Talking Points:

- The S&P 500 posted its biggest bullish gap on record Friday, but volatility and proximity to major support tamp conviction

- While the US indices are anchors for speculative holdout, sentiment throughout the financial system has eroded for months

- Updates for European stability, US-China trade wars, monetary policy support and Brexit will test market conviction

What do the DailyFX Analysts expect from the Dollar, Euro, Equities, Oil and more through the 4Q 2018? Download forecasts for these assets and more with technical and fundamental insight from the DailyFX Trading Guides page.

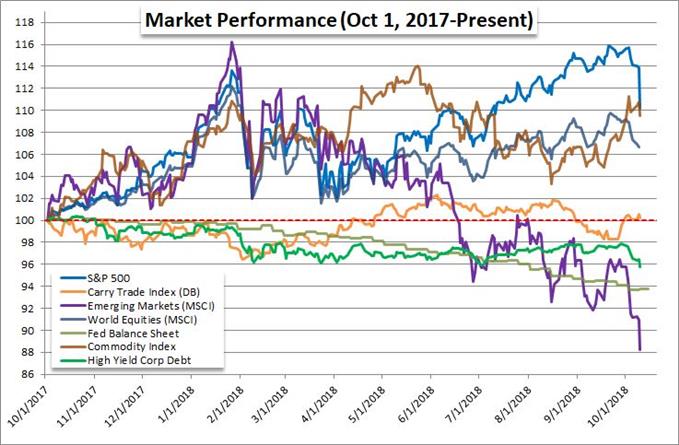

A Check to Risk Trends That Does Little to Truly Bolster Enthusiasm

We closed out this past week with an extraordinary but temperamentally desperate effort to revive speculative appetite. The benchmark US equity indices put in for a dramatic open this past Friday to push back against the plunge that shocked the market the two days prior. Specifically, the S&P 500 put in for its biggest bullish gap on the open that I have on record at nearly 1.5 percent. That is nothing short of extraordinary. The Dow offered a similar effort with a jump to start the day that fell just shy of the same percentage to reset a record that goes all the back to February 2000. If we evaluated this move without any context, it would stand as a remarkably bullish signal. Yet, everything dependence on context. This dramatic bounce followed one of the worst two-day periods of selling in years - certainly the worst since the February rout. What's more, other risk assets - global equities, emerging market assets, junk bonds, carry trade and others - have been sliding for some months before these fireworks. The US indices haven't even 'caught up' to the general risk setting of the global financial system. And, if they make another move to close the gap, it is likely to trigger a fresh wave of speculative flight that sends the capital market tumbling in concert. Critical in the week ahead is keeping tabs on the painfully obvious technical boundaries supporting the Dow (25,000), S&P 500 (2,720) and Nasdaq 100 (6,800). If they hold, the path for risk trends will take a more subtle tempo where the disparity in performance will cast enough confusion to prevent a collapse. However, if those particular support levels cave, hope born from doubt may falter.

Yields, Trade Wars, What Triggers Dip Buying or an Avalanche of Selling?

A rise or fall in risk trends is the effect of speculative commitment, but the cause can arise through many different outlets. Generally speaking, economic and financial conditions (and forecasts) are far more troubled than current pricing suggests. It is therefore difficult to mount genuine enthusiasm for lasting risk appetite or spin questionable developments into positive performance. In turn, it is growing easier for fear to grab a foothold in the speculative rank. Trade wars will be deliver a few poignant reminders of its sway over the future when the US Treasury reports on its evaluation of China's policy position and Friday when 3Q Chinese GDP crosses the wires. Early reports this past week suggest the Treasury Department has found that the key trade partner does not quality as a currency manipulator but the Secretary may yet change the official stance with pressure from President Trump. Whether a catalyst or coincidence, this past week's volatility came shortly after a rally in global sovereign bond yields. It stands to reason that another swell can prompt a market response whether it has a reliable fundamental connection or not. Perhaps the bounce in 10-year yields is drawing long overdue attention to monetary policy. With easing already extreme for much of the developed world, there isn't much acceleration in growth to show for the effort and certainly little left in the coffers to fight any future problems.

