Dow, AUDUSD, Dollar Talking Points:

- Many financial centers reopened after a holiday extended weekend to strong gaps lower that accounted for Friday’s US struggle

- US markets were ‘buffetted’ by news of a renowned investor divesting from airliners struck by the pandemic while news continued to trump a slow global economic reopening

- Renewed US-China trade wars are a man-made risk that threatens to drag on fragile sentiment as the US elections approach – a matter for AUDUSD

Risk Trends Play Catch Up Globally but Settle Locally

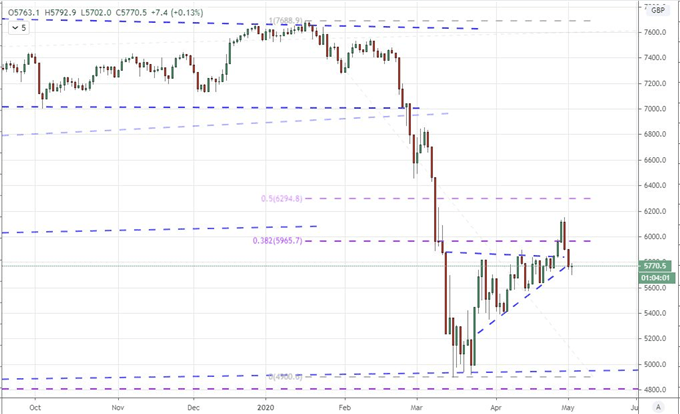

This past Friday was a market holiday for many financial locations around the world. Despite the draw on liquidity, the US benchmarks that were open through the final session of this past week would still put in for a meaningful technical break during the dusk of trade. It was against that backdrop upon which we would assess the potential for Monday. Risk aversion could have been described as a US phenomena which wouldn’t show up to start this new week. Clearly, that wasn’t the case as European and certain Asian markets closed on Friday adjusted with a jump lower to kick off this new trading week. The German DAX posted its biggest daily gap lower in a month while the UK’s FTSE 100 ground modestly lower. That may not seem so provocative a move if not for the reference for the initial break higher this past week which tracks out a loaded and heavy change of in risk trends.

Chart of FTSE 100 (Daily)

Chart Created on Tradingview Platform

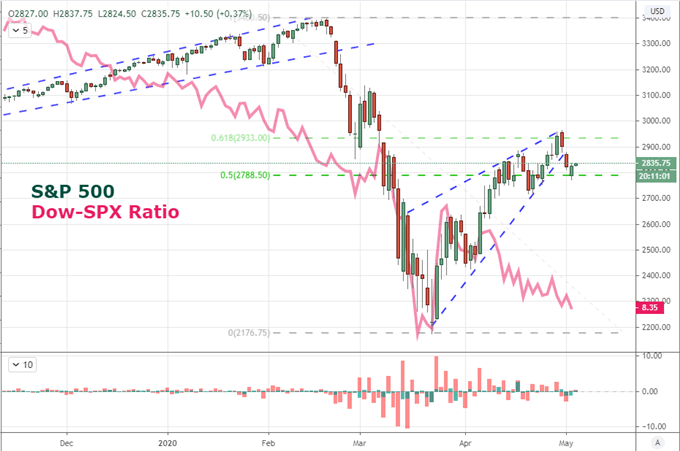

Despite the provocation from US indices to close out this past week, the sentiment of despair didn’t spill over into the S&P 500 or Dow this past session. The benchmark S&P 500 opened the new week with a third consecutive gap to the downside, but the day would ultimately end up a bullish one when measured close-over-close. When digging further into the performance of the New York session Monday, there was further a decided skew against the economically-oriented Dow index. A comparison of the blue-chip benchmark relative to the broader S&P 500 offered a sustained slide from the former. This perhaps shows growing deference for the onset of recession with an investor class more willing to acknowledge the hardship at hand rather than default to the ‘buy the dip’ mentality of the speculative rank. A reminder of this fundamental inequity was the news over the weekend that renowned investor Warren Buffett had divested his Berkshire Hathaway out of the troubled airliner companies which have been acutely hit during the pandemic.

Chart of S&P500 Overlaid with Dow-SPX Ratio and 1-Day Gap and Rate of Change (Daily)

