Market Moving Talking Points:

- The Dollar is pushing technical support on both the DXY and equally-weighted index, but does liquidity and fundamentals support the move?

- A clear break can be seen for AUDUSD, USDMXN, Oil while EURUSD, USDCAD and USDJPY are not yet showing the same degree of conviction

- What should we talk away from the largest lower wick from the DXY since the US Presidential election? It is liquidity but not temporary

Dollar Threatens a Technical Breakdown in Holiday Trade

The Dollar has taken an unceremonious tumble to close out this holiday-deflated trading week. A drop that hasn't happened suddenly or at the urging of a prime event risk, this has the more ominous look of a measured break for the world's most liquid currency. That would seem to fit the bigger technical and fundamental picture that has developed over the preceding months to our present illiquid phase. A dangerous wobble has developed for the benchmark for some weeks which has in turn jeopardized a more than 18-month advancing trend channel. Fundamentally-speaking, the safe haven appeal of the Greenback has waned, the Fed has pulled back the yield advantage and anticipation of relative economic outperformance has actually receded with the tempered trade war risks. Perhaps the low tide of liquidity is just making clear the shift in underlying circumstances. Then again, the swoon could also offering a false signal.

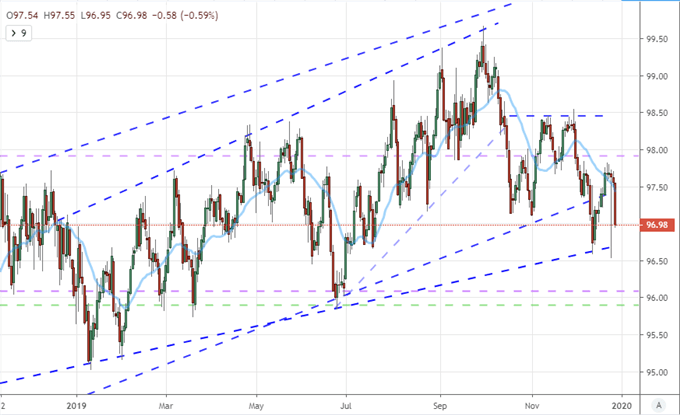

Chart of DXY Dollar Index (Daily)

Chart Created with TradingView Platform

A few things to note in order to contextualize our analysis of the Dollar's next steps. First, an extended consolidation doesn't always have a clear and decisive technical turning point. That is very different than the idealized 'V top' that so many traders hope for - or worse, assume. After a measured advance and months of leveling off, the shift towards a new bear trend can develop over time or even in stages. Conviction is what is important. Whether personal preference is on technical milestones which will deepen a traders' belief of a new prevailing trend or critical fundamental developments like a sudden drop in growth forecasts for the US in particular, look for something that suits your risk tolerance. One particular telling sign I would look for is if momentum in selling pressure persists through into the return of liquidity for 2020 given how reserved conviction has been for this FX leader.

Not All USD-Based Crosses Are Projecting the Same Urgency

The DXY is notably on the verge of a breakdown, but depending on where you draw your critical levels, it could be argued that the break is made or we are just leveling up to the decisive point just now. I believe one of the better means of evaluation the situation is to desconstruct by looking at the major components - where most of the trading is actually done for the currency. If you refer to the world's most liquid exchange rate - and arguably asset - EURUSD has the same borderline qualities as the trade-weighted index. The critical break for this pair is 1.1250 which is still some progress higher.

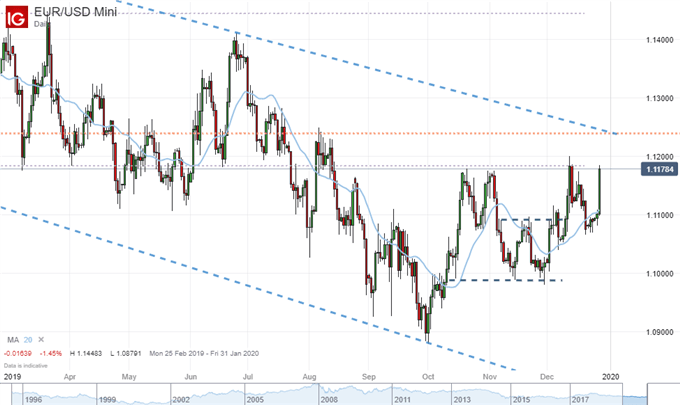

Chart of EURUSD with 20-Day Moving Average (Daily)