Dollar Increasingly a Carry but the Euro Offers Little Backup

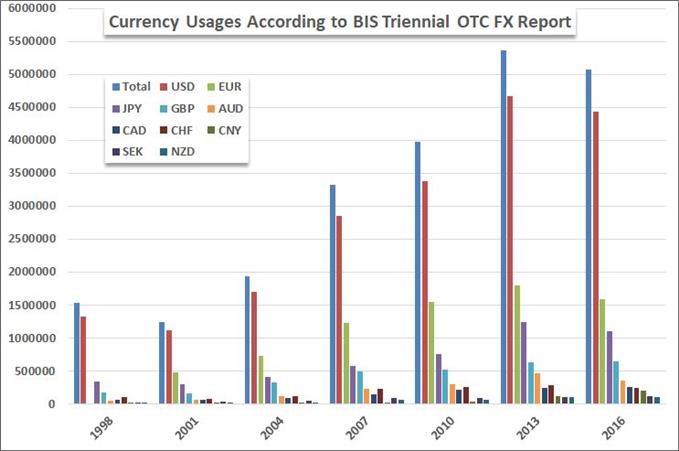

As the temperature rose in the capital markets this past week, the FX market notably broke from its standard roles. Most notable perhaps for those with only a passing observation of the currency market was the fact that the US Dollar - the supposed benchmark safe haven - fell alongside the stock market. If you haven't been keeping tabs on its fundamental circumstances these past few years, this could come as a shock. However, for the observant, the DXY's pullback to round out a right shoulder on a head-and-shoulders pattern fits its unusual position as the top carry currency amongst the majors. The Fed has taken to steady rate hikes where most others are waffling on even the first step towards normalization. That has imbued considerable speculative premium behind the benchmark which can obviously be shed should fear cut down risk-dependent assets. This currency will be a great gauge for the intensity of risk trends. If it is mild to moderate 'de-risking', the currency will likely retreat as carry exposure is unwound. If sentiment were to turn septic, on the other hand, the absolute need for liquidity would turn global funds back towards US Treasuries and the Greenback. In the former scenario where the most liquid currency comes under pressure, where will funds slosh? Typically, investors will seek out the next most liquid and stable counterpart. That would be the Euro. Yet, diverting funds to the Euro-area is a speculative call all of its own. In the week ahead, a simmering fundamental risk may finally boil over. Italian officials are running a media blitz as they discuss the budget ahead of - and during - the EU Summit Wednesday and Thursday. And, for good measure, the Deputy Prime Minister Salvini is due to visit Moscow on the first day of the Summit, a move that will no doubt raise the EU's ire.

Hitting Another Brexit Patch, Appeal for Carry Currencies and Gold

While the European gathering of leaders will inevitably have to discuss Italy's pressure, global trade threats and other pressing matters; one of the most prominent topics on the agenda is hashing out a solution to the Brexit impasse. With less than six months to go before the United Kingdom (UK) and EU part ways, the two side are still at odds on some critical points. This past week, the EU's Brexit negotiator offered up remarkably optimistic insight on his expectations for this meeting. We have seen such a positive turn a few times before only to have them crushed by dispute shortly thereafter. Keep an eye on Prime Minister May's cabinet meeting Tuesday preceding the Summit as well to see if the UK government can achieve a unified front at the negotiation table. In the scope of unusual currency performances, the safe havens have run afoul of their typical performance and so to have the historical carry currencies. Despite volatility and tumultuous performance on risk assets this past week, both the Australian and New Zealand Dollars were up this past week. While they are unlikely to continue this advance in full-tilt capital flight, moderate risk aversion could still see these currencies rise - and outright stabilization or advance could present genuinely undervalued speculative assets. The Australian employment data and New Zealand 3Q CPI should also be on your radar if you intend to track these currencies out. Gold should also be a frequented chart update given the state of the markets. We managed to break $1,210 resistance last week, but there is plenty of further upside potential if the markets start to falter. Back to the question of where capital goes if the Dollar's in retreat and Euro is dealing with its own troubling affairs; the markets will start to focus more and more on the precious metal. We discuss all of this and more in this weekend Trading Video.

If you want to download my Manic-Crisis calendar, you can find the updated file here.