Chart Created on Tradingview Platform

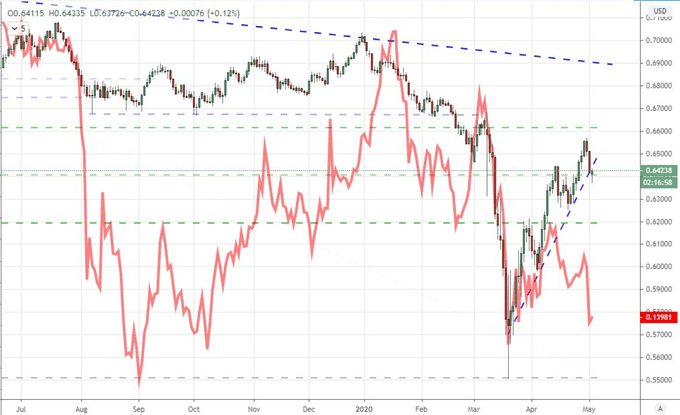

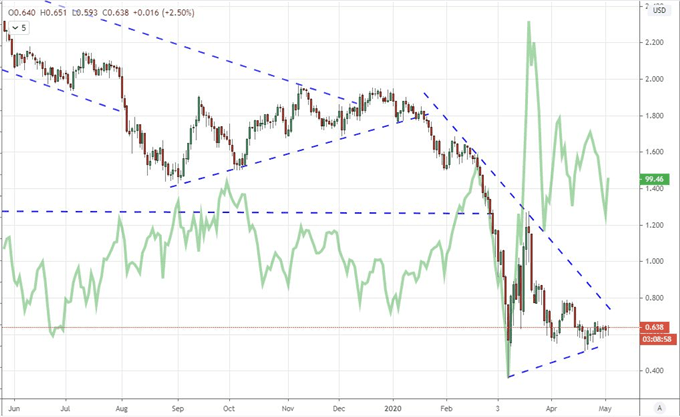

Fundamental Strains of Recession

The dive into recession is one that few investors are seemingly willing to challenge. That makes sense given the ubiquity of economic retrenchment among global central banks, governments and supranational institutions. That said, the debate seems to surrounding how far the market has discounted the economic pain to this point. Such a balance point is open to interpretation, but it will be a consideration open to interpretation among the masses. Against such a backdrop, news of slow re-openings and the CEO of Gilead donating all of their remdesivir will attempt to warm optimism. On the other hand ‘man-made’ issues will continue to lean into optimists. The US Secretary of State, Mike Pompeo, levied an accusation against China that the cononavirus has ties to a lab in the country and that the communist regime concealed the severity of the pandemic spread. This is in turn reviving trade war pressures among key economic players – a threat I am watching more in AUDUSD as a free-market benchmark versus the more native USDCNH risk.

Chart of AUDUSD Overlaid with CNHUSD Exchange Rate (Daily)

Chart Created on Tradingview Platform

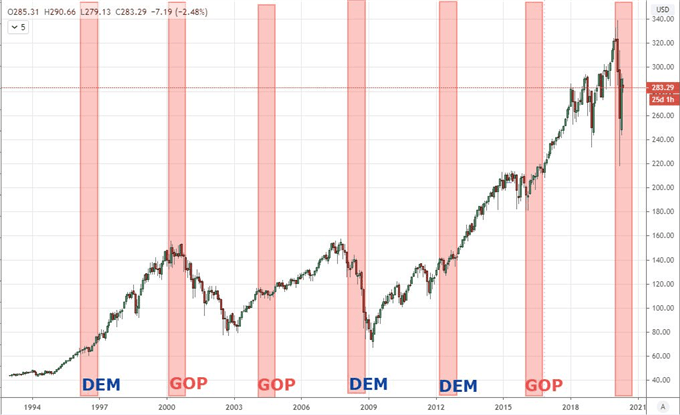

As we move forward, there may very well be a trend in timely indicators that show the course of recession is easing – not that we avoid economic slide but rather that the intensity of the contraction starts to level out. Yet, that does not prevent the fallout from potentially man-made issues from adding additional obstacles. The White House’s reversion to the US-China trade war is a not unsurprising move give the long standing complaint over trade practices for the latter. With a Presidential election six months away, the need to turn sentiment around is even more pressing. Given how slow economies shift course, a steady course of reasonable policy may not result in the outcome some in the administration would hope for.

Chart of SPY S&P 500 ETF with US Election Cycles – January to Election Date (Monthly)

Chart Created on Tradingview Platform

The Event Risk At Hand

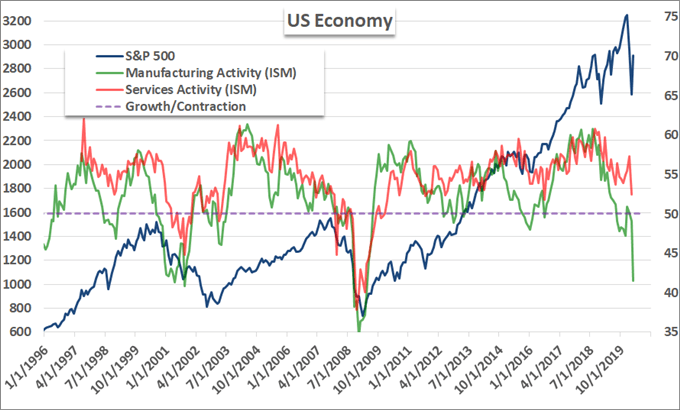

Ultimately, unscheduled event risk perhaps represents the greatest risk to the global markets as its abstraction can catch speculative positioning seriously off guard. That said, it lowers the probabilities materially to position for scenarios that are ethereal for their occurrence. If we are looking for updates on key themes through scheduled figures, the top listing on my docket would be the US-based ISM services report. The largest sector in the world’s largest economy certainly has weight to pull. That doesn’t mean it will be definitely market moving, but it has the capacity to be fundamentally important.

Chart of S&P 500 Overlaid with ISM’s Services and Manufacturing Indexes (Daily)

Chart Created by John Kicklighter with Data from Bloomberg

Meanwhile, on the other end of the spectrum, there are systemic updates that represent financial strain but aren’t yet crating the full market fallout that some may suspect. This past session, the US Treasury announced its borrowing in the current quarter would top $3 trillion – a record for the country and world. That didn’t seem to upset the Dollar or US 10-year Treasury yield. Meanwhile the ‘front-run’ mentality among speculators was slow to move on news that the NY Fed was prepared to start purchases of ETFs around assets like junk bonds ‘early’ this month. Despite sparks of fear and greed, reaction is proving truncated.

Chart of US 10 Year Treasury Yield and DXY Dollar Index (Daily)

Chart Created on Tradingview Platform

If you want to download my Manic-Crisis calendar, you can find the updated file here.

.