Chart Created with IG Trading Platform

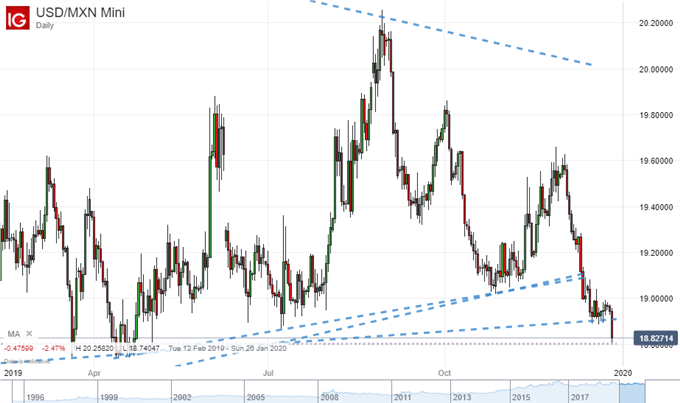

Alternatively, if you are looking for a true break, there are a few pairs that already qualify. If you refer to these pairs without context of the broader market, you could be led to belief that follow through is a much higher probability with the break already out of the way. However, unless the counter currency is going to foot the speculative bill, there is not likely enough liquidity out of these pairs to actually drive the Dollar to a true trend. A high correlation to EURUSD, USDCHF has cleared trendline support with today's drop. AUDUSD has coasted through a technical resistance in a long-term trendline and 200-day moving average days ago and is now attempting to cement conviction. Game day sentiment goes to USDMXN meanwhile which is trading at a multi-month low as of today, significant when you consider the much higher time frame chart which shows a multi-year wedge at risk of breakdown.

Chart of USDMXN (Daily)

Chart Created with IG Trading Platform

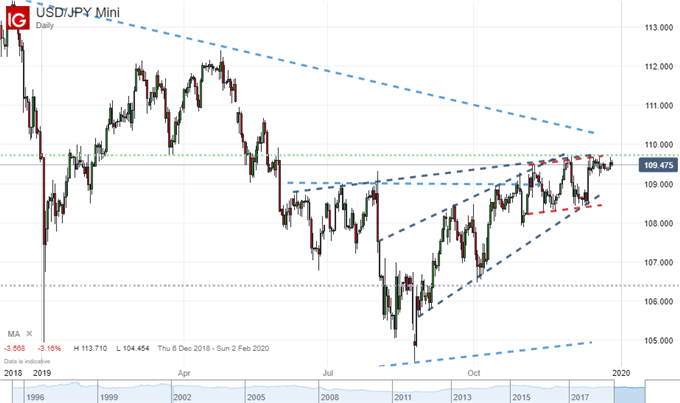

Then there are the Dollar pairs that are making impressive moves of their own but aren't triggering the critical breaks as of today. These are arguably more appropriate given our conditions as a break (or reversal) that occurs when liquidity is in full swing will be given greater conviction by the open market. In this category, I think USDJPY and USDCAD are two of the most impressive options. They have enormous technical congestion of their own, yet the critical technical bounds still stand. I will watch these closely for confirmation of any momentum intended for the Greenback over the next week or two.

Chart of USDJPY (Daily)

Chart Created with IG Trading Platform

An Incredible Wick that Is More than Just a Temporary Liquidity Drain

Finally, a word on that enormous wick present in the DXY Dollar Index on December 25th. This intraday tumble and reversal is unique in that it is the largest such swing since the US Presidential election back in November 2016. It is easy to write this off as a condition of liquidity. It indeed happened during the rollover of Christmas day and had the qualities of a liquidity issue rather than genuine market problem. Further, the same extreme move was not present with key measures like EURUSD, USDJPY, GBPUSD or an equally-weighted Dollar index. That said, I would not simply ignore this temporary event. It tends to fit with a broader concern in short-term lending conditions in the US which the Fed has been actively combating through enormous infusions. This has been cleaned up as of now, but don't be surprised if we need to revisit this instance in the near future.

Chart of DXY Dollar Index With Daily Wicks (Daily)

Chart Created with TradingView Platform

If you want to download my Manic-Crisis calendar, you can find the updated file here.

.