Talking Points:

- The S&P 500 closed at a record high 2,874.7 this past week - a clear contrast to other risk assets such as global equities and EM

- A technical swell to support a systemic Dollar bull trend was fully undermined this past week, and it wasn't Powell that disarmed

- Ahead, liquidity will be a critical market headwind, while themes (trade wars, political risk, etc) offers more impact than data

What makes for a 'great' trader? Strategy is important but there are many ways we can analyze to good trades. The most important limitations and advances are found in our own psychology. Download the DailyFX Building Confidence in Trading and Traits of Successful Traders guides to learn how to set your course from the beginning.

An Abundance of Catalysts Versus the Height of Illiquidity

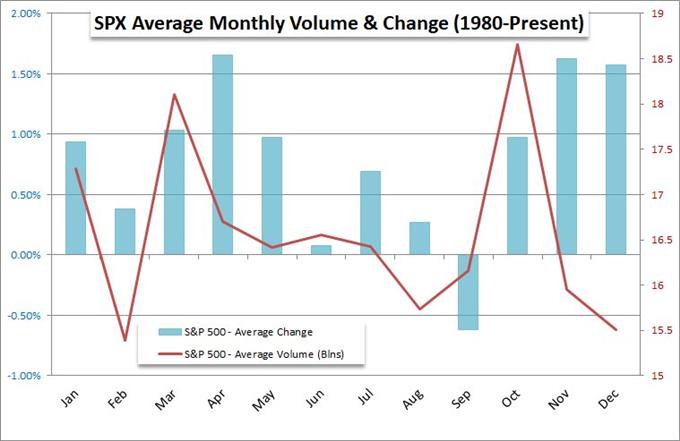

The headlines are not exactly quiet for global markets at the momentum. In fact, we are dealing with an overabundance of key market themes, any one of which could single-handedly sustain a trend in 'risk appetite' or any number of key assets and currencies. And yet, there is an overt lack of reliable trends across the markets at present. Perhaps the most convincing move for the bulls has been staged by the S&P 500. The broad US index closed at a record high Friday marginally overtaking the previous peak set in late January and fully retracing the losses over that seven month period. Yet, the enthusiasm this chart would insinuate is clouded by the distinct disparity it draws relative to other risk-leaning assets and even the other benchmark US indices. The EEM Emerging Market ETF for instance is barely off the multi-month lows earned after four months of backslide. There is a wide disparity in the correlation of 'risk' assets which suggests this universal driver is set to neutral, but the alternative influences that exposes the US markets to doesn't exactly set the scene for a backdrop that impresses enough to override the curb on liquidity. August is one of the most reserved months of the year historically, and the final week leading up to the Labor Day holiday transition is the trough of volatility. Will we fight the tide?

The Potential of Political Risk and the Impact of Trade Wars

If we were looking for motivation that could reasonably be capable of beating the undercurrent in Summer Doldrums liquidity, the range of high profile themes we are dealing would certainly be the list to rely on. That said, the catalysts we are currently dealing with are more profoundly oriented towards spurring fear of speculative exposure than they are furthering exposure. Political risks have grown to a position of prominence this past week for a number of countries. Most prominent were the United States and Australia. In a quick transition, the Australian government ousted Prime Minister Turnbull and Scott Morrison looks to be in line for the position. Given the developments leading into the Friday drama, this was not completely unexpected - and also why the Aussie Dollar dropped sharply Thursday to more-than-a-year lows. Yet, the selection of Morrison seemed to soothe fears and prompt a recovery for the currency. Whether there is more political instability discount to claw back remains to be seen. In the US, the situation is far from resolved. News that the Trump Organization's CFO was offered immunity to testify in the Michael Cohen investigation and President Trump's warnings of a market crash should impeachment proceedings begin draws an understandable sense of uncertainty for the capital markets. Global investors are not worried that a single leader makes or breaks sentiment, but uncertainty is always a point of concern - especially in markets running far beyond standard measures of value. And, this is only the most recent theme.

So Much for that Dollar Revival

What technical milestones the Dollar won through August have been significantly cut down through this past week. The DXY Dollar Index made a remarkable effort to complete a 12-month long consolidation pattern that turned out to be a clean 'head-and-shoulders' pattern. Two weeks ago, when the US-Turkey tensions hit critical mass, the contagion to emerging markets and broad risk aversion drove capital to the shelter of the US markets. That was an effective enough spark to earn such a high profile break, but it wouldn't seed full momentum. With the seasonal curb on speculative ambition and a lack of a driving fundamental theme, the breakout faltered. More than just losing traction, it has closed back below the very trendline, range midpoint convergence which signaled a critical break was afoot in the first place. Looking to assign blame for this about face, there was a lot of attribution given to Fed Chairman Jerome Powell's remarks at the open of the Jackson Hole Symposium. Yet, his remarks stuck to the script of previous speeches and Fed decisions. If anything, the currency eased in spite of his persistent hawkishness relative to global counterparts. Ahead, we have the second day of the Symposium, the Fed's favorite PCE deflator and consumer confidence figures which will give insight to political concerns. None of this immediately comes loaded with the natural capacity to recharge a clear EURUSD or USDJPY trend. As always, set reasonable expectations.

Will the Euro's Run, Aussie Volatility or the Gold's Turn Trigger Trend?

Shallow market depth is a difficult hurdle to overcome, but it isn't truly unsurmountable. All that is needed is a fundamental charge strong enough to delever a shock of volatility or ideally systemic enough to carry a trend. There have been some impressive technical developments for a few key markets this past session and noteworthy event risk. So it is reasonable to evaluate whether the exception to the norm is among these options. From the Euro, we have a remarkably robust advance. While there has been volatility for the likes of the EURUSD and EURGBP, an equally-weighted index for this currency tallied an incredible 8 consecutive days of advance through Friday - the longest bull run since December 2012. Where is this lift coming from? It seems to be the benefactor of trouble for the Dollar, Pound and Yen which leaves few liquid alternatives. That is unlikely to stand as a reliable drive moving forward. The Aussie Dollar was charged with an extraordinary level of volatility this past week as political uncertainty developed into the change in Prime Minister. What was initially a point of concern and drop for the AUD turned into a lever for an end-of-week rebound. There may yet be some political risk discount that could still be worked off moving forward, so keep tabs on productive Aussie crosses (AUDCAD, AUDCHF, AUDNZD). Finally, gold mounted its largest single day rally since May 2017 to end this past week. This resulted in a potentially critical technical break for channel reversal, but if the motivation is purely the Dollar's retreat, carrying this fledgling recovery will prove difficult. We discuss all of this and more in this weekend Trading Video.

If you want to download my Manic-Crisis calendar, you can find the updated file here.