this otherwise important update. Nevetheless, I will be watching the Shanghai Composite and Chinese Yuan closely into the coming session.

Chart of Shanghai Composite Index with Inverted USDCNH (Daily)

Chart Created on Tradingview Platform

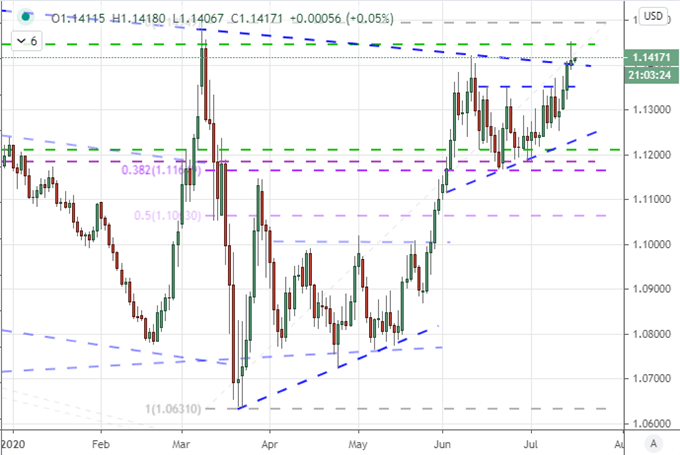

If anticipation is to be taken into consideration, the European Central Bank (ECB) rate decision Thursday is likely to rouse the same tepid response from EURUSD that Chinese data urged from USDCNH or AUDUSD. The central bank is due to weigh in on policy this coming session, but they have escalated very recently and have every reason to wait for fiscal authorities to take the reins with their proposed, massive stimulus program. Meanwhile, the Dollar will be attempting to find its way as a ‘safe haven’ with retail sales figures on tap.

| Change in | Longs | Shorts | OI |

| Daily | -5% | 8% | 0% |

| Weekly | -13% | 21% | -1% |

Chart of EURUSD with 50-Day Moving Average (Monthly)

Chart Created on Tradingview Platform

If you want to download my Manic-Crisis calendar, you can find the updated file here.

.